Our Latest Model Portfolio - Energy Sector

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

“A.I.? That’s So Tomorrow. Get Me Some Oil!”

by Alex King

In our Inner Circle service we run model portfolios using rotation methodology. The intent is to find baskets of stocks, usually by sector, that appear to be under institutional accumulation. Then to hold them in the model, collecting and re-investing dividends along the way. And further, in this ideal world, to sell them from the model when it looks like the sector is topping out and may be under institutional distribution. We use all manner of technical and fundamental analysis to do this but in the end it comes down to spotting telltale accumulation signs in the sector, then finding a group of high quality single-stock names with which to play the theme.

One day we are going to mess this up. But so far, we have not yet messed it up. There is always tomorrow. But here’s how it’s gone so far.

(Each model portfolio, by the way, is measured thus: five to seven tickers in each, all dividends re-invested back into the ticker that produced them, no fees charged because they are intended to be self-managed portfolios, allocations set at inception and unchanged thereafter, and no cash left in the model at inception).

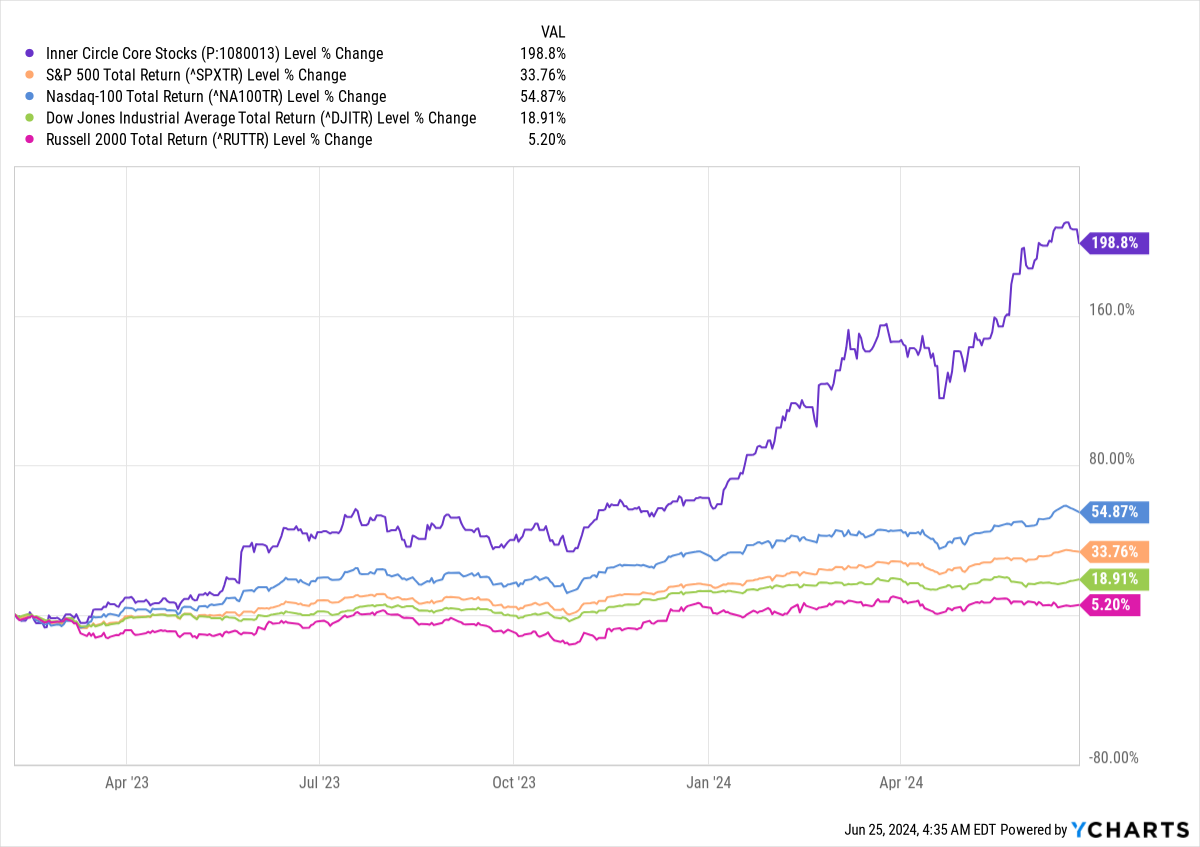

Inner Circle Core Stocks - 7 February 2023 Inception To Date

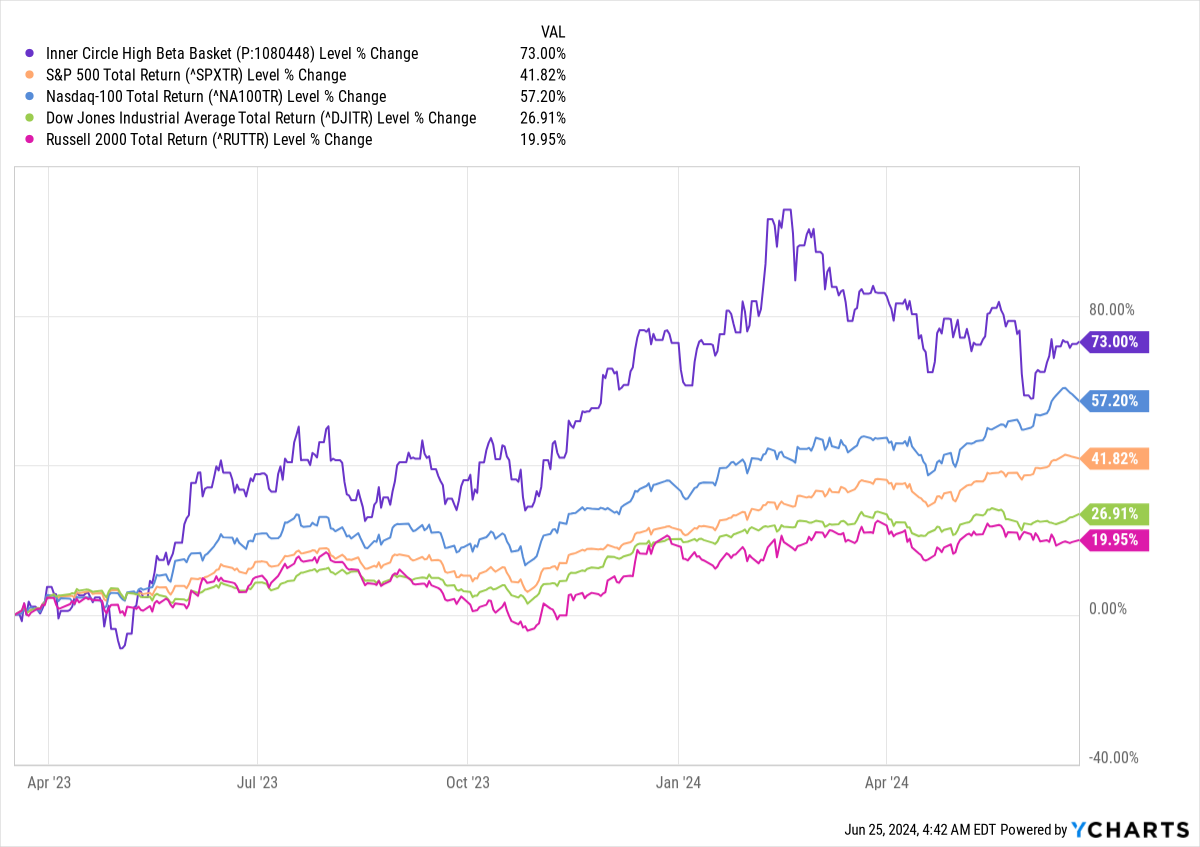

Inner Circle High Beta - 17 March 2023 Inception To Date

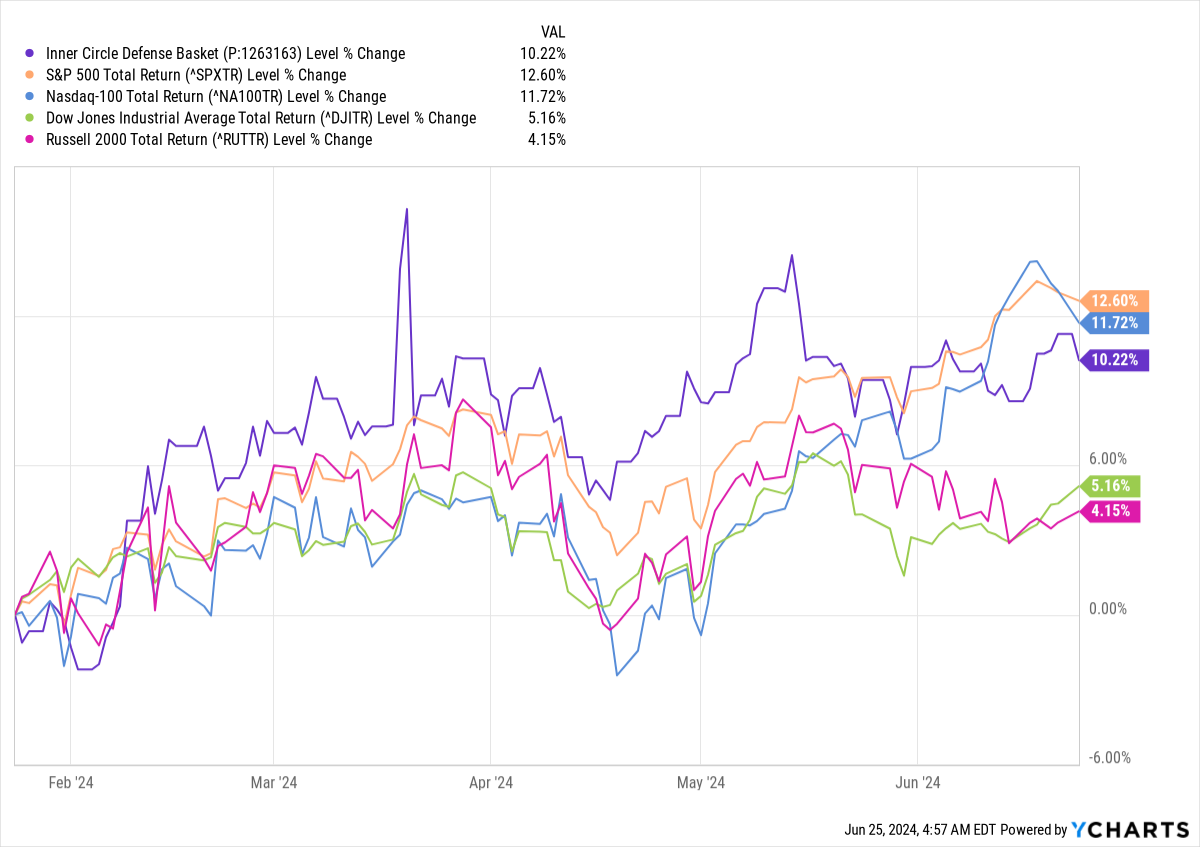

Inner Circle Defense - 24 January 2024 Inception To Date

Note, this was not set up to beat the indices - it was set up as an, er, defensive portfolio. So it’s a pleasant surprise to see how well it is doing.

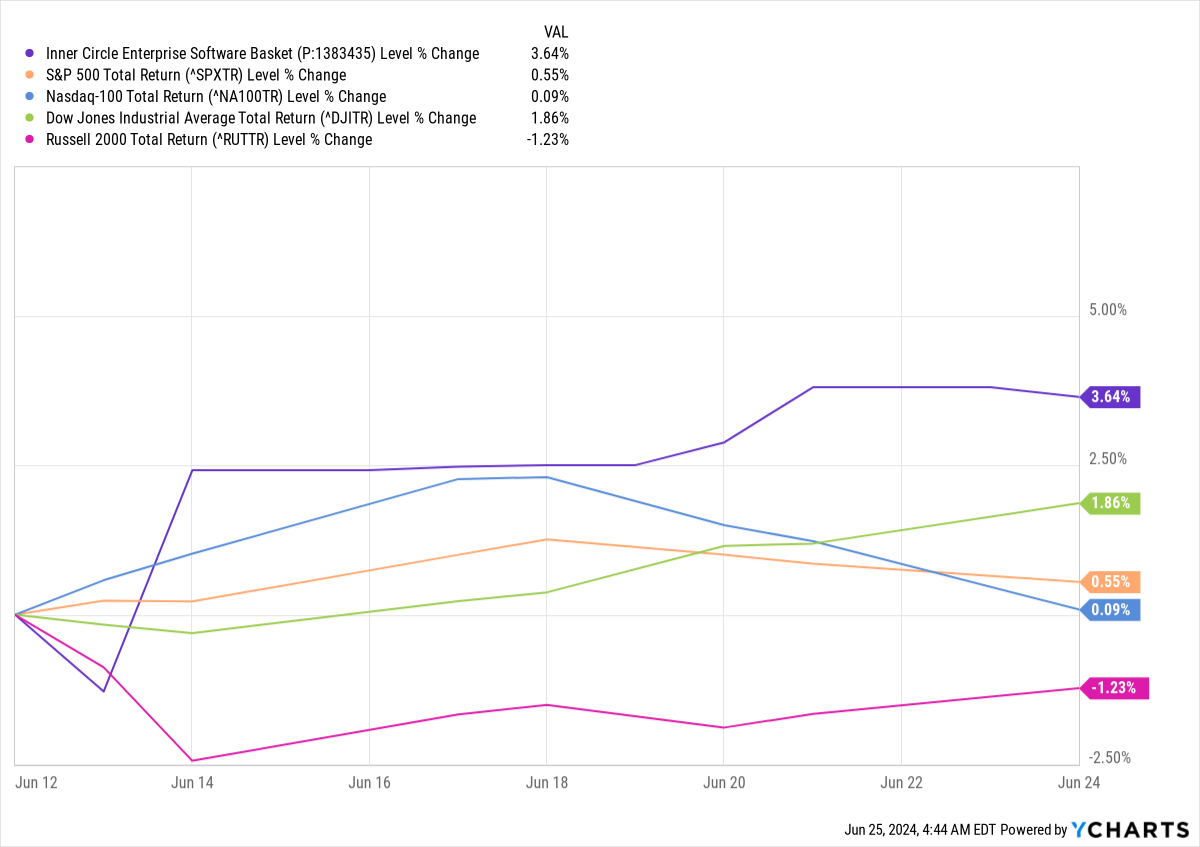

Inner Circle Enterprise Software - 12 June 2024 Inception To Date

So far, so good.

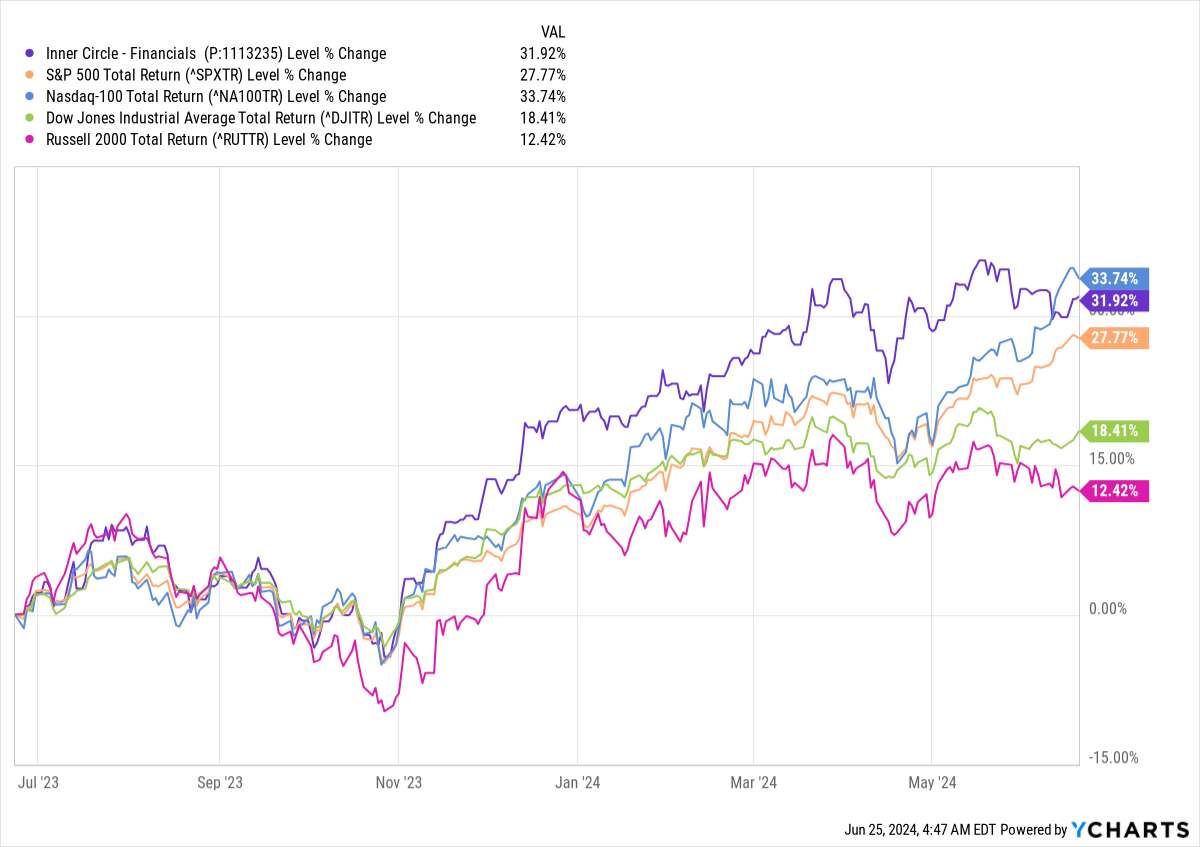

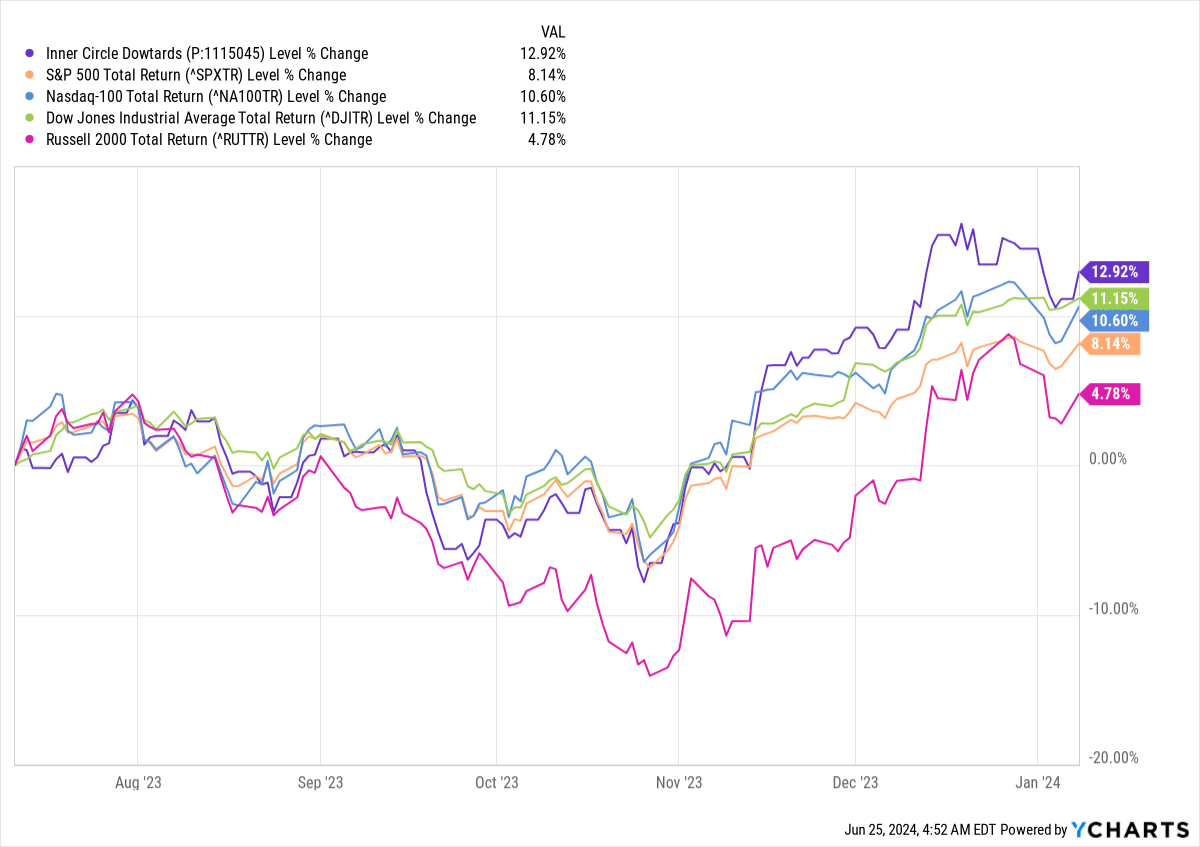

To date we have also closed out two model portfolios - our “Dowtards” - aka. Laggards Of The Dow! - and Financials portfolios. They did well, began to fade back towards the index performance, so we cut them, ie. “sold” the stocks in the model.

Here’s how they did from inception to closeout.

Inner Circle Financials - 23 Jun 2023 To 20 Jun 2024

Inner Circle Dowtards - 11 July 2023 To 8 Jan 2024

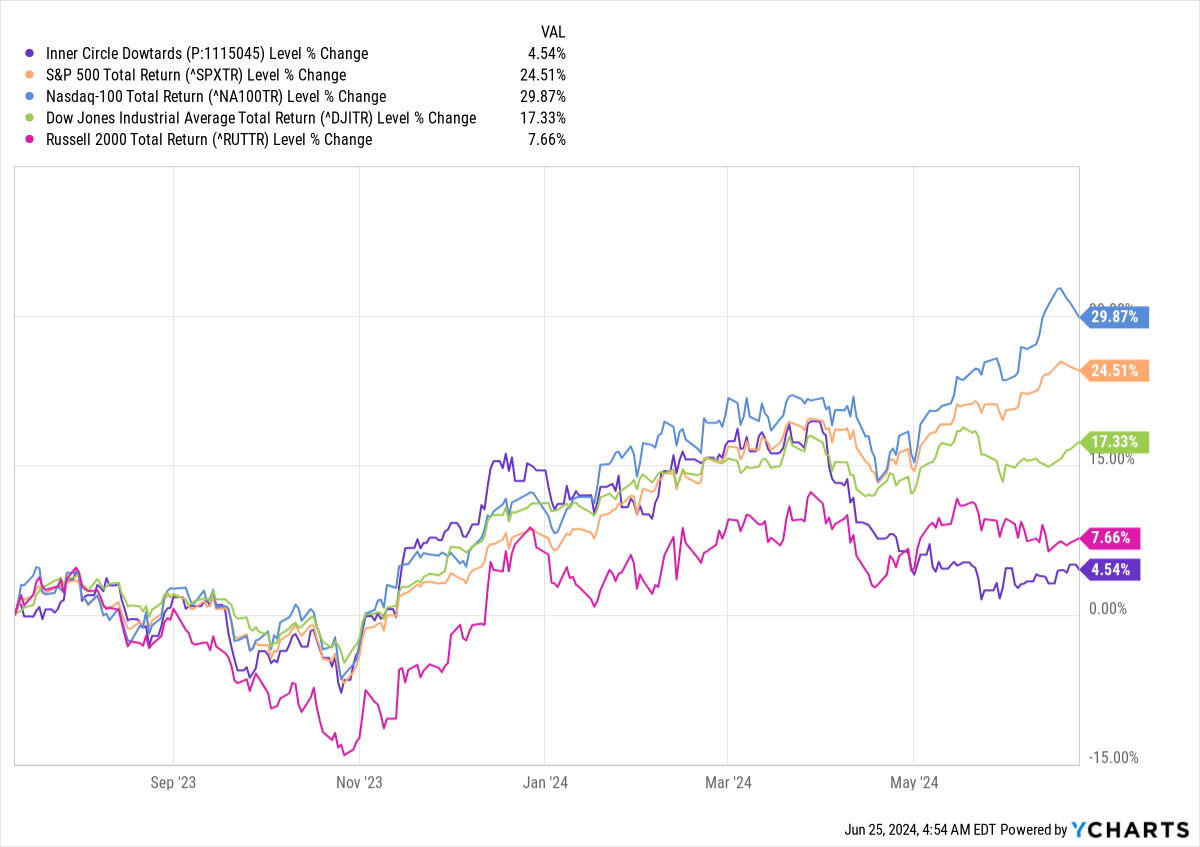

By the way - this is why we close these out sometimes. If you had held that Dowtard portfolio to date, and not sold it? Instead of your +13% gains, ahead of all the indices, you’d be looking at this:

D’oh!!

Energy Sector

Today we announce the latest in this series of model portfolios - our Energy Sector model portfolio. This model portfolio is available to our Inner Circle subscribers only. If you'd like to join the Inner Circle service, here's how to do it.

Firstly go see what it offers - you can do that here.

Secondly, if you're a free reader here, you can sign up using this button:

Note, if you're already a paying Market Insight subscriber, you can upgrade using this button:

And if you have any problems whatsoever, you can reach us anytime using this contact form.

OK. Let's get to work. Here's all about our Energy Sector Model Portfolio.