Okta Q4 FY1/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Pretty Good Quarter, If It Matters

OKTA stock reacted very well to earnings this quarter and so far has held up over the gap it put in on the print. In this market that is no mean feat. Personally I opened a small short position in $OKTA after it mooned; that’s a little underwater still so we’ll see how it goes.

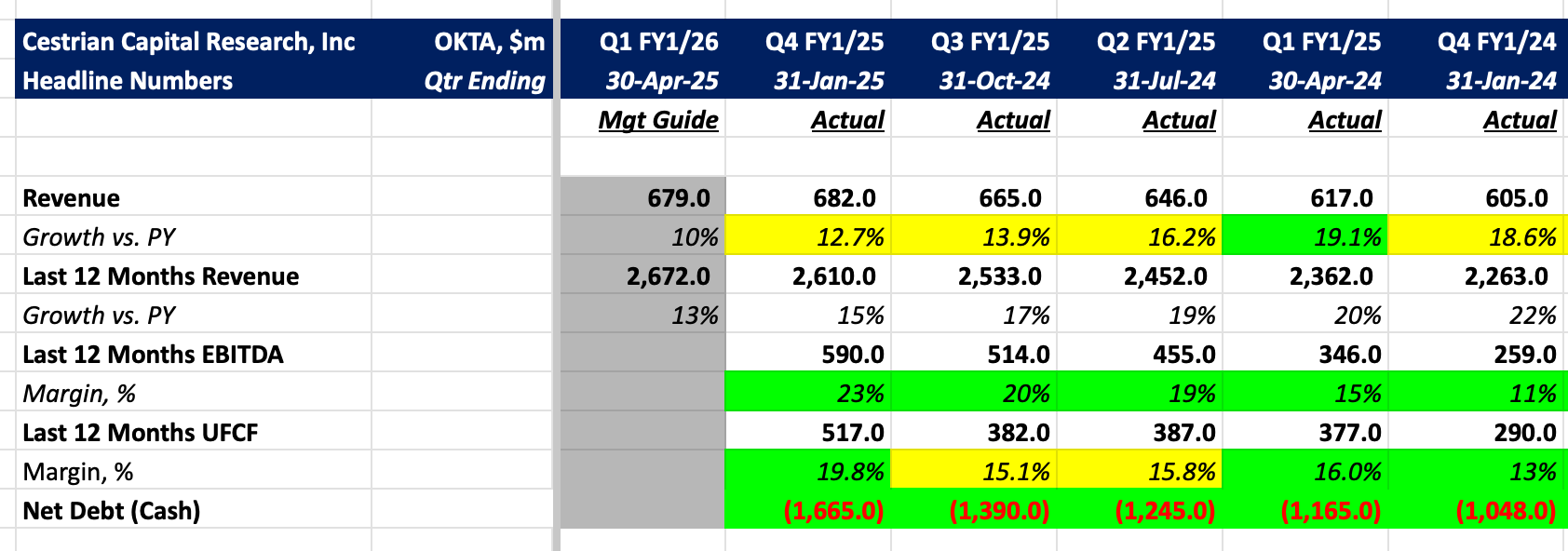

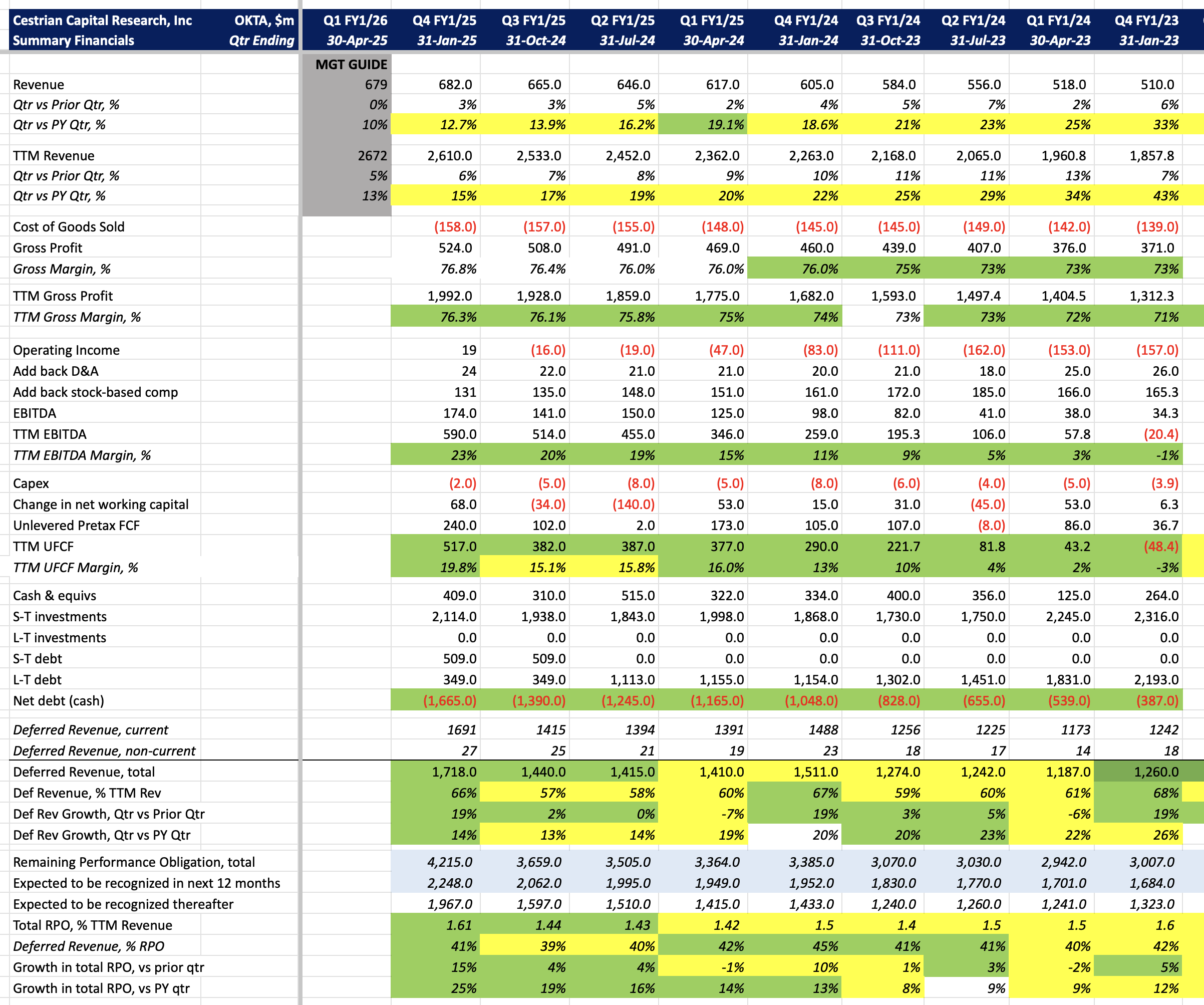

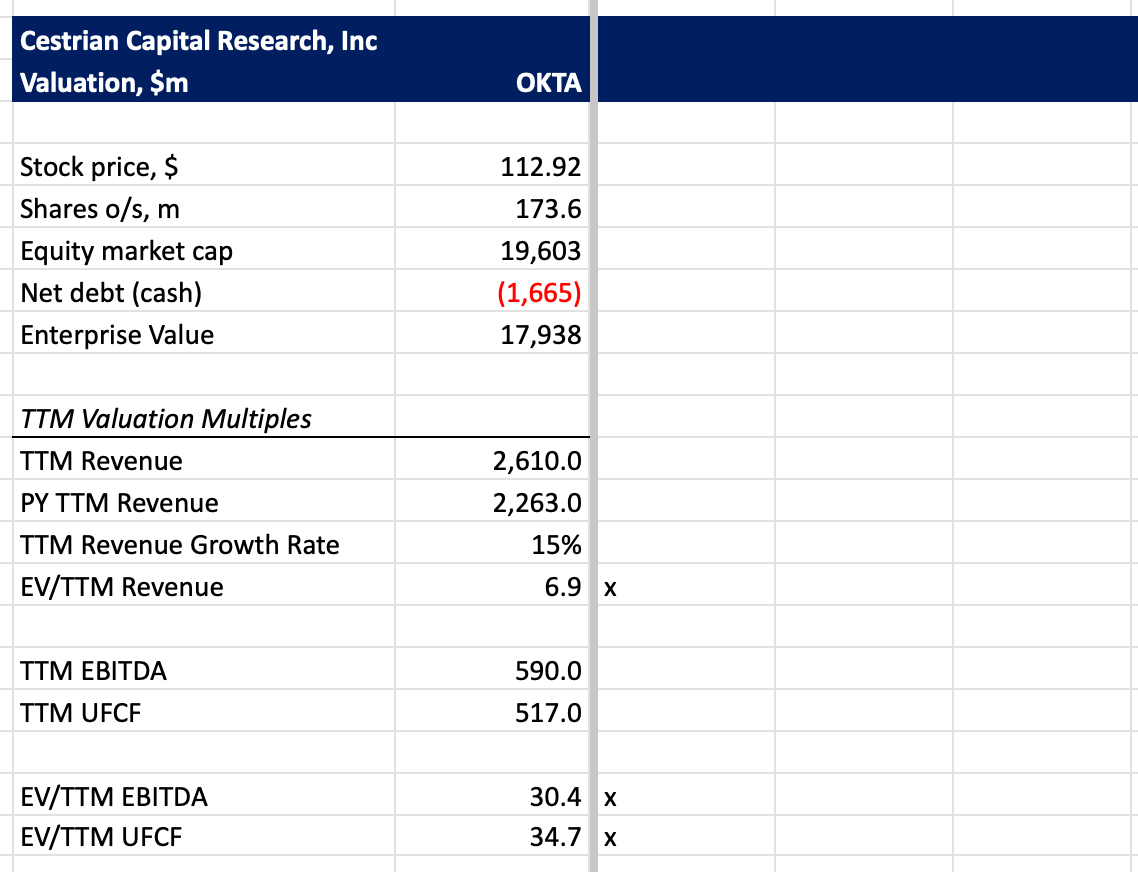

It was a solid quarter. RPO (order book) growth is accelerating and has been since the October 2023 quarter. Cashflow margins are just shy of 20% now - that’s good - the company has $1.7bn of net cash - that’s good too - the fly in the ointment is slowing revenue growth and a guide to slow further. Today the stock closed valued at a little under 7x TTM revenue / 30x TTM EBITDA / 35x TTM unlevered pretax cashflow which is probably a little on the pricey side given the growth, but it’s not a reason to be bearish in and of itself. If the market turns up I would expect Okta to move up nicely, given how strong the stock has been during this risk-off period in the Nasdaq.

Here’s the headlines.

Fundamentals

Valuation

Now let’s look at the stock chart, price outlook and ratings.

Stock Charts

Since its IPO, the majority of OKTA stock volume has traded in the range $45-106/share, as you can see from the volume x price chart (gray horizontal bars below). The stock is currently at $113. In a bull market the lack of potential unsold supply at higher prices could see the stock push higher due to limited resistance. You can open a full page chart, here.

But in this market? I think the earnings gap may close before any material move higher - this is why I opened a small short position. The stock can’t get up and over $116 for now. You can open a full page version of this chart, here.

I think this name is market dependent. If the market stabilizes and moves up, I think OKTA will outpace the market due to the clear air above the stock at this price. If the market sells off further I would expect the earnings gap to be re-tested. So - don’t miss our Market On Open notes to help you navigate the market day by day!

Cestrian Capital Research, Inc - 18 March 2025.