Okta Q4 FY1/24 Earnings Review

Now Looking Like A Real Company!

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

The Road To Redemption

by Alex King

Okta, Inc ($OKTA) is a cybersecurity software company, with a specific focus on identity management - this means it provides the piece of the puzzle checking whether the user and/or device asking for access to particular network resources is in fact who or what it claims to be. This is a critical element in enterprise security; large companies can buy the functionality from many providers, from Microsoft to CyberArk ($CYBR) and plenty in between. Okta is a well established player in this field; it doesn't hold the kind of oligopolistic market position we prefer to see in software companies but its stickiness is reasonable.

The stock hit a 2021 high just shy of $300 before plummeting to $44 in October 2022, bottoming along with the equity market indices. In part this was a function of the rate hike selloff in equities, and in part it was a response to Okta's bungled $7bn acquisition of Auth0, during which time the company encountered most of the major difficulties of big M&A. In my opinion, the company stumbled with its failure to clearly define a single go-to-market strategy - two sales teams remained in place where one should have been created. Due diligence seems to have been problematic, because soon after the deal was announced, the company had to restate the quantum of deferred revenue it had acquired in Auth0. The CFO of Okta left the business soon afterward. These problems sound simple to resolve if you haven't had to live through big M&A - they aren't simple though, they take time and money and the solutions leave a trail of collateral damage along the way.

However.

This quarter Okta looks to have grown up. The financials present as a well run software company which is maturing - growth is slowing - but doing so gracefully - margins are rising and so is the pile of net cash on the balance sheet. Someone has had a let's-call-it-kindly arm around the CEO's shoulders explaining how things need to be.

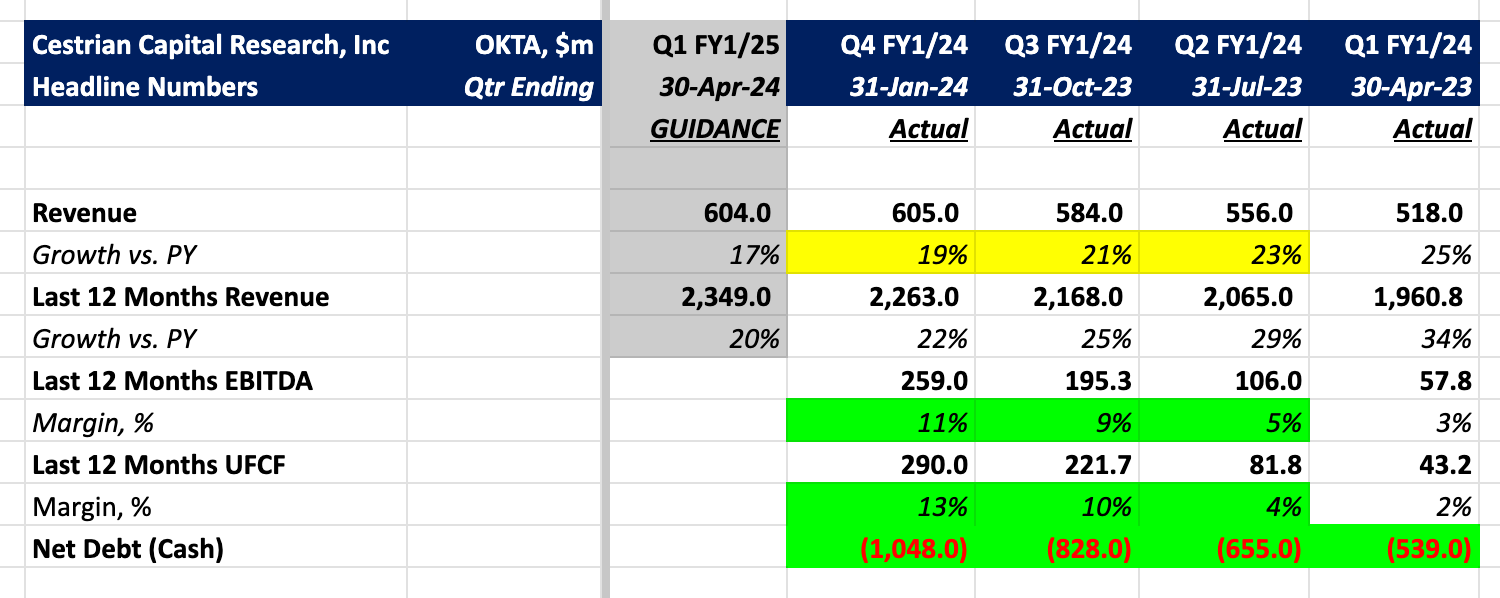

The headline numbers look like this:

In short:

- Growth is slowing but remains at a solid +19% YoY this quarter and +22% on a last 12 months basis. The guide is for a further slowdown.

- EBITDA and cashflow margins are climbing, quite convincingly too.

- The balance sheet is increasingly solid - now with $1bn of net cash.

Let's turn to the stock price outlook, more detailed financials, valuation analysis, and our rating.

Read on!