Okta Q2 FY1/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Attaboy!

by Alex King, CEO, Cestrian Capital Research, Inc.

Okta started out very well as a public company. High growth, losses reducing over time, big order book and forward revenue visibility, all that. Then came the hubris; the acquisition of Auth0 in 2021 was completed at too high a price with too little clarity on the post-merger organization, who was to do what, when etc. The deal claimed the Okta careers of the then-CFO (problems with due diligence and subsequent reduction in deferred revenue balance) and a number of sales executives. That the CEO survived is a matter of board dynamics rather than any reasonable attribution of fault. Okta went on to have a terrible 2022, on fundamentals as well as on stock price; only recently has the company looked to be getting back on track. A remarkable feat of survival and rebuilding by the current CEO. Right now I would say the company and its stock have a bright future.

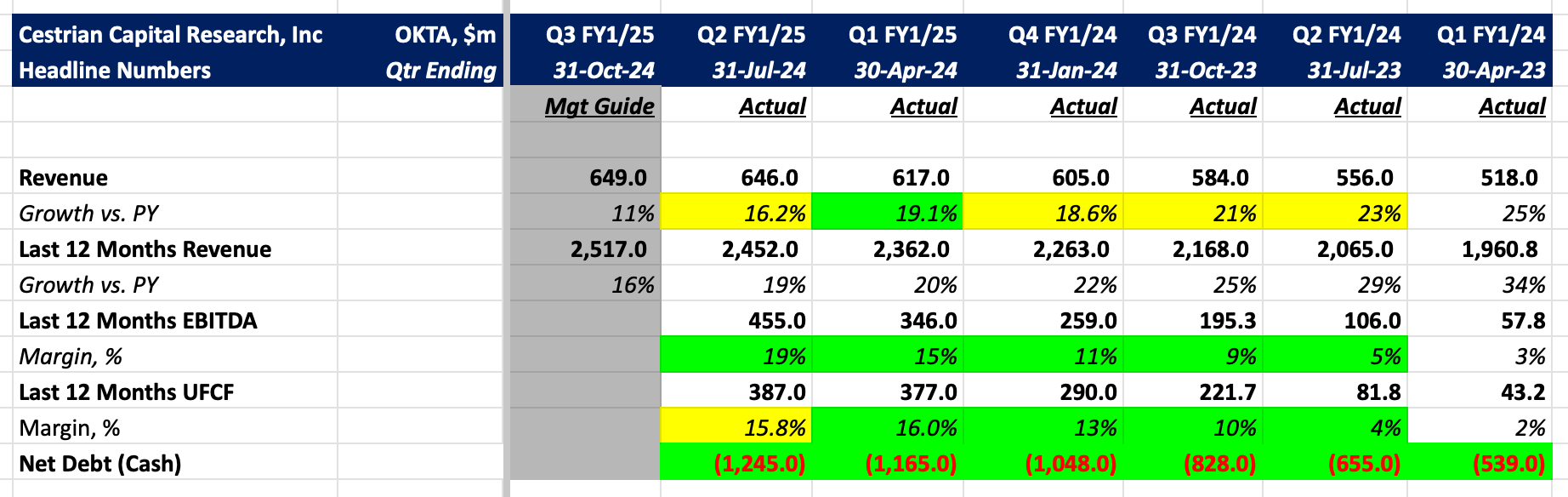

Here's the headline numbers. Below, for our paying subscribers here of all tiers, we dive into more detail on numbers, charts, price targets and stop levels.