Obsessives 1, Doomscrollers 0

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Market On Open, Monday 3 June

by Alex King

If, on Friday last week, you had something interesting to do like go to a real job, take the kids to school, walk the dog, cook dinner, read a book, doomscroll TikTok, anything normal, then when you checked in on the news later that day you might have said, hm, the markets were up a little.

If on the other hand your weekdays are spent doomstaring at stock charts then you would have concluded, GEEZ what a day! Wowsers!!

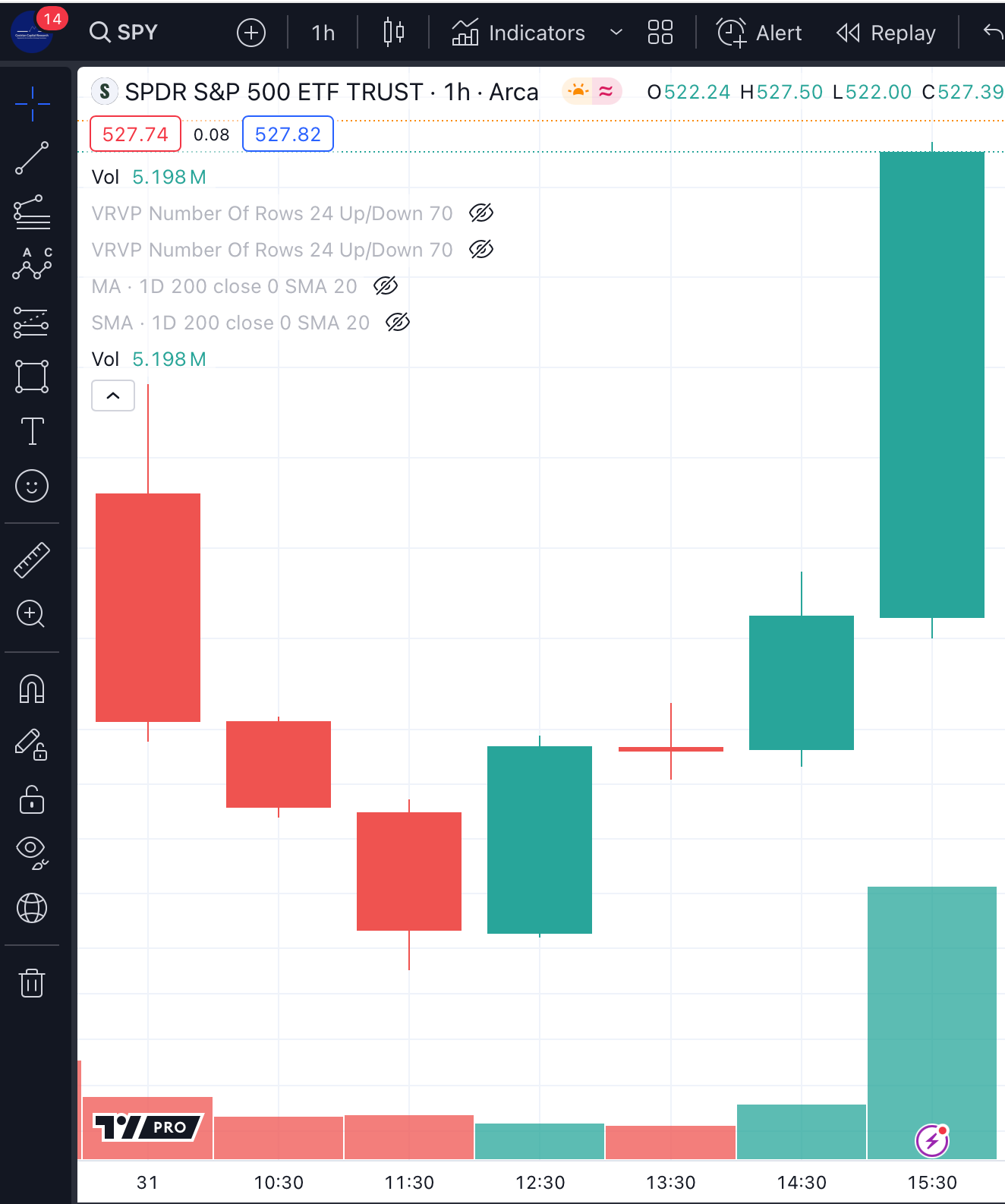

Here’s what happened Friday to normal people:

And here’s what happened Friday to OCD people:

Now, for next-level OCD types we could begin to explain this in terms of hedging flows and such. But I think for now we can just say, sometimes markets are hilarious, particularly in their capacity to scare folks into selling or shorting at local or long-term lows only to rip back up at a time solely of bigs’ choosing. Which is yet another reason to follow price, price only, not try to work out what may happen tomorrow based on the news, the latest junior Fed member’s proclamation, Twitter, whatever. Price can tell you where price may move next, if only you can tune the antennae correctly.

So let’s get back to our pattern recognition. As always in these notes, today we cover all four primary US equity indices (the S&P500, Nasdaq-100, Dow Jones-30 and Russell 2000); bonds (TLT), volatility (the Vix), oil (USO) and sector-specific ETFs including semiconductor (silicon being the new gold!!).

Yet to sign up?

Monthly and annual subscriptions available - right here. Market Insight gets you daily market, er, insight, and single-stock research notes aplenty; Inner Circle gets you all that plus 24/7 chat with our own analysts and wonderful investor community, plus a live weekly webinar, and of course trade disclosure alerts right before Cestrian staff personal accounts place trades in covered stocks or ETFs.