Nvidia Q4 FY1/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Channelling Mr. Musk

Of course it was going to be a nothingburger. The most anticipated Big Tech earnings since - oh, well, since the last Big Tech earnings, and not just Big Tech but, you know, the Big Kahuna Of Big Tech, The Biggest … oh you get the picture. Nvidia. The Big Dog.

With a backdrop of market weakness coming into the print, any investor in denial about the change in market character this year and who had failed to adjust their approach accordingly was sat hoping, praying to the Great God Mammon, that Nvidia would blow their numbers out of the water, in a good way.

Over on the dexter side, voracious market realists were sat poised for an underwhelming print, the last pillar holding capitalism in place to fail.

Calls and puts, fully loaded.

As is their wont, the company then took their sweet time releasing the numbers. Almost as if they enjoy the drama, that final rising tension in the air before they make careers on the one side and break hearts on the other.

And then the reality. A big ole pancake of a response, barely a change on the closing price. Which reminded me of Mr Musk’s 2022 mantra that “the most likely outcome is the most entertaining one”, to which he later added, “it just won’t necessarily be entertaining for those involved”.

The print was hugely entertaining for one set of folks, being option sellers. If you played this game aligned with market bigs and sold options to those hungry for bull or bear gains, congratulations. A grand pile of premium is now yours to keep. If you bought options? Thanks for playing, you can chalk this one up to the ‘investor education’ budget.

The numbers were fine. I think the stock will rise and fall with the market at this point rather than necessarily leading the market. With all of the US equity indices sat below their 50-day moving averages I would not be surprised to see the pop this morning fade before a more supported bullish move comes along.

Let’s take a look at those numbers, the valuation multiples, and the stock chart.

Oh, a final word. That must have been the most soul-destroyingly-dull earnings call I have listened to in a very long while. And I have sat through a lot of earnings calls in my time. Two bright spots for me were (a) a <checks notes> moment from the management team when dealing with gross margins, I liked that and (b) a sellside analyst gone AWOL somewhere in what appeared to be a 1996-era Lucent Technologies phone system that was hosting the call.

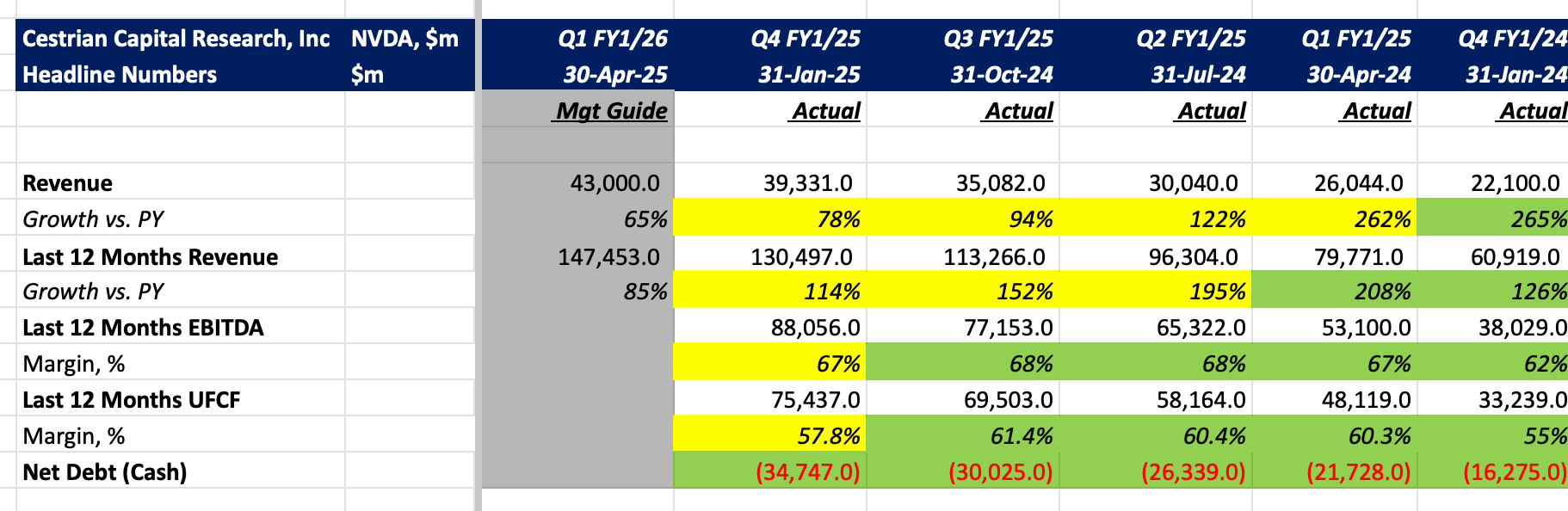

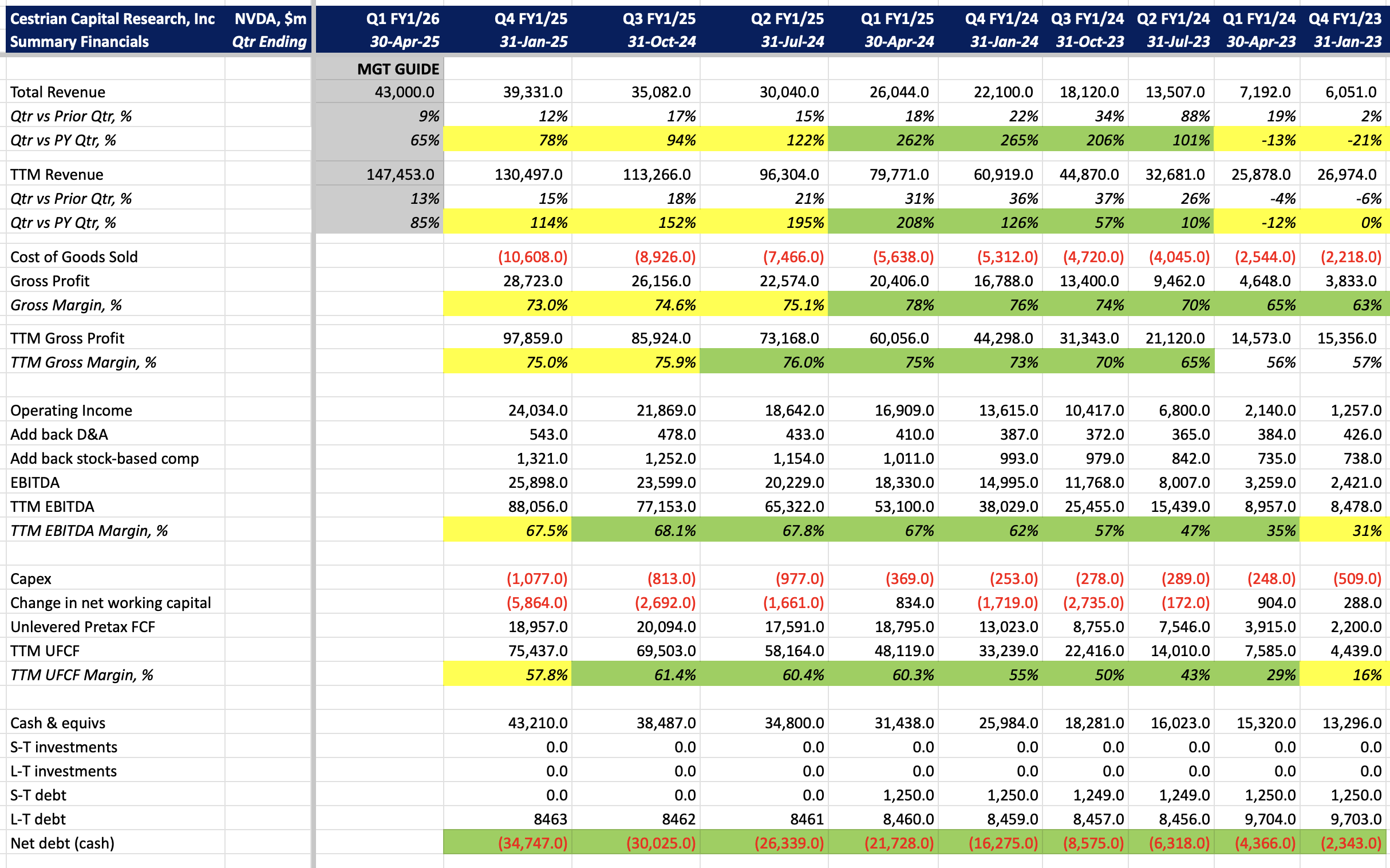

Anyway. Headlines. Growth slowing but still very very high. Cashflow margins declining but still very very high. Cash pile large and growing. Overall you would say - the present growth wave from AI is maturing and soon enough they are going to have to find another wave to surf. I don’t make the rules.

Here's the detail.

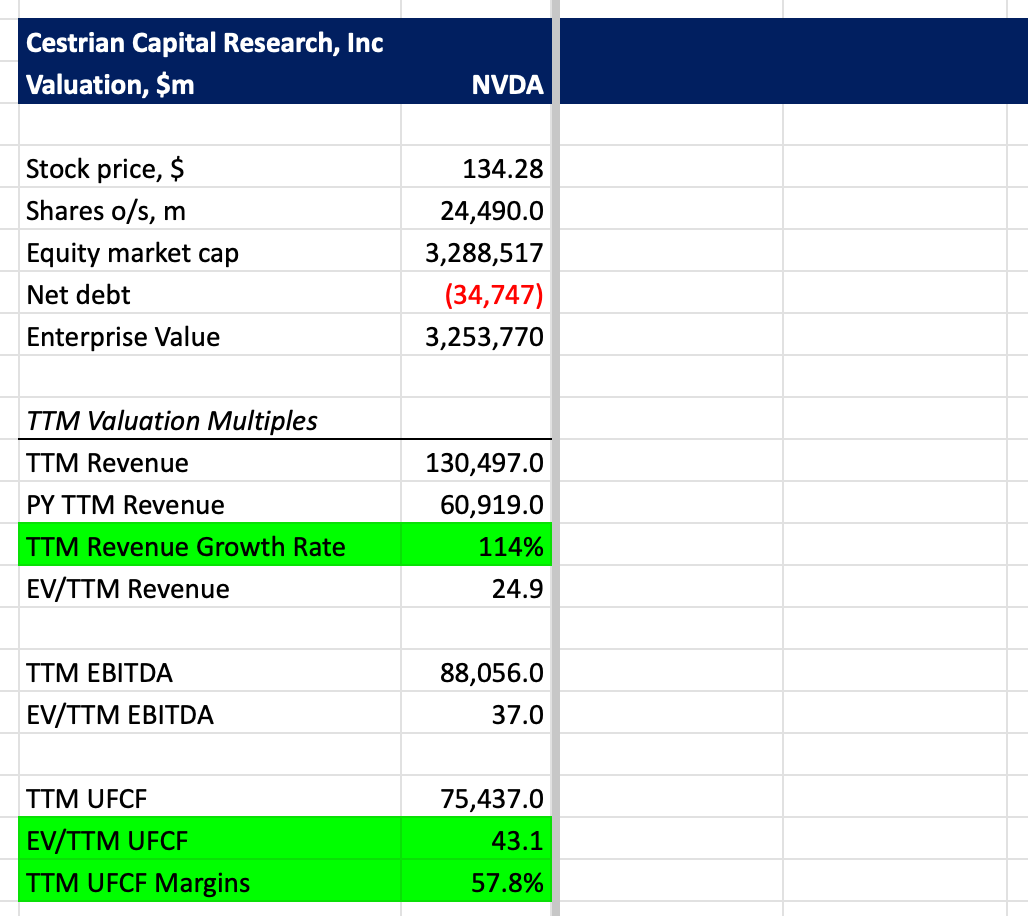

Valuation remains inexpensive. Nvidia, for all the heat and light around the name, has been inexpensive since it started the big AI earnings run back in 2023 in my view. These aren’t big multiples for the growth, margins and balance sheet on offer.

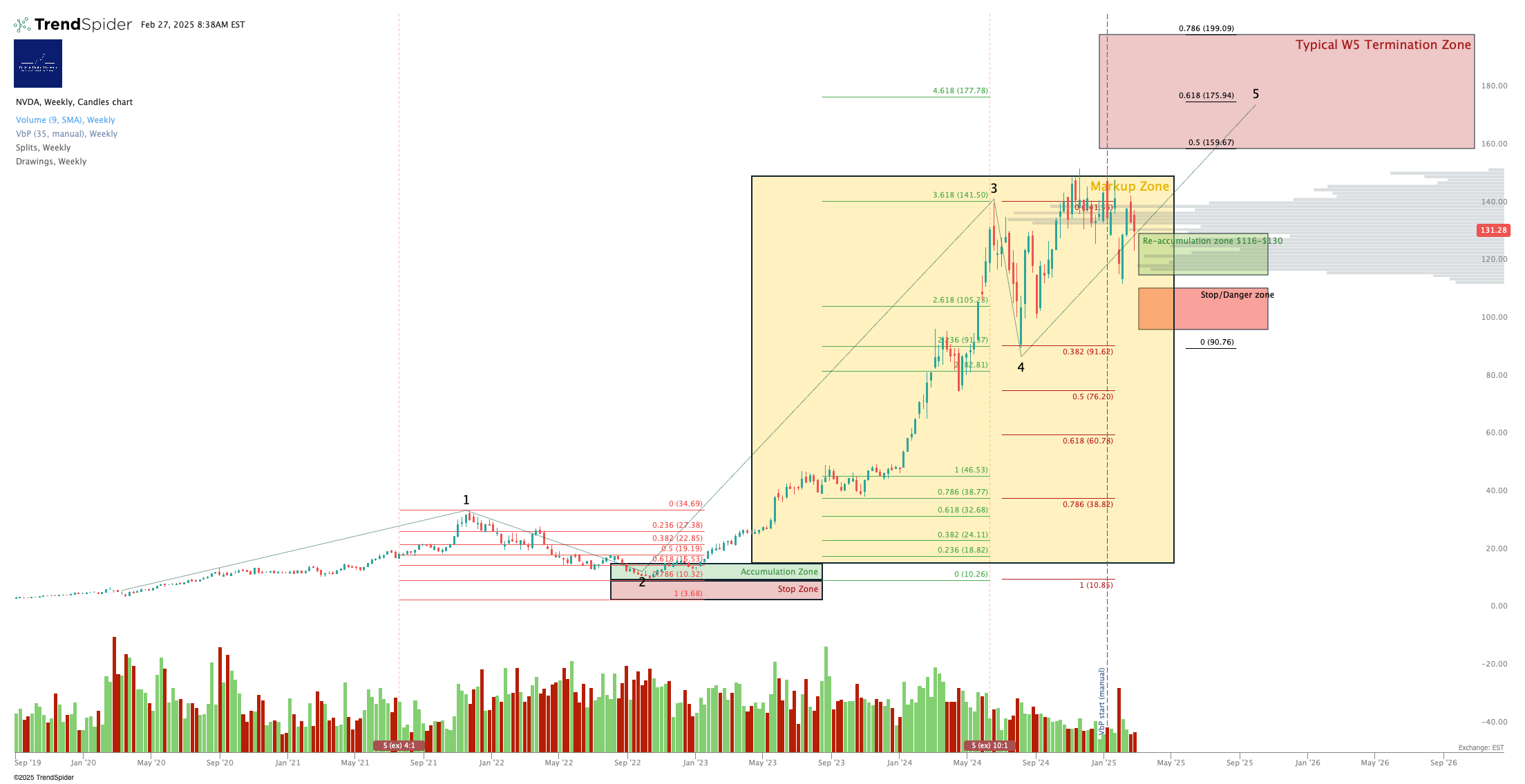

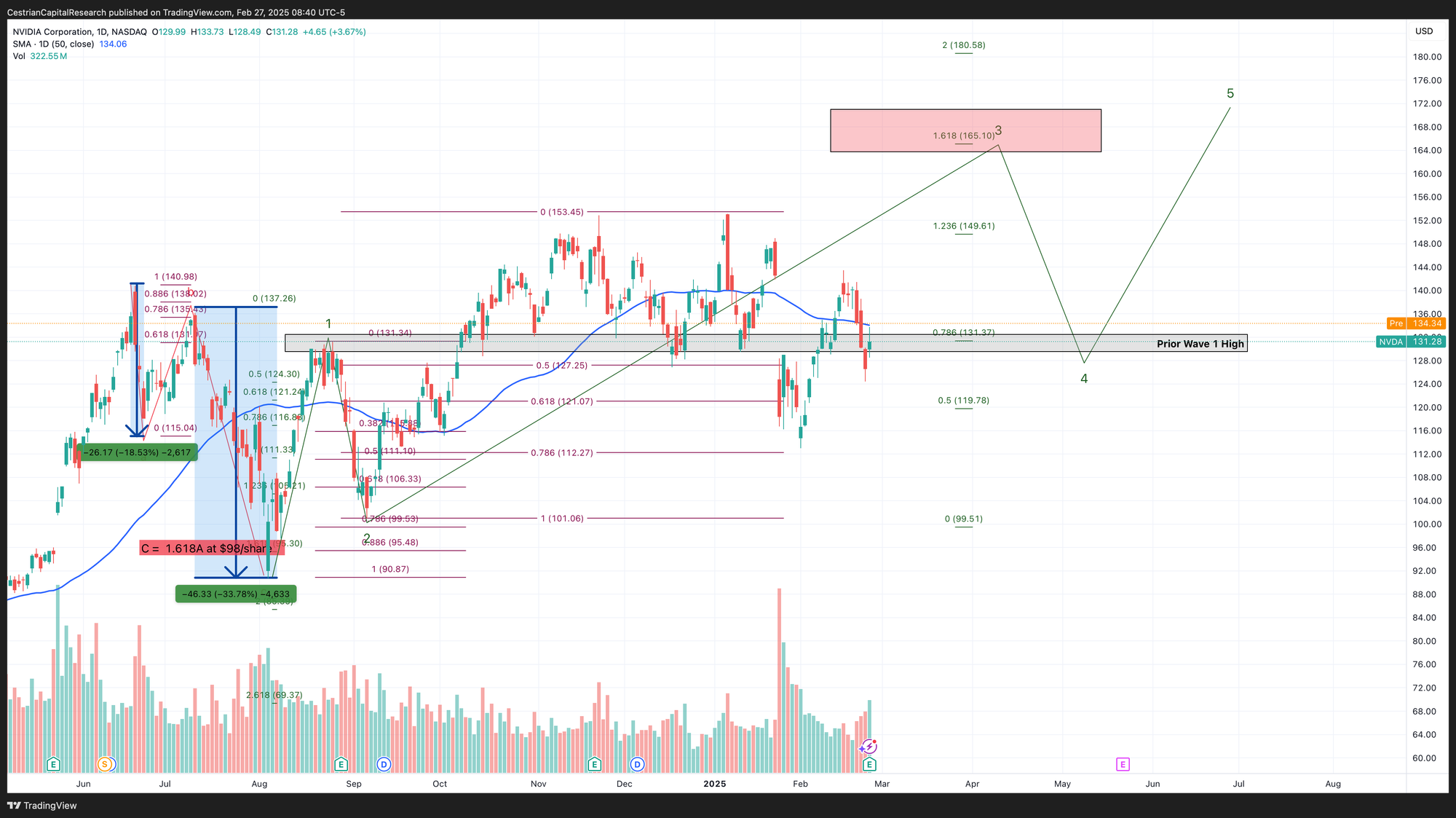

Charts? I think the name can reach $150-175, with an outside chance of $200, before hitting some material resistance and rolling over.

You can open a full page version of this longer-term chart, here.

Shorter term here. A close today over $135 (that’s the 50-day moving average) would make bulls feel a lot better.

We rate the stock at Hold - risk/reward insufficiently compelling in my view to rate at Accumulate.

Cestrian Capital Research, Inc - 27 February 2025.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, $SOXL.