Nvidia Q3 FY1/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Old Line Monopolies, Read It And Weep

A hundred years ago in 1984, the Federal Government decided to take an ax to AT&T, because unless you knew a guy who knew a guy, you couldn't get an international call connected to any country smaller than maybe Germany, and once you did get a connection the call cost you more than a small sedan particularly because it would take place at a time when your overseas friend was asleep and you had to call someone else to go wake them up and talk to you. Oh, also because Bell Labs. Which it turned out already had invented basically Internet 2.0 by maybe 1980 but hadn't told anyone. Not least because of all the fat profits AT&T was making on X.25 lines. Anyway for all these reasons and more, the sleepy ole utility called AT&T was broken up into small pieces and everyone was better off for it. You see this same initiative at work with Google right now (current Administration) and you see the same gunning for Meta Platforms too (incoming Administration). Everyone hates monopolies.

Except Nvidia ($NVDA) shareholders. Because this is the finest monopoly ever created. The company, as you know, makes chips. Woot. Clever chips, no doubt, but that's not the whole story. The whole story is that a generation of developers have been trained on the company's software platform; and that a generation of customers have been Pavlov'd into only buying Nvidia because, er, nobody ever got fired for buying Nvidia.

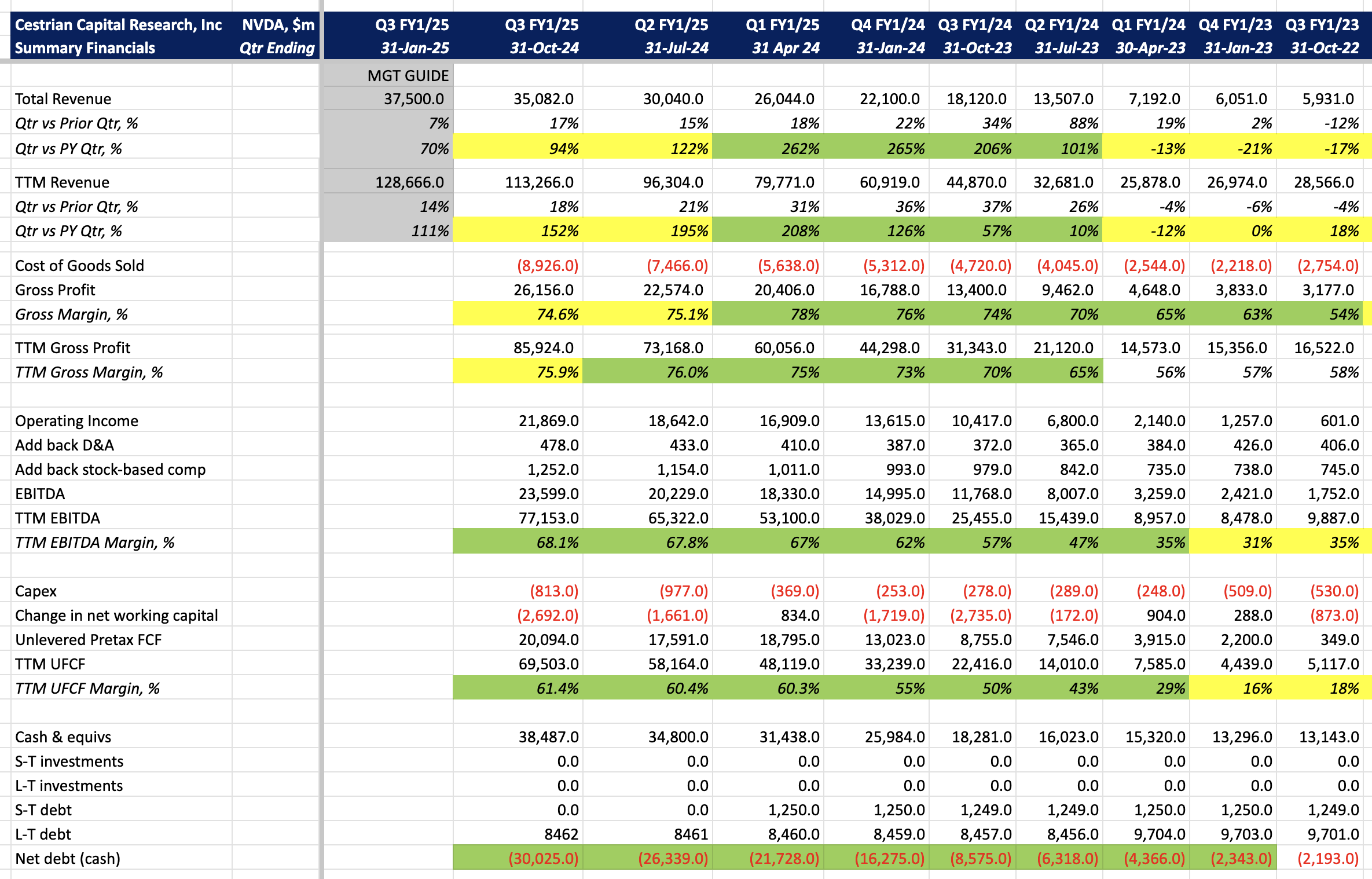

The genius of Jensen Huang is many levels deep, from painting a picture of the future to designing the ecosystem that serves that vision to selling the things required to deliver that vision to all the while telling everyone he is leading them to a better place. Whilst clicking in 61% TTM unlevered pretax free cashflow margins (AT&T could only dream of that even when they had you paying them half your first paycheck for line rental). And whilst sat atop a ginormo pile of cash - currently around $30bn net of debt.

Oh also, the only company that can remotely hold a candle to NVDA GPUs, AMD, is run by ... his cousin Lisa Su. Yes really.

One day, the people who really hate NVDA, which is all the companies currently forking over a gigazillion dollars per year just to stack Jensen Processing Units in case they need them one day - this being your MSFTs, your METAs, your AMZNs and so forth - one day these companies will work together to undermine and deflate and ruin NVDA, most likely by agreeing on a new development platform to which they all contribute intellectual property, and by agreeing standard chip design elements that they can partner with suppliers from $ARM to $INTC and $TSM and beyond to actually make ... and basically rolling their own. They will probably own equity in the companie(s) that make and sell the new Not-Vidia chips when they come. I don't think these big companies are going to be held hostage again. I think they are playing nice because they have to, all the while looking for ways to knife NVDA in the back when it's not looking.

Jensen Huang knows this, because he is a genius, and so everything he does is designed to extend the monopoly just a little longer. It won't last forever, because monopolies in tech never do, but it's not going away tomorrow.

We've had a superb run in $NVDA stock. We rated the name at Accumulate between $10-15/share, on a split-adjusted basis. We rated it at Hold from $15/share to about $145/share. We moved to Distribute at $145, that being 10-15x up on the entry price range, this last week. And after today's print we move to Do Nothing. Why Do Nothing? Because I think the stock has upside to $165, maybe $200; and downside to maybe $120. The stock is at $145 right now. So, $25 of downside vs. $20-35 of upside, not very compelling risk/reward. Nothing to do with the superb print today; just that the stock has run up already.

Let's look at the numbers first. Then we'll do charts and suchlike.

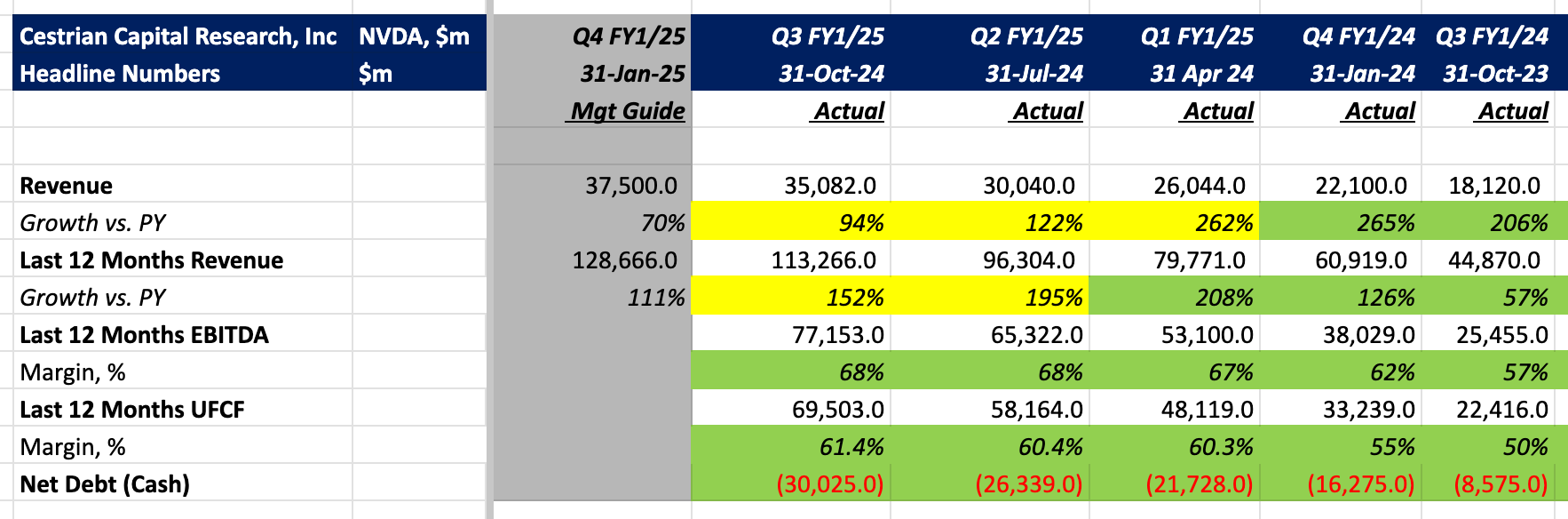

TL:DR - Headlines

Revenue growth is declining, inevitably; margins are holding up great and the cash pile just keeps growing. Doubleplusgood on any standards. The great print isn't enough to moon the stock because of that slowing growth.

Financial Fundamentals

If you have any questions about the numbers by the way, post them in Slack Chat (Inner Circle members) or in comments to this article (everyone else).

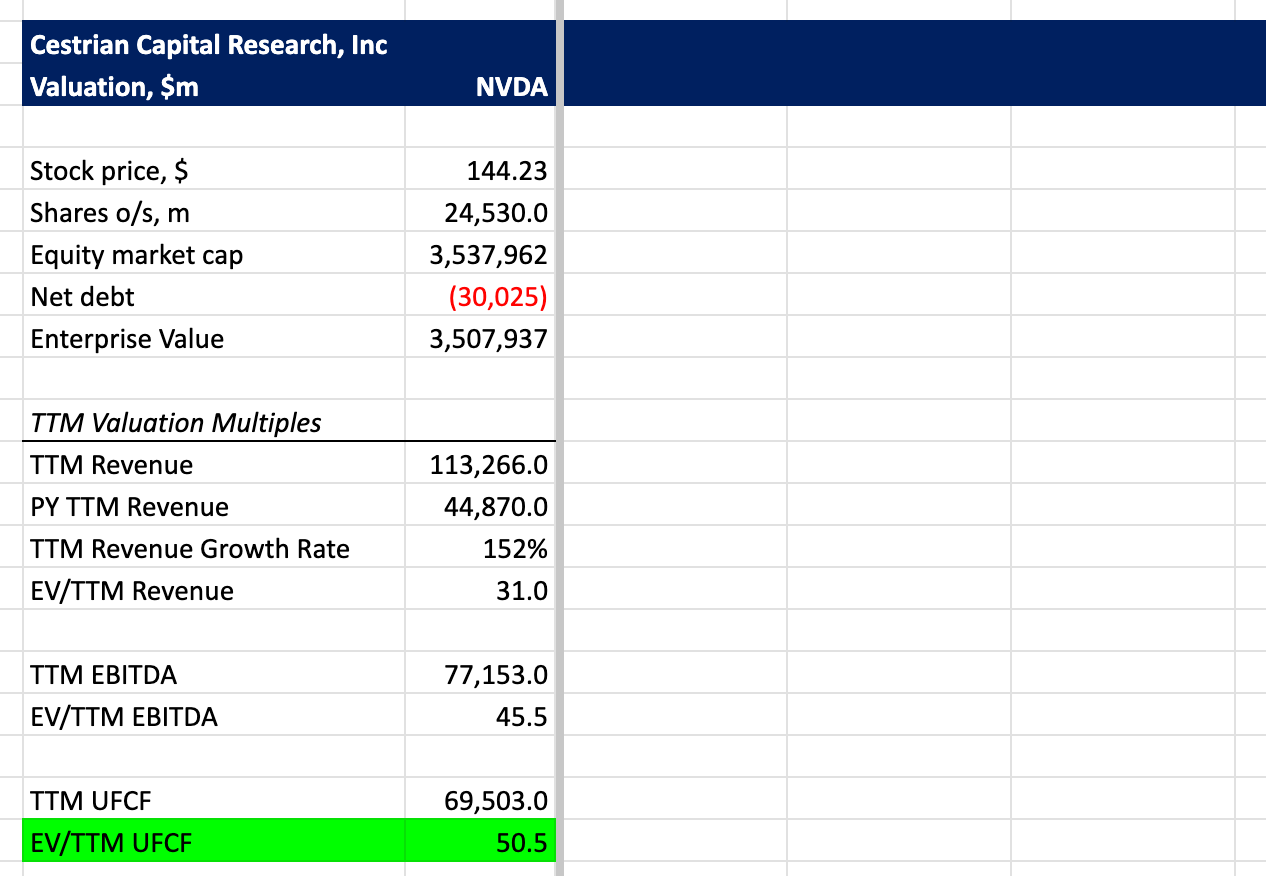

Valuation Analysis

50x TTM unlevered pretax FCF is not expensive for this thing. You'll pay 25x for an ex-growth defense contractor.

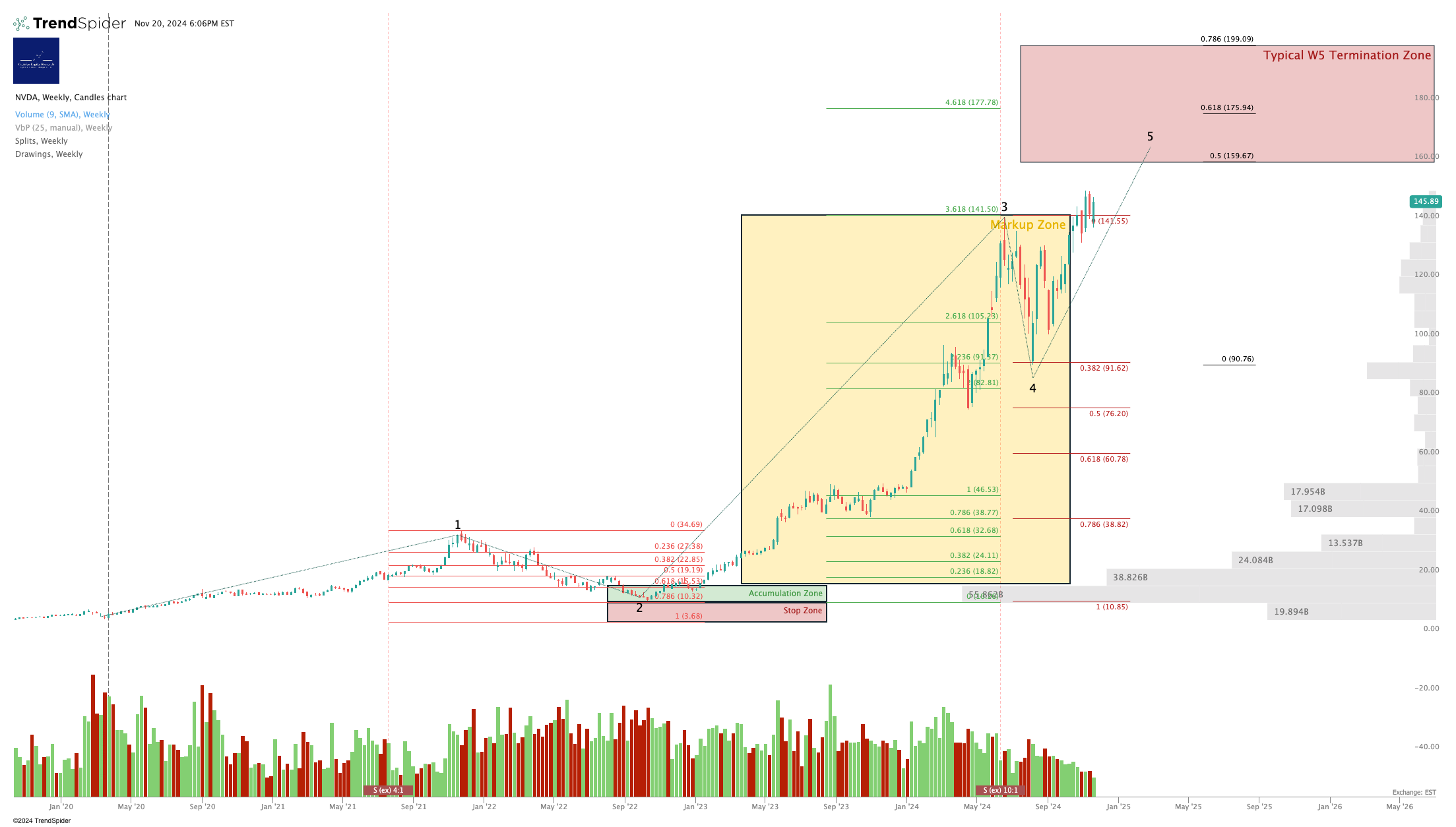

Longer-Term Stock Chart

Here's our take on the larger degree. The stock on this timeframe has, I think upside to between $165-200/share, and downside to maybe $120/share, in both cases just considering "reasonable" outcomes ie. neither hubris nor demolition derby in the market.

You can open a full page version of this chart, here.

Short-Term Chart

The move up from the August lows confirms my view of the price outcomes above.

Full page version, here.

Stock Rating

We rate at Do Nothing right now. Personally I sold my last NVDA holdings recently; I am long SOXL so it would suit me if NVDA went up from here.

Get More From Cestrian Capital Research

Yet to join us? You can sign up right here:

Alex King, CEO, Cestrian Capital Research, Inc. - 20 November 2024.