Nvidia Q2 FY1/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Let's Not Overthink It

by Alex King, CEO, Cestrian Capital Research, Inc.

So as to not add to the groaning weight of dross that will be written about NVDA today, let's keep it simple, to save the Internet from further overload.

- AI is a real thing

- Nvidia remains the only game in town to process AI at scale

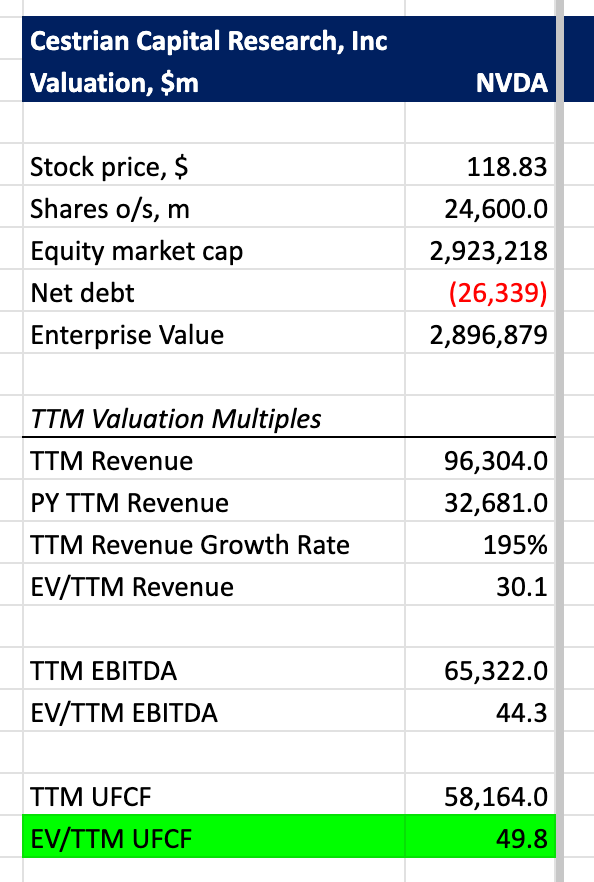

- The stock isn't expensive on fundamentals - it trades at 50x TTM unlevered pretax free cashflow, about twice what you'll pay for an ex-growth defense contractor

- Revenue growth remains astounding for the size of company, and cashflow margins continue to tick up.

- The balance sheet is awash with cash and there is very little debt in comparison to the cash balances.

We retain our Hold rating. We rated this at Accumulate between $10-15/share, split adjusted, in 2022-3. It's up nicely since then and we think there is more upside ahead.

Here's the breakdown.

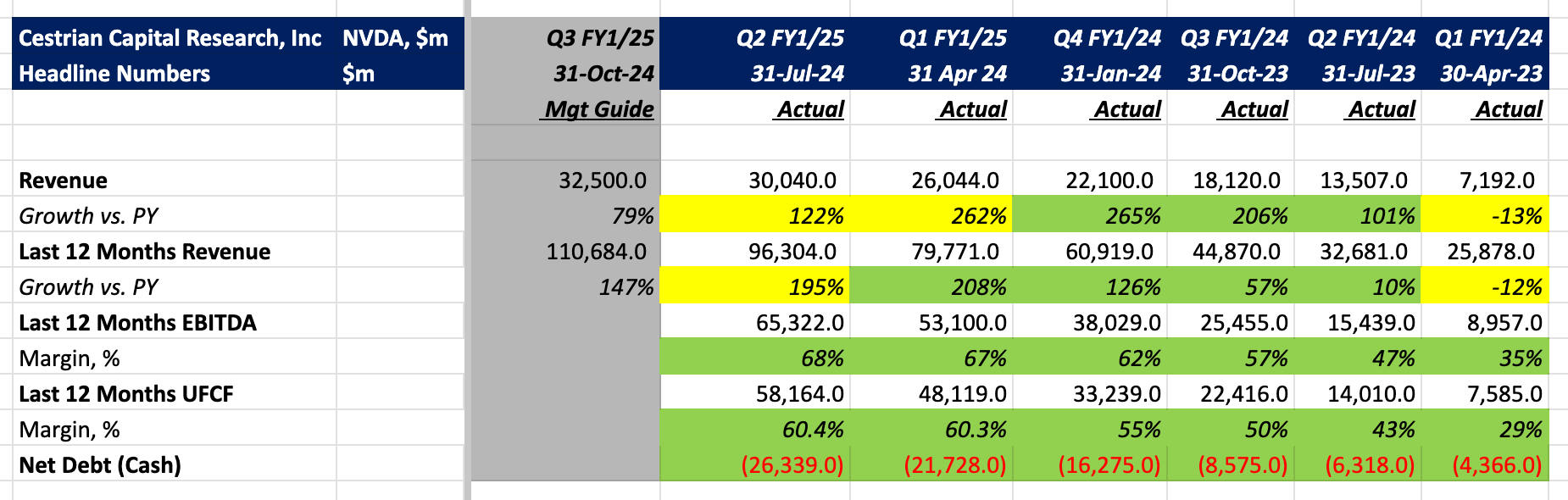

Headline Fundamentals

Now the detail. Want to dig into this? Ask us in Slack chat if you're an Inner Circle member - discounted annual here and discounted monthly here.

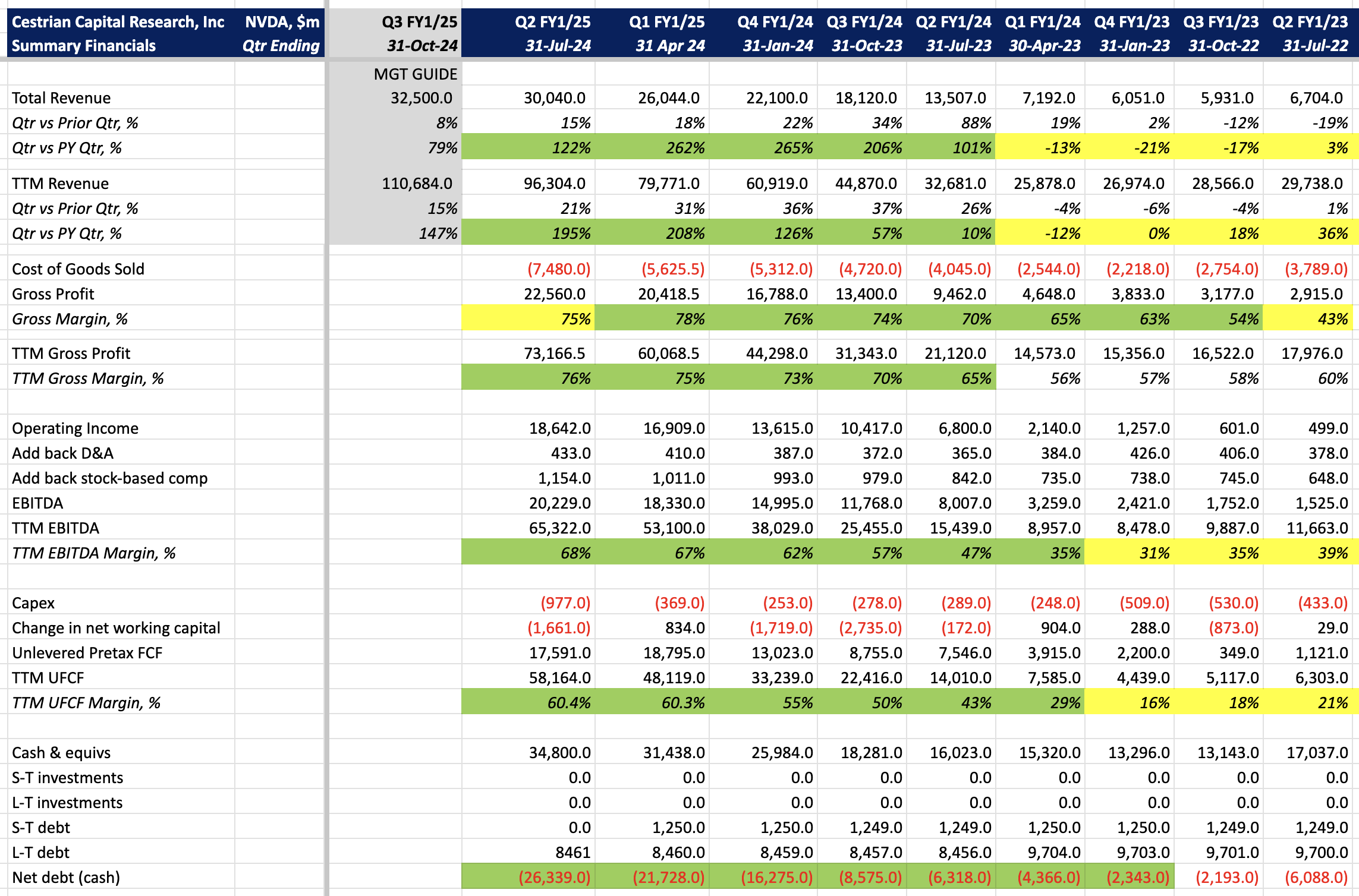

Financial Fundamentals

In short - doubleplusgood.

Fundamental Valuation Multiples

The green box is the most important part. Anyone who says this is overpriced - it isn't, in my view, if you actually do the work.

Technical Analysis

You can open a full page version of this chart, here.

Our price target of $141.50 was more or less hit already - we think it can go significantly higher from here.

Here's a shorter term chart.

Holding at the .382 Fibonacci retracement of the move up from the Aug 5/6 lows. Bullish in my opinion. A break below $106 warrants caution. Below $90, something is wrong with the stock or the market or both, so extreme caution at that point.

Rating

We rate NVDA at Hold.

Cestrian Capital Research, Inc - 28 August 2024.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long positions in $NVDA and $NVDL.