Nvidia (NVDA) Q4 FY1/24 Earnings Review

- NVDA delivered an exceptionally strong quarter on all measures - revenue growth, cashflow margins, and balance sheet strength.

- We do not believe the stock to be overvalued on fundamentals in the present market.

- Can Nvidia stock dump tomorrow? Of course it can. But long term, on technicals and on fundamentals, we think up is the direction.

- We continue to hold NVDA in staff personal accounts and we continue to rate the stock at Hold.

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Not Mixed Signal

That's a semiconductor joke. Pretty funny, if you like semiconductor jokes. But it's also true. The message from NVDA's earnings print just now will be digested, regurgitated, analyzed, put under all manner of microscopes and discussed by most everyone with even a passing interest in stocks.

The thing is though, we don't think it's that complicated.

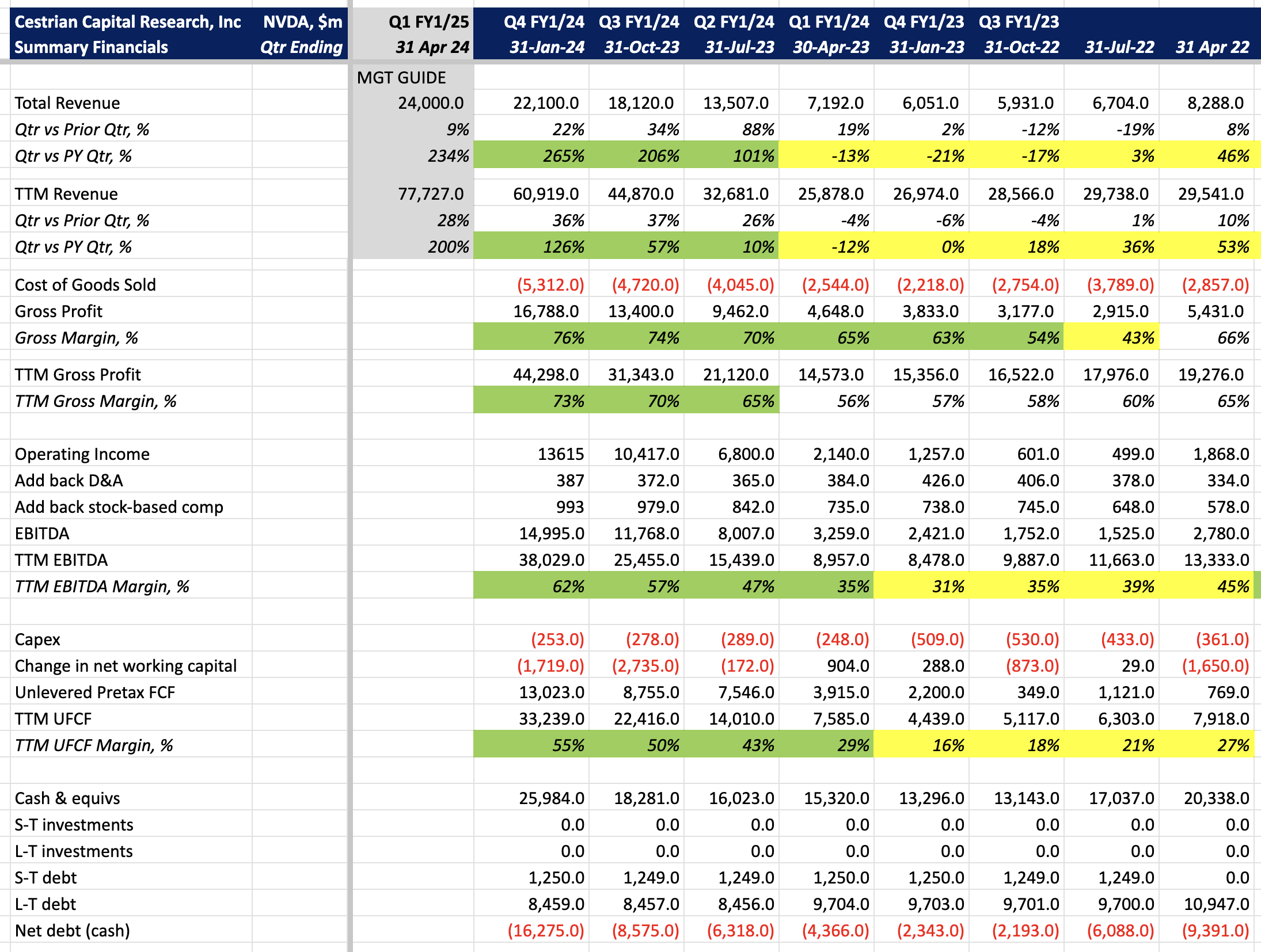

Fundamental Analysis

Here you have:

- A company with $61bn of trailing twelve month revenue which is growing that annual revenue base at 126% vs. this time last year.

- A company which delivered $22bn of revenue this quarter, which was 265% growth vs. the same quarter last year.

- A company which did all that whilst achieving cashflow margins of 55% on a trailing twelve month basis.

- A company with $16bn of net cash on its balance sheet.

That is an exceptionally strong set of fundamentals - truly exceptional in achieving that level of growth at that scale, and those margins at that rate of growth.

Here's the numbers.

Translated - good.

Now for valuation.

Get our 🎥 content, click here and subscribe.

Not a paying member? Subscribe for fundamental and technical analyses of 40+ stocks. Hit the button below now!

Enjoying our work? 🌟 Help us grow by sharing our newsletter with your social network. 🚀

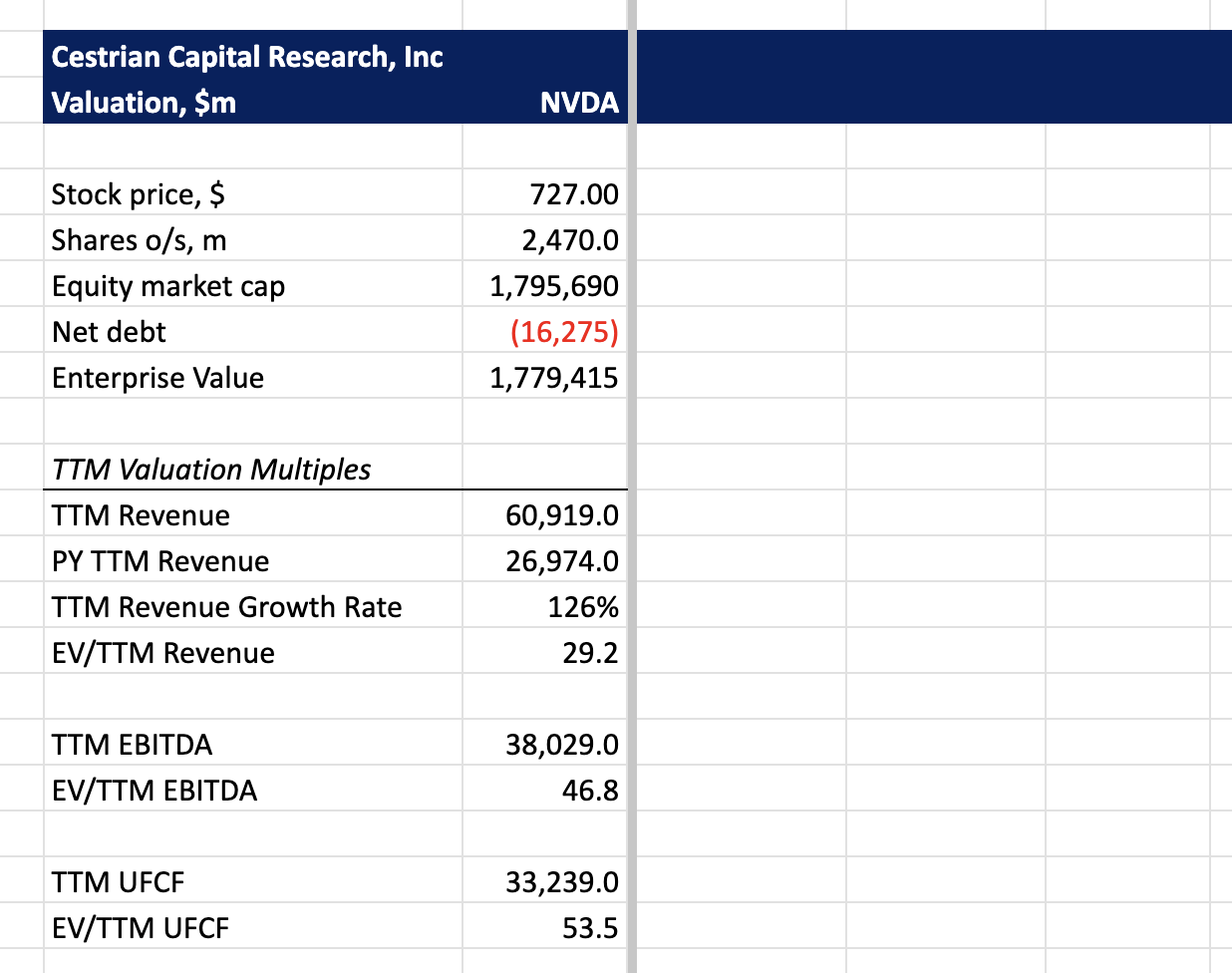

Valuation Analysis

NVDA stock is trading at around 53x TTM unlevered pre-tax free cashflow. Which sounds a lot until you think that Raytheon (RTX), a company growing revenues at 3% per annum with 10% cashflow margins and which has $34bn of net debt on its balance sheet, is trading at around 23x TTM unlevered pre-tax free cashflow.

Is NVDA worth twice the cashflow multiple that RTX trades at? I think it is. I don't think it is overvalued in the light of those fundamentals above.

Translated - not too bad.

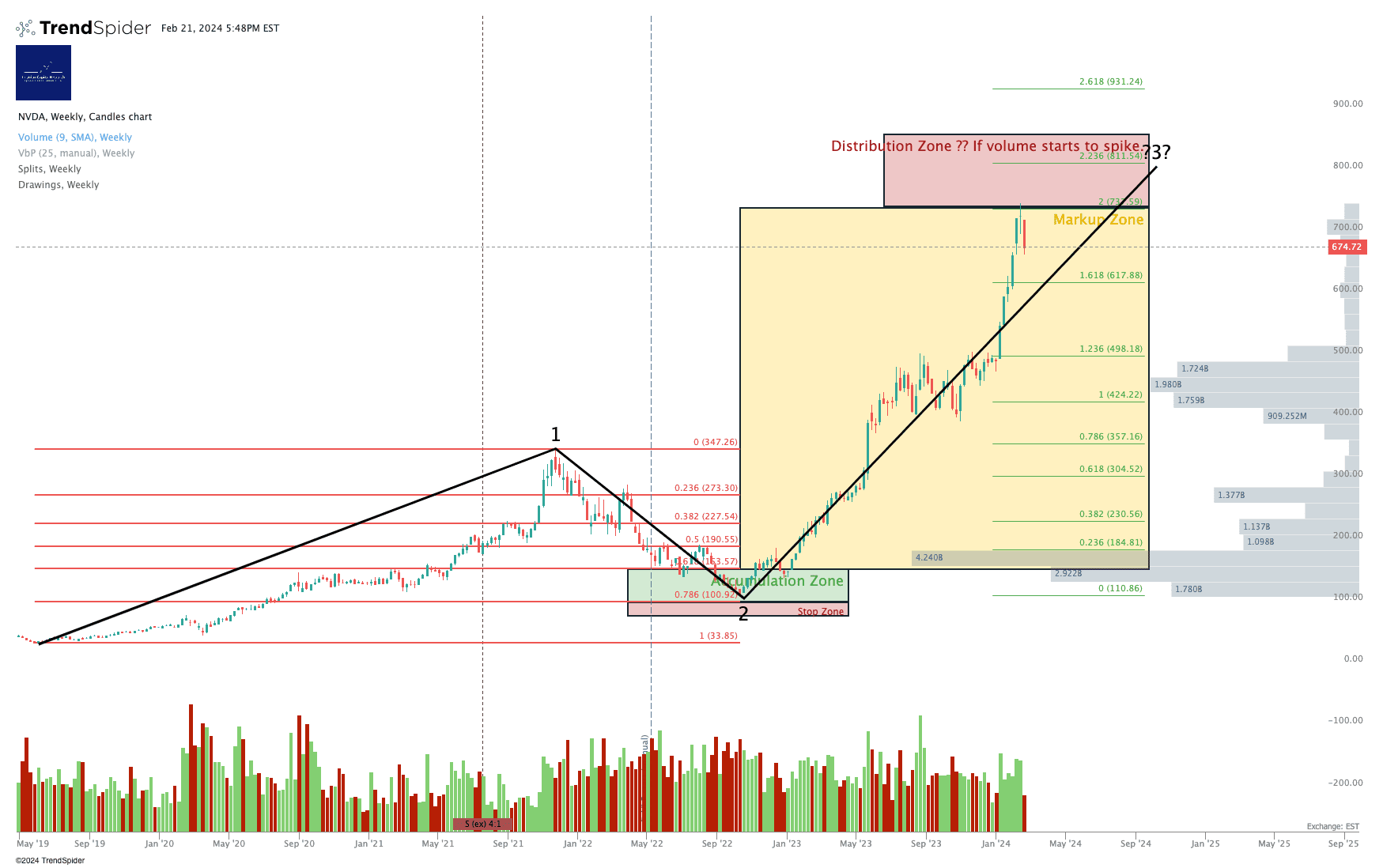

Technical Analysis

Based on this same chart, which we put together in 2022, we rated NVDA at Accumulate between $100-150 and said that the stock could reach the $600s. So far so good. (You can open a full page version of this chart, here).

I am watching the placement of that Distribution Zone very carefully. I expect to have to move it up, because I do not expect to see much high-volume distribution in that price zone. I believe institutions are holding longer.

Translated - we think the stock can move up, until it stops doing so. Then if it starts moving down at high volume - gray bars on the right hand side of the chart - we can reconsider. But until then, we think up is the likely long-term direction.

Rating

No change to Hold rating. Translated - in staff personal accounts we continue to hold NVDA, neither buying nor selling at these levels.

Enjoyed this article? Hit the ❤️ button — it'll make us smile! 😊

Cestrian Capital Research, Inc - 22 February 2024.