Not So Fast-ly - Q2 FY12/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Hit The Brakes

by Alex King, CEO, Cestrian Capital Research, Inc

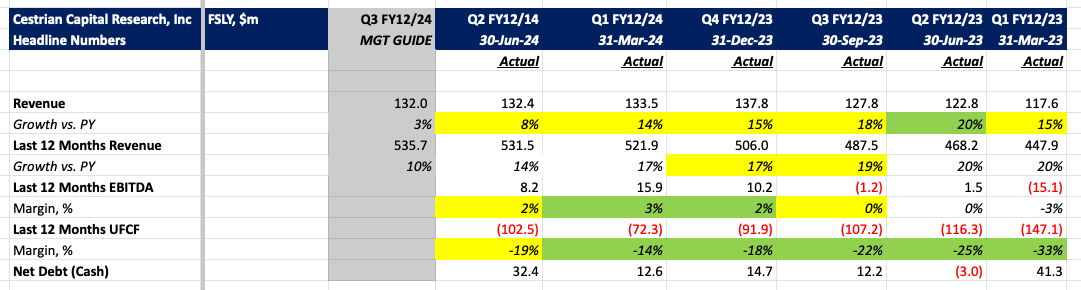

There is nothing great going on at Fastly, which is a shame, since (1) I own the name personally and (2) we’ve had this as an ‘Accumulate’ idea in our subscription services. Bah. This quarter saw revenue growth decelerate further, EBITDA and cashflow margins drop and the balance sheet weaken. The earnings call saw the company admonish themselves about the problems in their largest customers - they didn’t say, but should have said, that this was a function of excessive revenue concentration in one sector. On the plus side they have hired a new Chief Revenue Officer - that’s the artist formerly known as VP Sales I think - who comes from a private equity rollup, Imperva, so even if he didn’t knock the cover off the ball there, he should know what good looks like and be able to spread some of the religion around Fastly. In addition they are taking an ax to the cost base, good. (I never yet saw a company that couldn’t in my opinion have 30pc of costs taken out and nothing bad happen). And finally … the price. 1.6x TTM revenue, ladies and gentleman. Cheap as chips! (I think I probably said that at 2x revenue too, unfortunately).

The upside remains (1) that the company is sold, always a possibility and/or (2) that in the end the compressed valuation proves too tempting and the buying program starts. To the downside - well, until fundamentals put in a low and start picking up, the bad news could continue. Personally I continue to hold this one, it’s a modest allocation so if it went to zero it would be annoying but not ruinous, but everyone should apply their own risk appetite as always.

Here’s the headlines:

Below - available to paying subscribers of all tiers here - we review the fundamentals, the valuation, the stock chart, our rating and price target. Read on folks.