Not A Bubble (NVDA Q1 FY1/25 Earnings Review)

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Nvidia Q1 FY1/25 Earnings Analysis

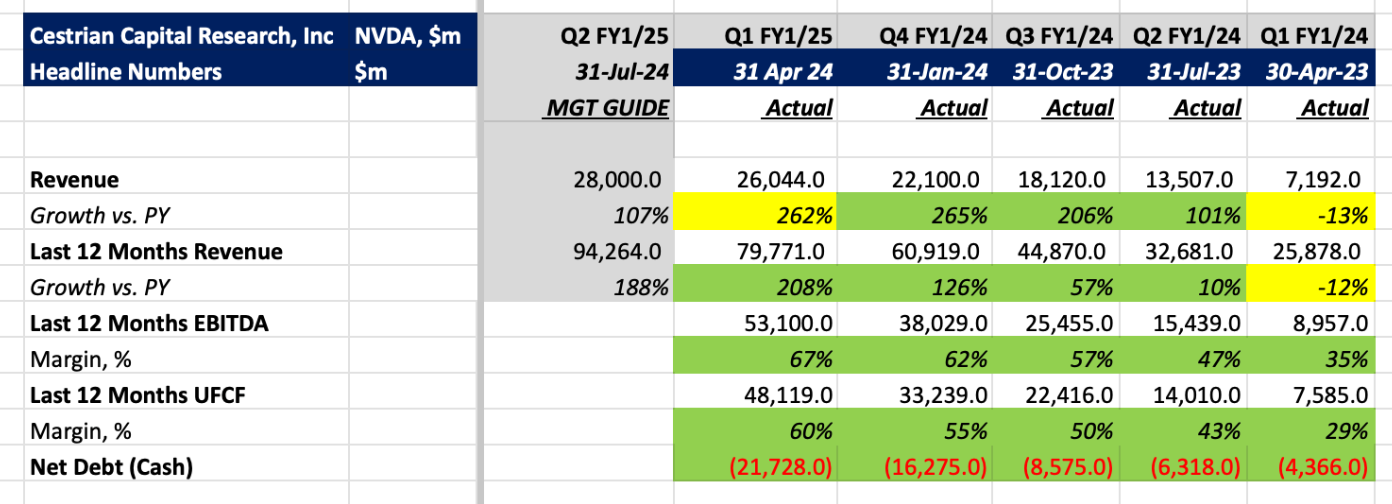

Think AI is a bubble? It’s not a bubble. When one of the largest companies in the world brings in a quarter with revenue growth of +262% vs. the same quarter last year, which means TTM revenue growth of +208% vs prior year, and here we’re talking about a company clocking up nearly $80bn in annual revenue right now? That’s not a bubble. And the 60% cashflow margins tell you that nobody is buying much in the way of AI GPUs from AMD or Intel or other right-tail types either.

For now, Nvidia remains the King of the Street.

Nvidia Headline Financials

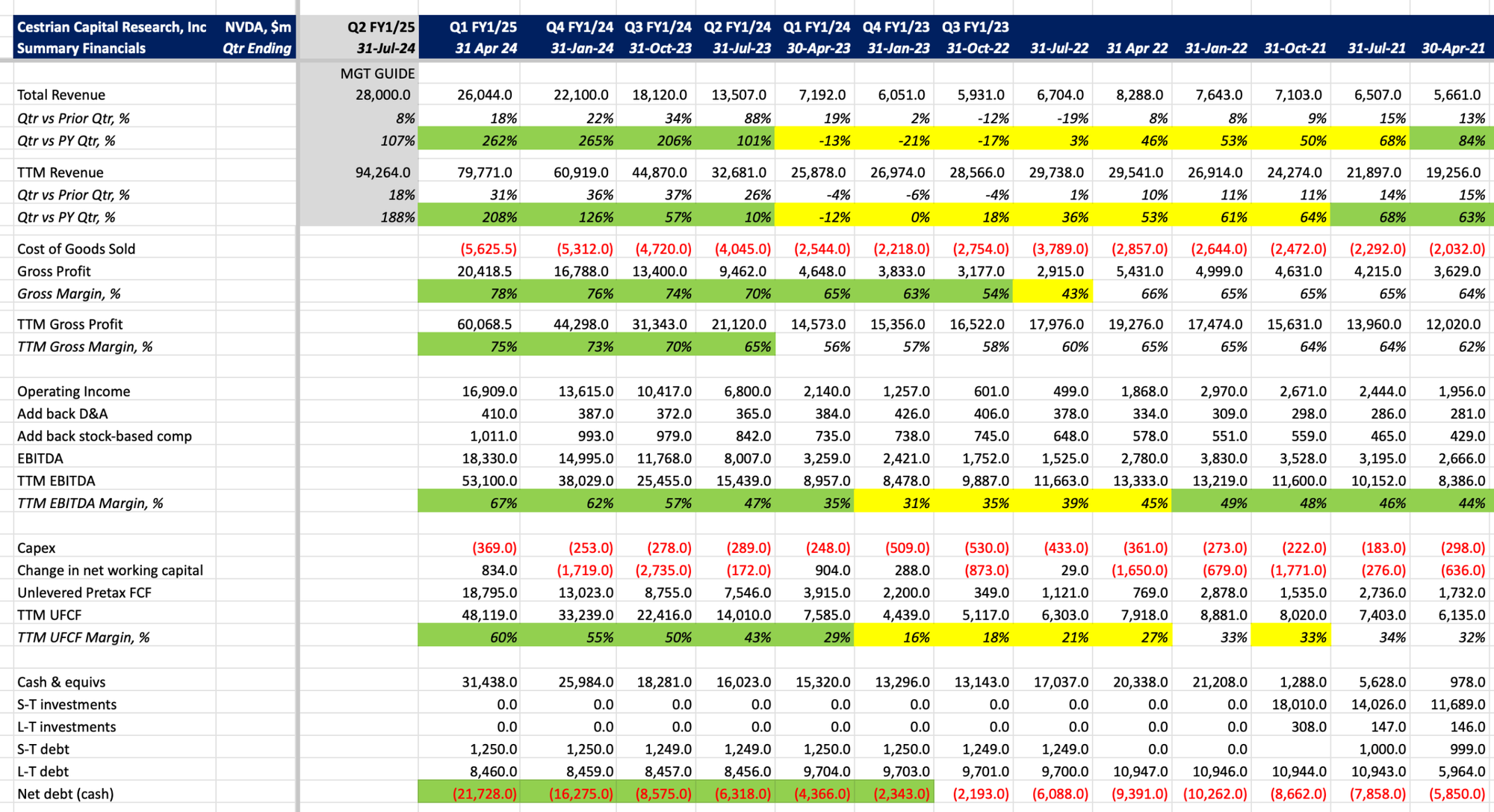

Detailed Fundamental Analysis

Huge rates of growth at huge margins with a huge pile of net cash on the balance sheet. That’s about as complicated as you need to make the analysis right now.

One day it will slow and one day someone will eat away at its margins. But not today.

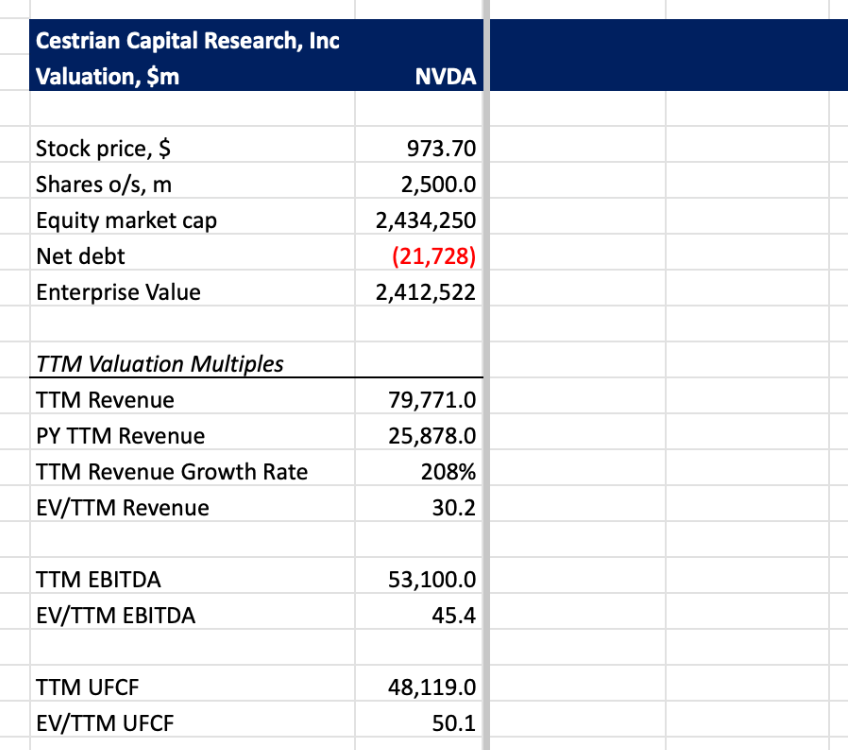

Valuation Analysis

If you think 50x TTM cashflow is expensive for this, please tell the rest of us what you think is a good value stock and why. 50x TTM cashflow is not expensive for this in my humble opinion. It’s about 2x the price of a boring defense contractor. I’m not saying don’t own boring defense contractors, I own some and I love them. But if you stop yourself from owning the stock du jour because you think it’s expensive? I think your emotions are clouding your judgment.

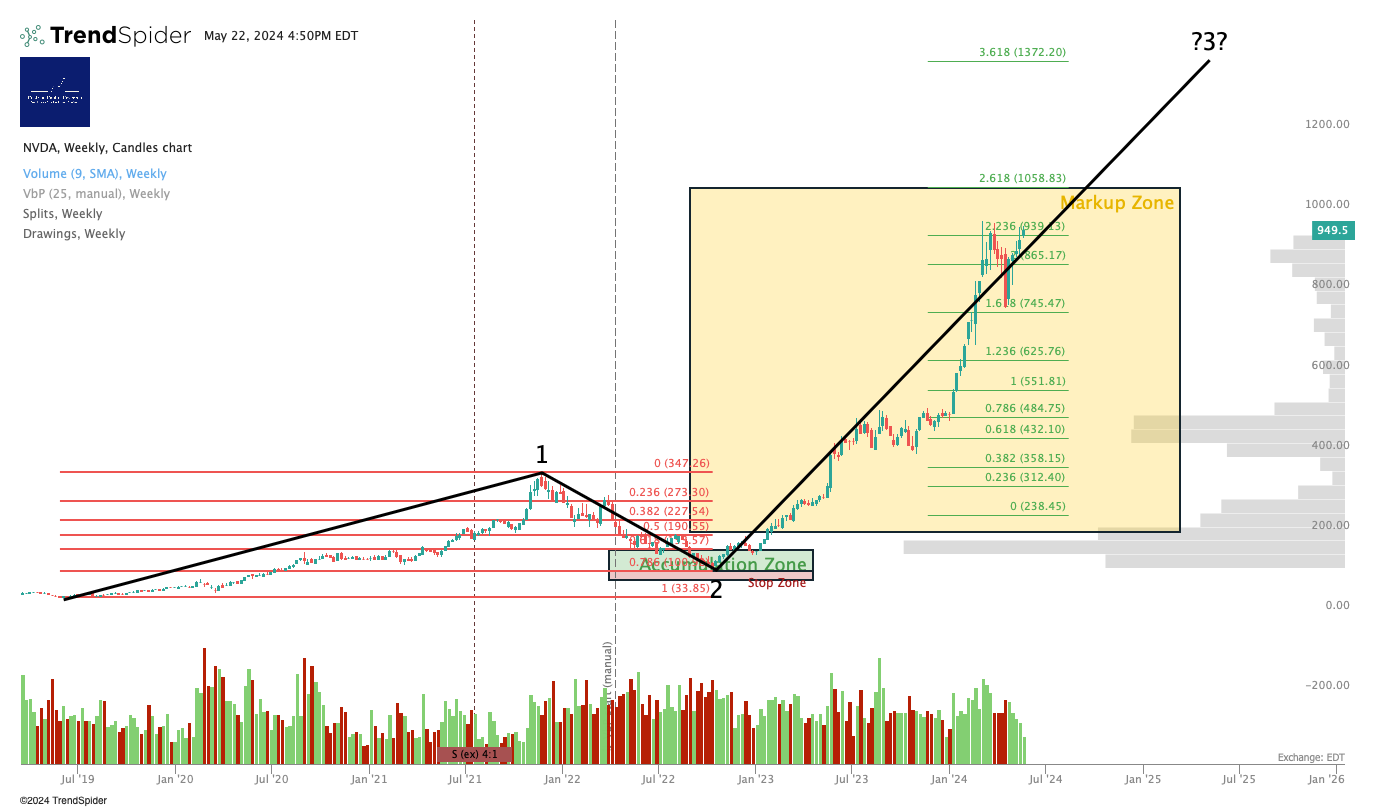

Technical Analysis

You can open a full page version of this chart, here.

Price target, $1372; that’s the 3.618 extension of the prior Wave 1 up on this timeframe.

Here's a shorter-term take including a path of short-term selldown if one is taken. Full page version, here.

Stock Rating

We continue to rate NVDA at Hold. (We rated at Accumulate between $100-150 in 2022-3).

Cestrian Capital Research, Inc - 22 May 2024.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long position(s) in NVDA.