Northrop Grumman Q4 FY12/24 Earnings

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Carry On, Nothing To See Here

by Alex King, CEO, Cestrian Capital Research, Inc.

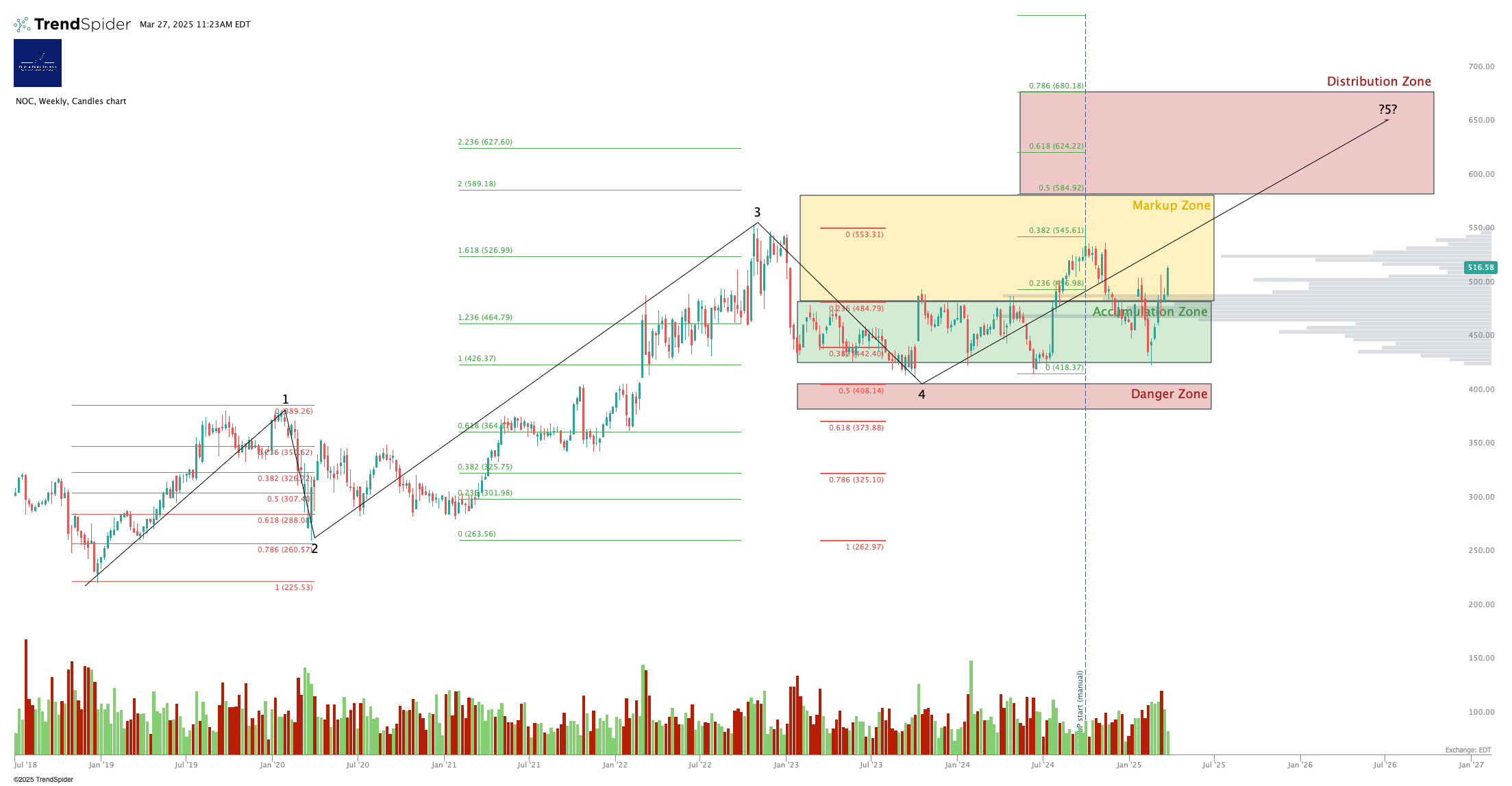

Northrop Grumman ($NOC) stock continues to perform well. This is the chart we’ve had in place for some time now, with only time passing since it was drawn:

(Click here for a full page version of the chart).

I think that if you step back for a moment and think about the risks to NOC’s business, they are probably a little higher than for Lockheed Martin.

Even if US defense spending falls substantially, LMT still has Europe and others to buy F-35s and whatnot. But NOC tends to focus on the heavier-duty equipment and there aren’t so many customers for long-range strategic bombers outside of the US government. In addition, should the federal spending reviews decide that the GBSD contract (renewal of the Minuteman III nuclear missile arsenal) is not required in part or at all, or is not required for a while longer yet, then that’s a $90bn, yes $90bn, prime contract that NOC was expecting to fulfill that will evaporate faster than hydrazine. And that’s going to hurt. Also like hydrazine.

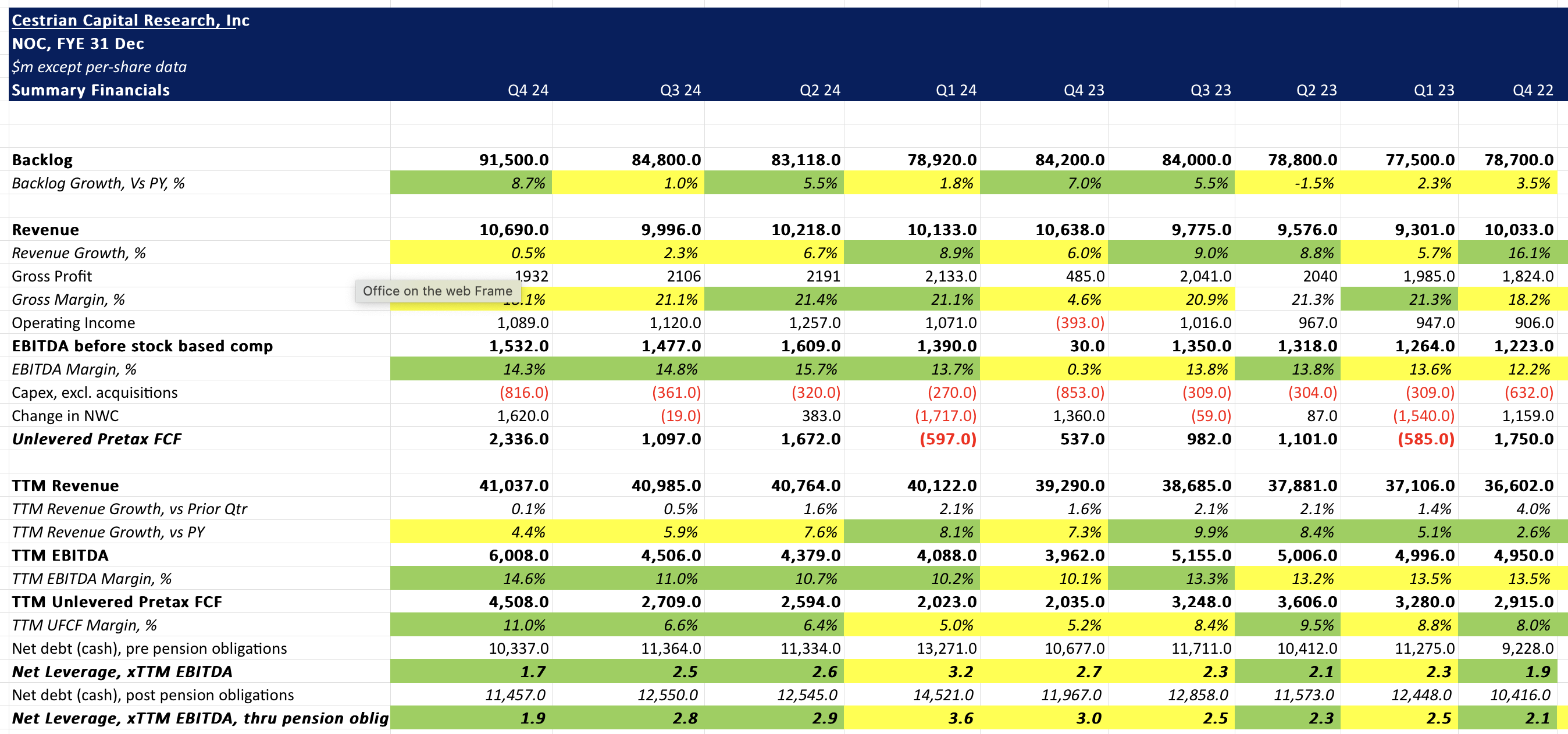

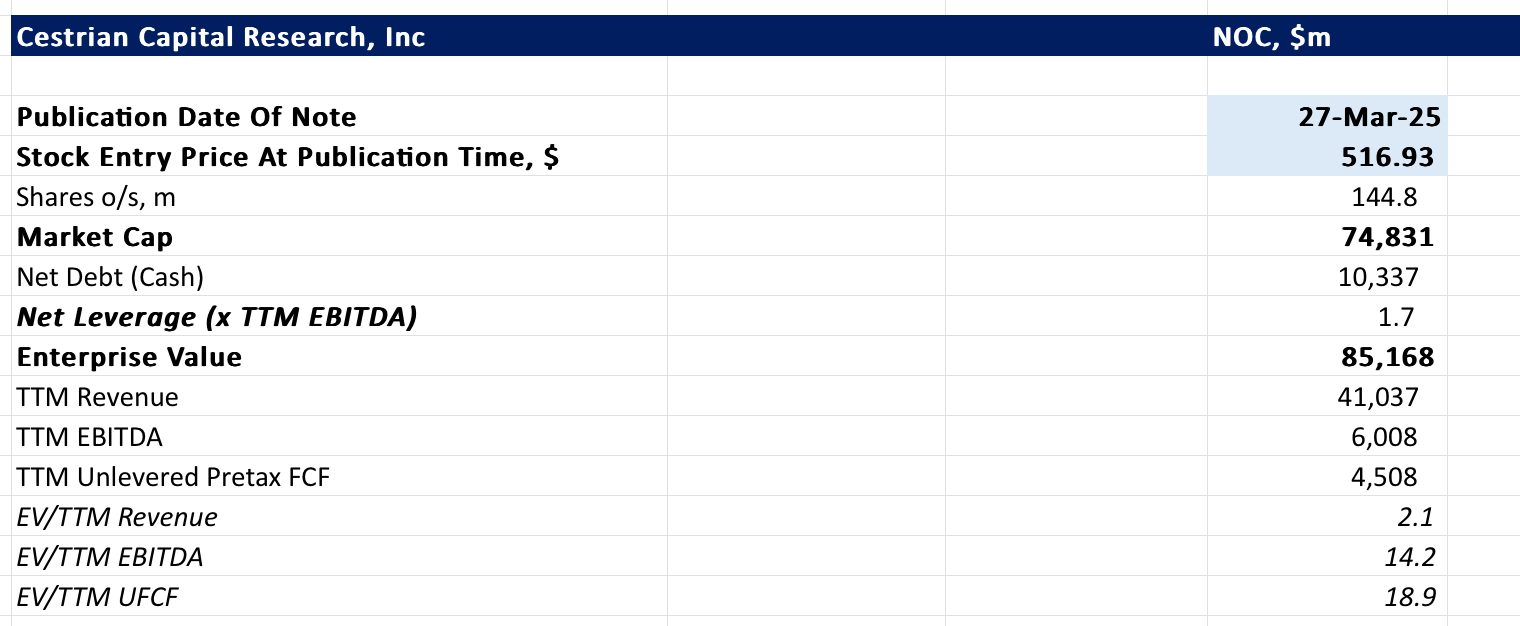

So far though, this is just worry, it’s not numbers. The numbers for NOC look solid, valuation is fine, and the stock chart as you can see above is holding its own. We continue to rate at Hold, with a price target range of $585-$680.

Cestrian Capital Research, Inc - 27 March 2025