Never In Doubt (*) (ZS Q3 FY7/24 Earnings Review)

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

(*) Little Bit In Doubt

This is a no-paywall post covering the ZScaler ($ZS) earnings report printed after the close today. If you know anyone who might like to read this, please share it far and wide on all the usual platforms. And remember, our entry-level paid service here, Market Insight, goes up from $299/yr to $399/yr in a little over 24hrs' time, so if you want to sign up, now's a good time!

ZScaler is, we believe, one of the top two cybersecurity plays (the other being CrowdStrike, $CRWD). The company provides in-network security services; if you use ZScaler to secure the enterprise network, you don't have to buy rooms full of hardware boxes from Cisco and/or Palo Alto Networks, and you don't have to employ cafeterias full of IT bods to manage those boxes either. If the company is big enough, the mere act of cutting the late-night pizza bills alone can help to pay for a switch to ZScaler.

Fundamentals at the company have been strong for some time, a good blend of growth, cashflow margins, and revenue visibility, as measured by growth in the order book ("remaining performance obligation") and the prepaid part thereof ("deferred revenue").

Today's print re-inforced that story - it was a good quarter on the numbers.

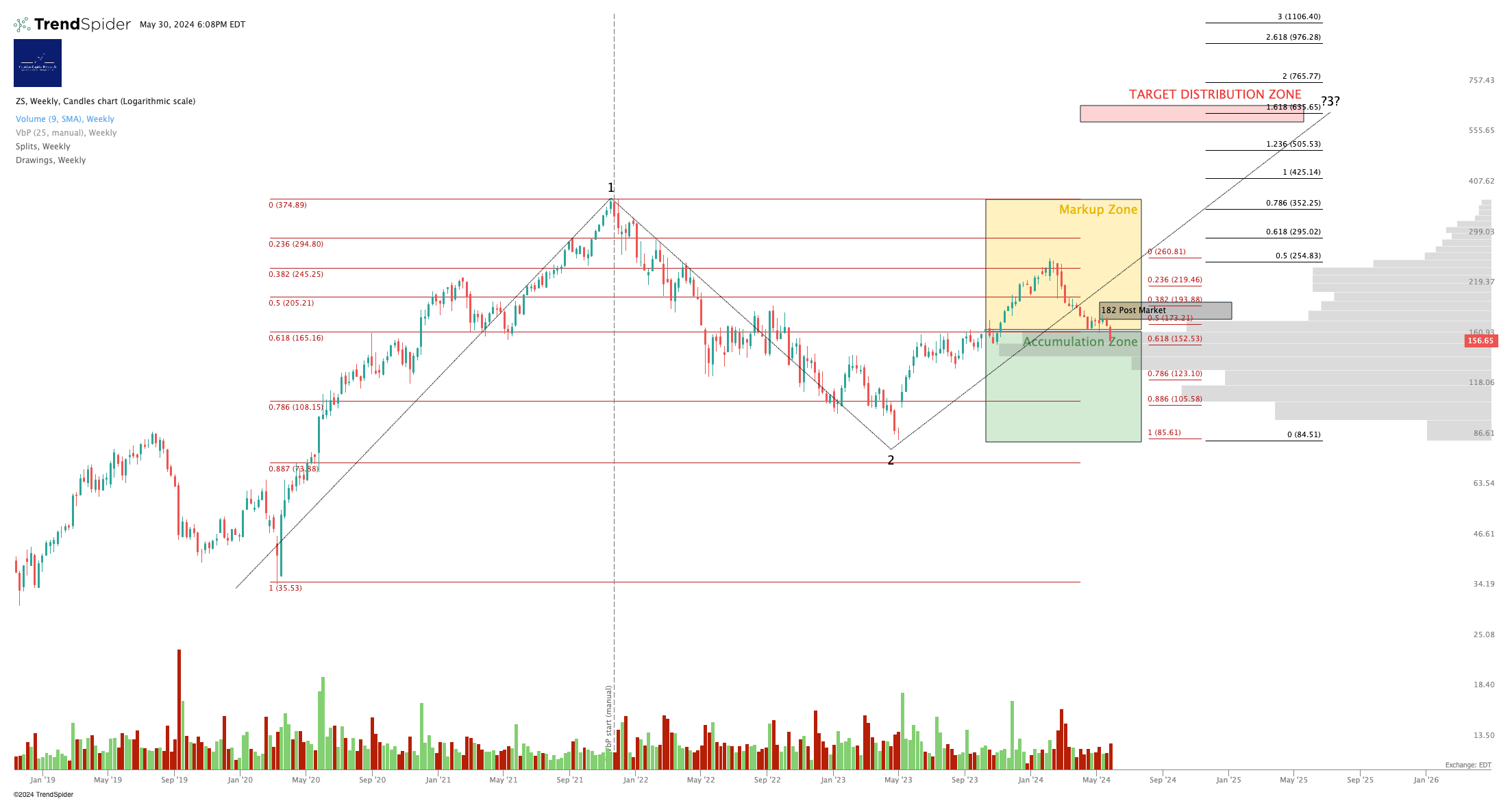

The stock has been weak since February this year, selling off from a high of $260 in February to a low of $156 at today's close.

The after-hours reaction has been good thus far - the stock is sat at $181 at the time of writing (6pm Eastern). We shall have to see if that holds up tomorrow - Okta, which printed yesterday and was up after hours as a result, couldn't hold the gains and sold off during regular trading hours today. Perhaps the same fate may befall $ZS.

The stock is on the cusp of our 'Accumulation' and 'Markup' Zones; we rate at 'Accumulate' between $85/share - $165/share; yes, a wide range, but this is a high-beta stock, so all ranges are wide. Above $165, we rate at Hold. We'll see about a Distribution Zone if and when the stock makes a sustained move up.

Let's look at the numbers, the valuation, and the stock chart.

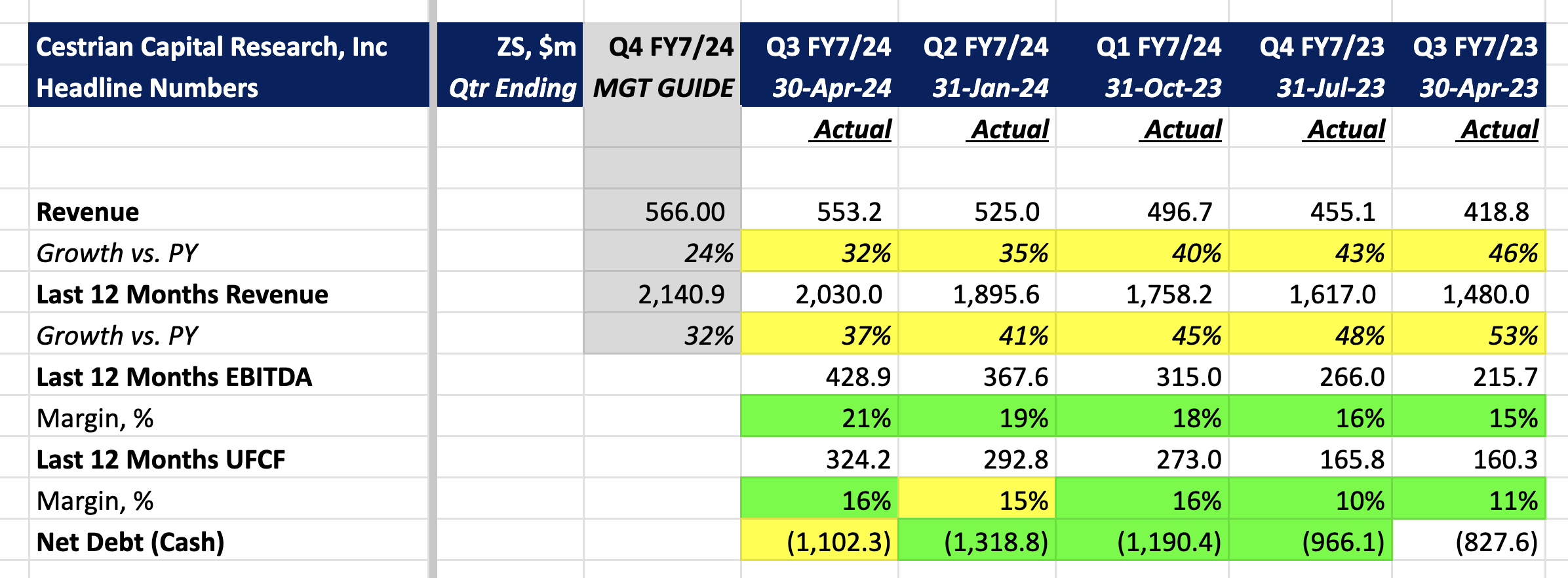

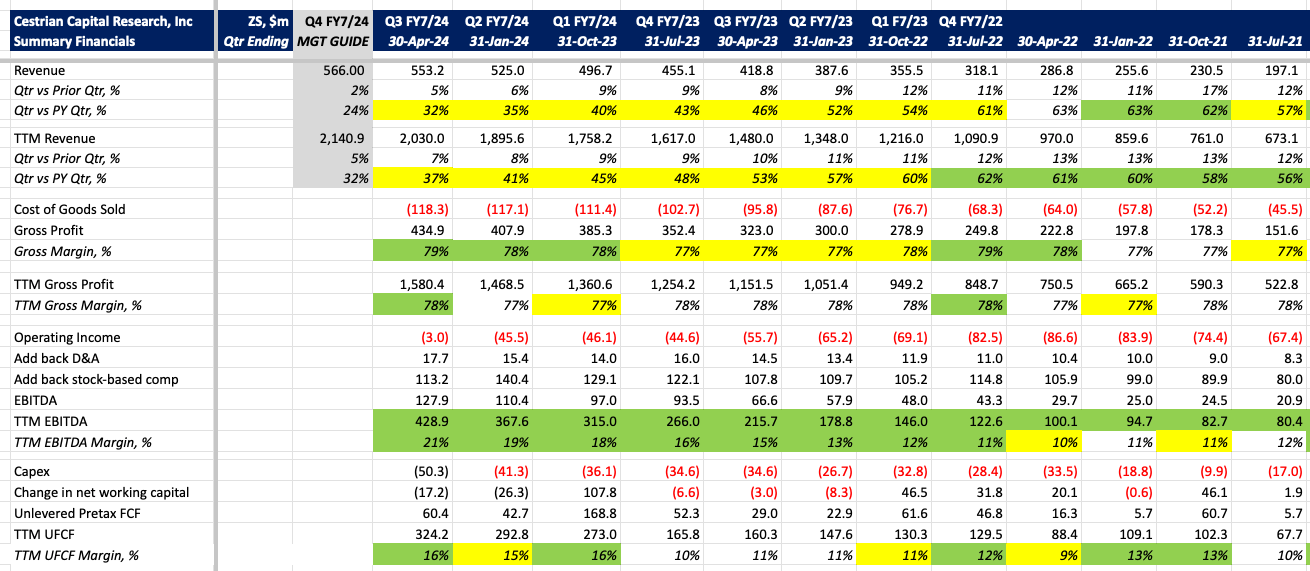

Headline Financials

Detailed Fundamentals

- Revenue growth fell somewhat to +32% YoY in the quarter, +37% YoY on a TTM basis. That's OK but it would be nice to see growth rates level out, as they did at Okta this quarter.

- Gross margins are up; EBITDA margins up; cashflow margins up. All good.

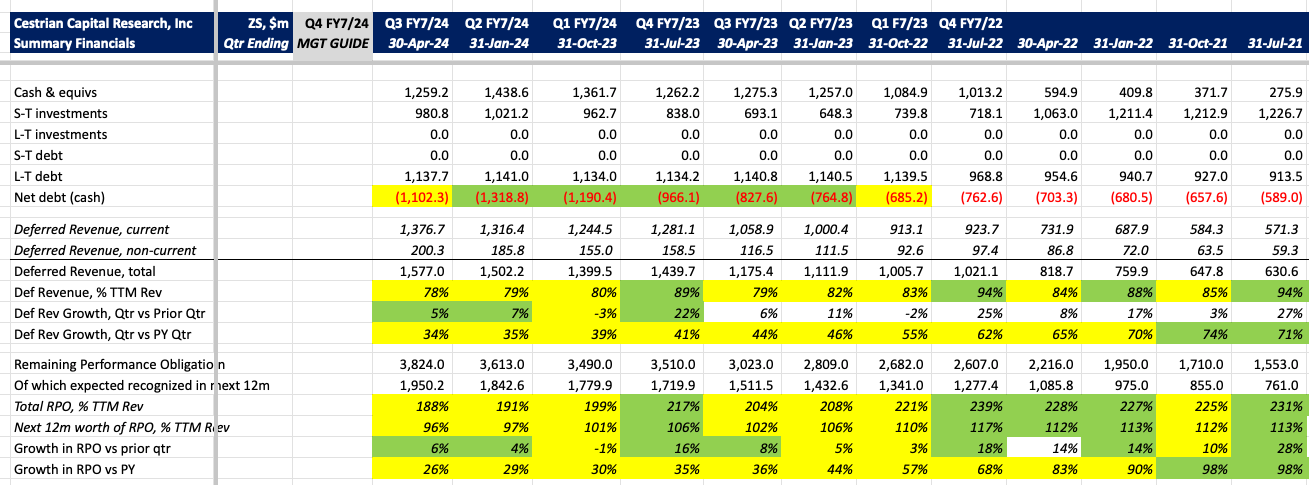

- Less net cash than last quarter but it remains >$1bn and this thing generates cash every quarter, so no worries on that front.

- Deferred revenue (see definition above) grew at +34% YoY, down only a touch from last quarter's growth rate - that's good.

- RPO grew vs. last quarter, but the growth rate vs PY continues to decline - this is a nagging concern for me at least.

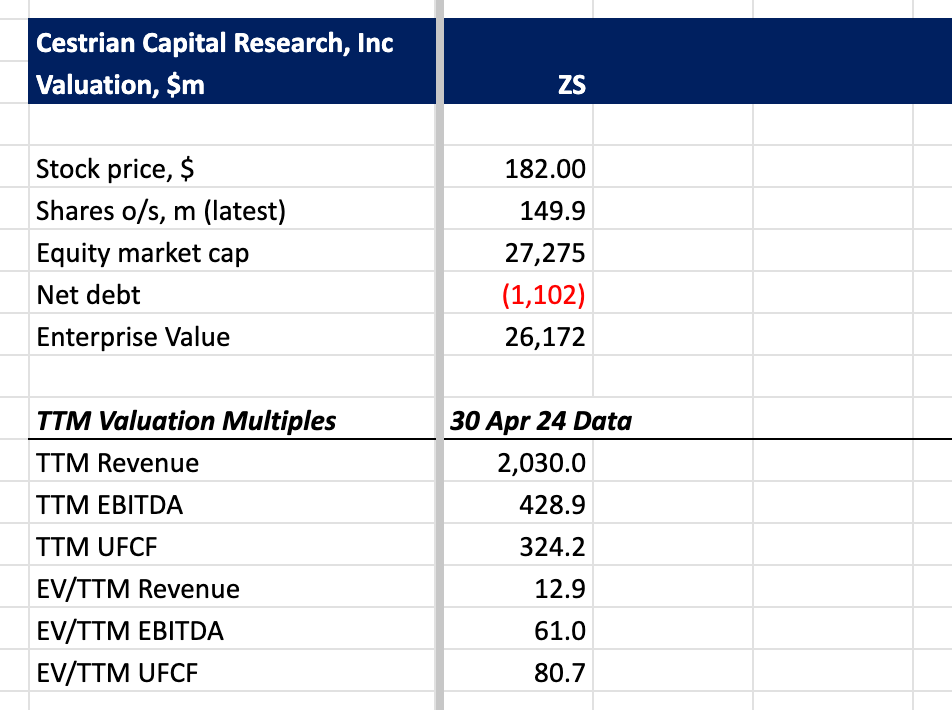

Valuation Analysis

I don't think the stock is particularly expensive for the growth rate, margin and visibility on offer. (It does make NVDA look cheap at 50x TTM cashflow in exchange for 200% revenue growth though!).

Technical Analysis

You can open a full page version of this chart, here.

Here's a shorter-term chart.

Which I don't mind saying is a bit flaky, because the Wave (4) shown broke the Wave (1) high which technically means this chart is, er, wrong. But we'll stick with it for now. If ZS dumps during market hours tomorrow, we have to re-visit the chart.

Stock Rating

We rate ZS at Hold - note the zones above.

Cestrian Capital Research, Inc - 30 May 2024.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long position(s) in, inter alia, $ZS and $NVDA.