MongoDB Q3 FY1/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Because They Don't Want To

By Alex King, CEO, Cestrian Capital Research, Inc.

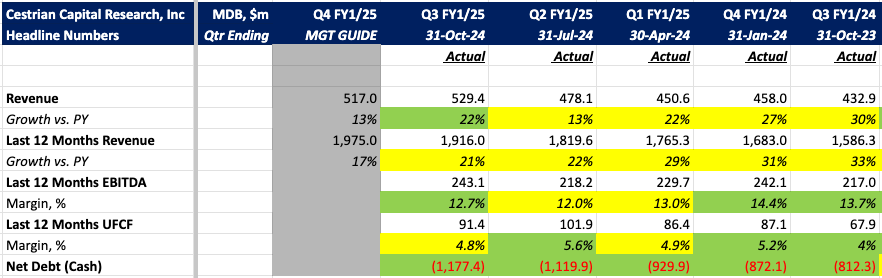

Want to know why some companies only make 5% cashflow margins when others, in ostensibly similar lines of business, make 20-30%? Because they don't want to. Or they don't know how to. Now, soggy cashflow margins would be fine here if $MDB was growing like the proverbial, but it isn't. 21% TTM revenue growth (declining sequentially for the lasts four quarters) and 5% cashflow margins? Yech. Oh also, 13% EBITDA margins but, again, 5% cashflow margins? And a massive gulf between the two not because capex but because change in working capital aka. not collecting cash fast enough? Yech squared.

The stock chart on this thing is bullish. But the fundamentals? Not for me thankyou.

Financial Summary

Here's the headlines.

Now, for our paying subscribers of all tiers here, we go on to look at financial fundamentals, valuation analysis, our rating and price targets.