MongoDB Q2 FY1/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Wen Data?

by Alex King, CEO, Cestrian Capital Research, Inc.

I've said on a number of occasions that at some point we ought to see companies not called Nvidia benefit from AI spending; since we can consider AI to be nothing more or less critical than a capex refresh in the IT value chain, this new era of compute should see spending cascade from semiconductor through systems, software and services. I would expect database and data manipulation / management providers to be major beneficiaries - from Oracle through Palantir and onto smaller names like MongoDB.

It may be a coincidence that MDB's guide for next quarter is that revenue growth will accelerate, or it may not, but either way that's a good sign. The stock has been wildly volatile in recent years; fundamentals are slowly improving insofar as the company has moved from a careless cash-burning frolic into a steadily cash generative maturing company and now, if the guidance is hit, one with accelerating growth too.

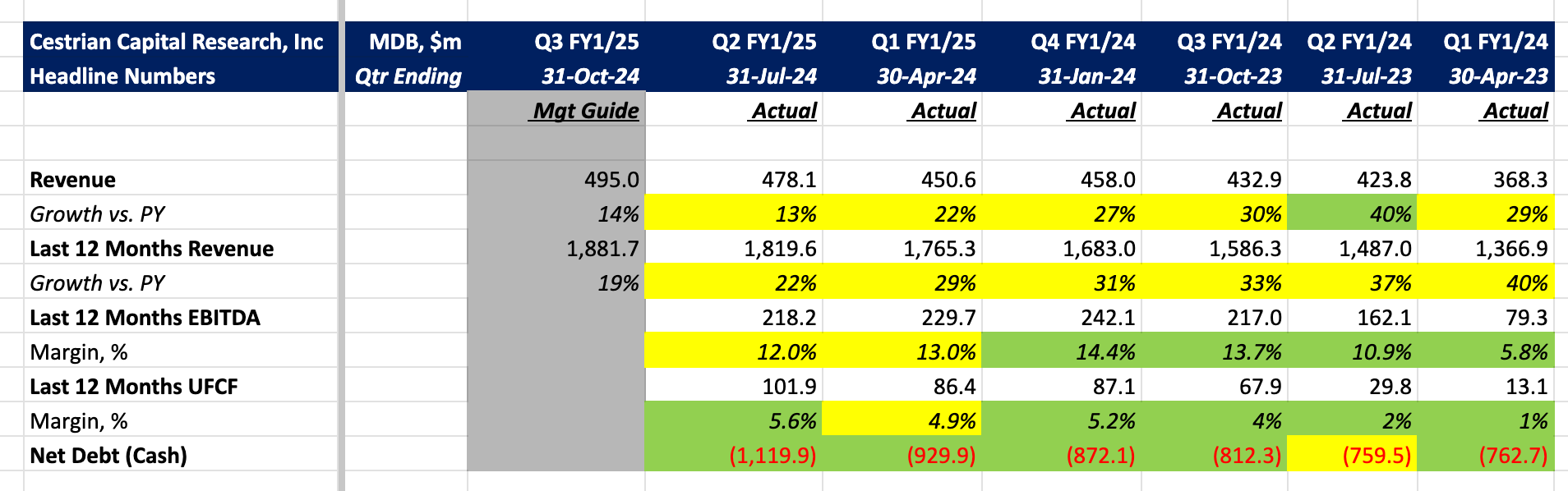

Here’s $MDB headlines.

Read on for the financial detail, valuation, our stock chart and rating! Any paid subscription here gets you the full note.