Microsoft Q4 FY6/24 Earnings Review (No Paywall)

Still The Big Dog. Blue Screen Of Death Notwithstanding.

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

All Is Not Lost. Only 6% Is Lost.

by Alex King, CEO, Cestrian Capital Research, Inc

Microsoft ($MSFT) reported its Q4 of its FY6/24 today after the close. The stock is off a little - around 6% at the time of writing (1645 Eastern) - but the print was good.

There's a lot of talk about pending US recession at present, and certainly there is some noises-off in consumer that says this could happen. FedEx is reducing cargo flights in the US; McDonalds says folks are eating out less often; and so on. I've yet to check in on Pinterest $PINS numbers today but weakness in adtech can often be a prelude to consumer spending air pockets.

Microsoft does exist in the real economy and is vulnerable to a slowdown - but not in the same way as say a Meta Platforms $META and so forth. The bulk of its revenue and profits and cashflows are driven by enterprise and government customers, and it's one of an unholy triumvirate of cloud providers that are now part of the plumbing in most of the developed world (the other two being $AMZN and $GOOG of course). Its stock held up in the 2022 bear market much better than did most tech names, for that reason, and it recovered very quickly once the bull took hold once more.

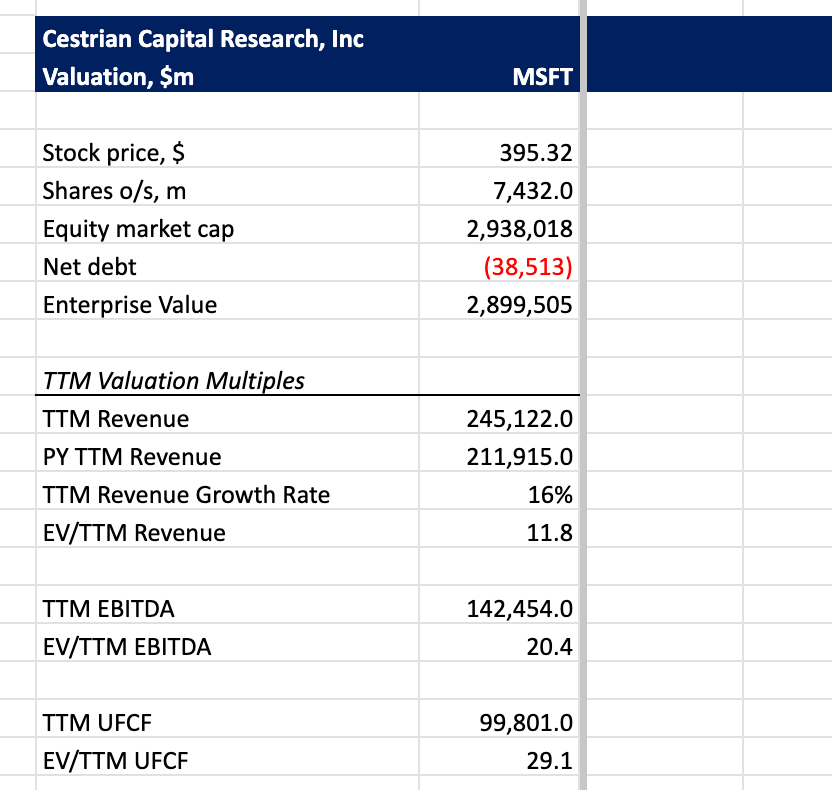

The quarter just printed was rock solid on fundamentals; the valuation is unchallenging, good value even in my view. There aren't that many companies in the world with 16% TTM revenue growth, 41% TTM unlevered pretax FCF margins, $39bn in the bank and with their stock available at just 29x TTM unlevered pretax FCF. You'll pay close to that for an ex-growth defense contractor, and before you say "but yield", check what you're actually getting in dividends from the defense community these days - it's not so different to what Seattle's finest will pay you.

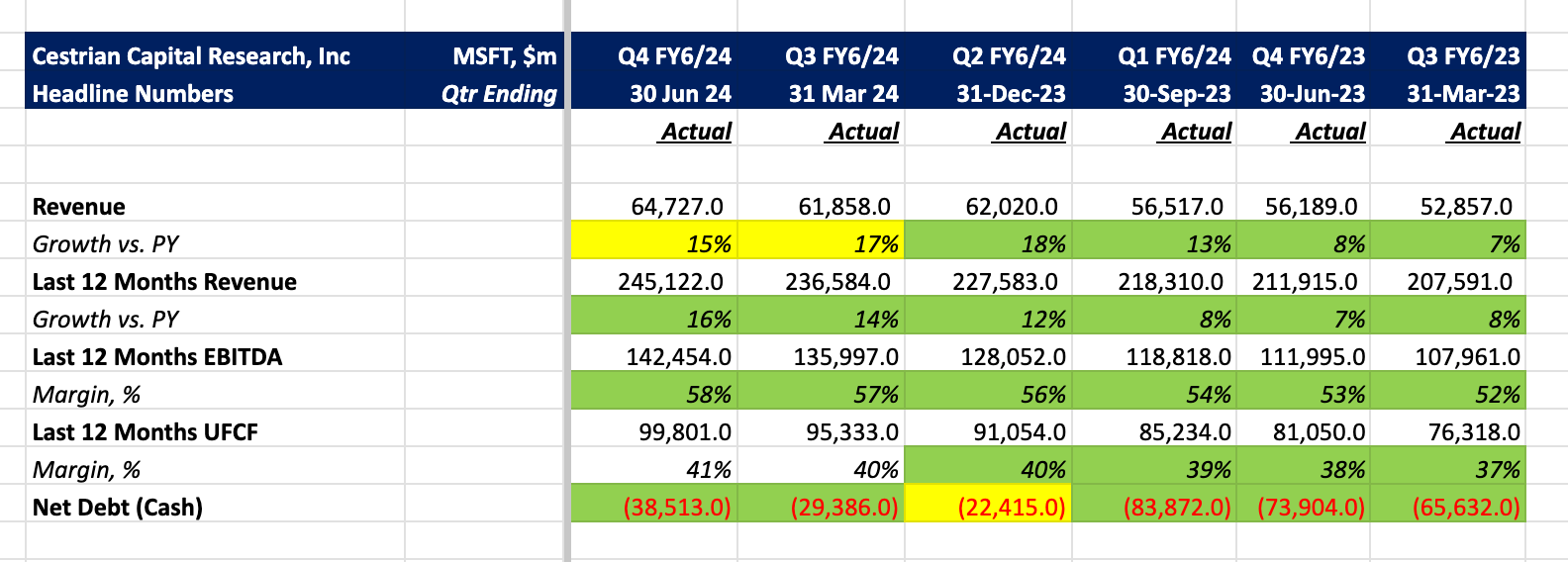

Here’s the headline numbers as of this quarter.

In short:

- Revenue growth ticked down a little to +15% vs PY on the quarter, and so far as stock prices are at all related to fundamentals, it's that which has caused the post-market sneeze I think. TTM revenue growth is still climbing - now +16% - as this is a slower, flywheel-type measure of growth.

- EBITDA margins continue to climb - now 58% on a TTM basis.

- Unlevered pretax free cashflow margins are also rising, now 41% on a TTM basis.

- The balance sheet now features just shy of $39bn net cash - more net cash than any major nation state I can think of.

Tech stocks are in a downdraft at present, a matter of technical weakness rather than a bear market, I think. And MSFT stock was caught in that wash today. I think, though, that the price can recover nicely in time. We retain our Hold rating with a price target of $487. It won't hit that tomorrow but it may get there for the patient investor.

Let's turn to more detailed financials, valuation analysis, our stock chart and how we get to that price target.

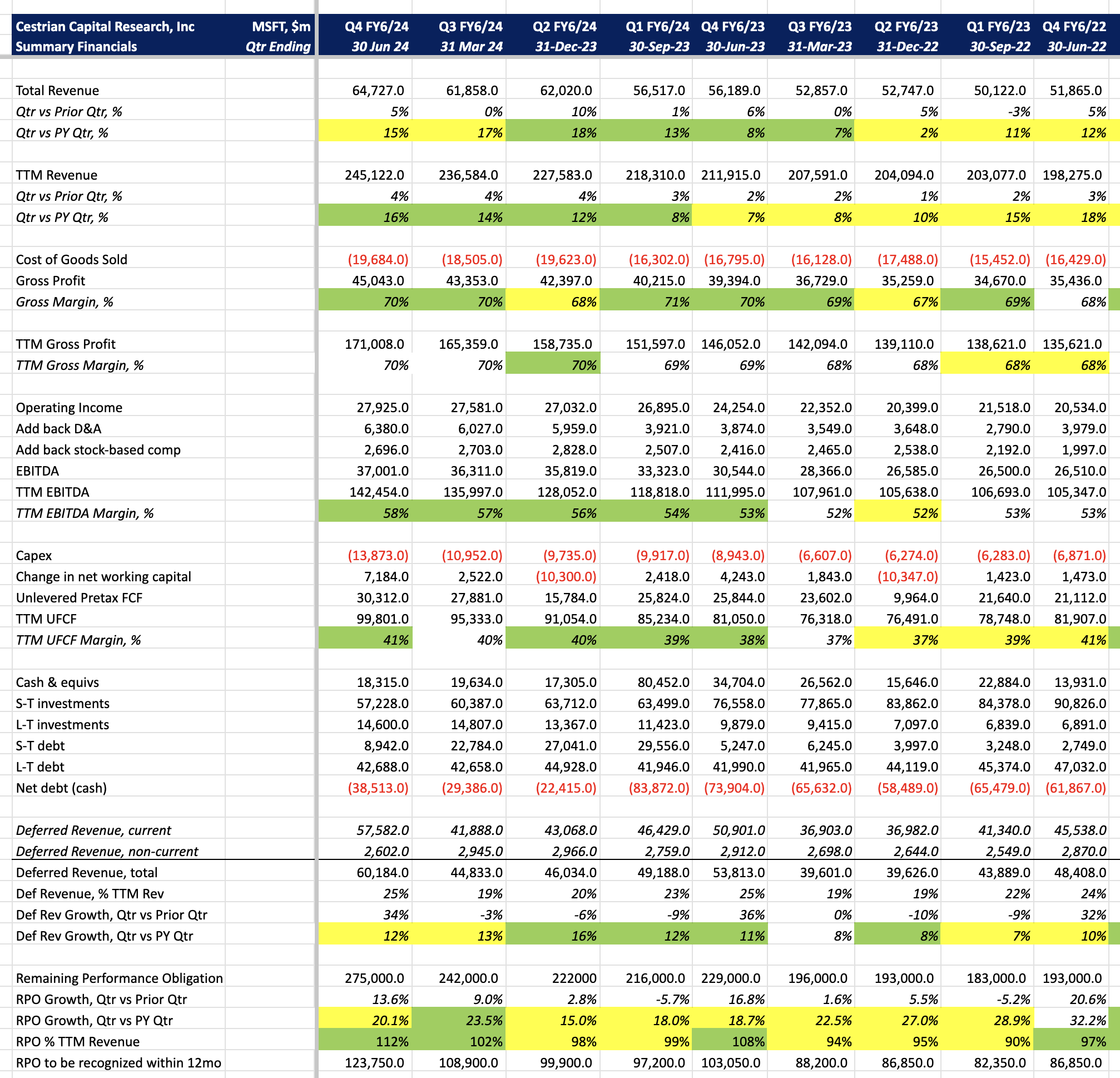

Fundamental Analysis

Here's our detailed take on Microsoft fundamentals.

Valuation

The stock is inexpensive on fundamentals in my view - not a reason to sell, and if not a reason in and of itself to buy, you can certainly add it to any technical logic in favor of owning the stock.

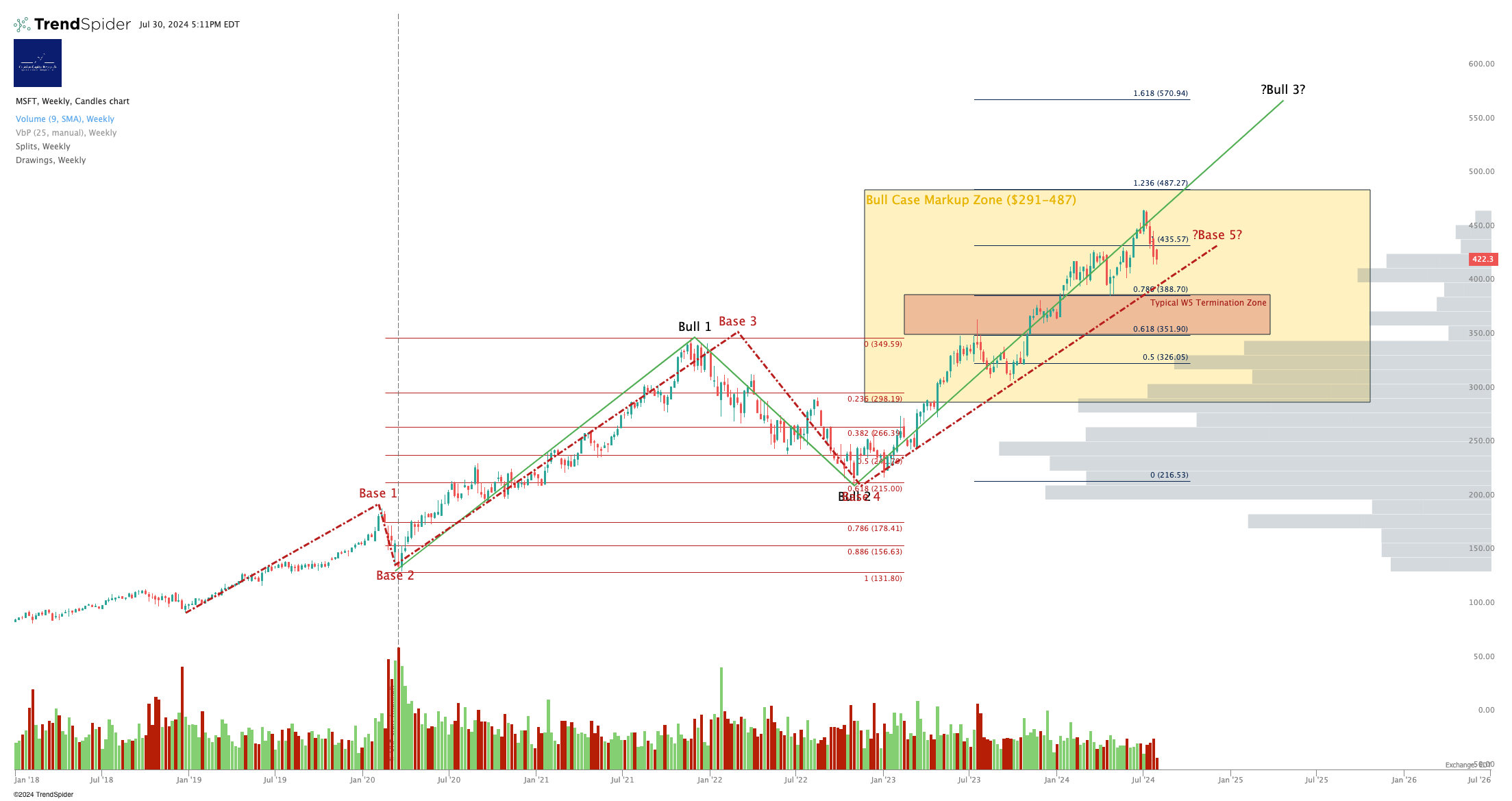

Technical Analysis

MSFT stock has already defeated our 'base case' price outlook and we believe it can hit our 'bull case' price target of $487 based on this chart. Here's our longer-term take. You can open a full page version of this chart, here.

The stock put in a +$210/share Wave 1 move from the Covid crisis lows to the 2021 bull market high; then a perfect 61.8% Fibonacci retracement to the rate-hike crisis lows in 2022, and it spent very little time down there. The obeyance of standard technical patterns tells you that this is an institutionally-traded stock liable to follow pattern recognition templates and not be an entirely random walk.

This is the basis for our $487 target, which is a relatively modest 1.236 Wave 3 extension of that Wave 1 up placed at the bear market low. If the market really gets going in 2025, I would not be surprised to see MSFT hit $570, which is the 1.618 Wave 3 extension of the same. But we don't need to get ahead of ourselves at this time.

Stock Rating

We rate MSFT at Hold. We moved to Accumulate rating on the stock at $247, so even after the dump, it's up some 60%, excluding dividends.

Questions?

If you have questions about any of the numbers, charts, anything, reach out in comments to this note or on social media (Twitter here, StockTwits here, LinkedIn here).

Cestrian Capital Research, Inc - 30 July 2024

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold no positions in $MSFT save via $TQQQ, $UPRO and $QQQ3.