Microsoft Q3 FY6/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Was It Enough?

by Alex King

Summary:

- Microsoft earnings printed last week were good, not great.

- Against the backdrop of a faltering equities market, the question is - were the numbers good enough?

- We consider this below.

It’s Not Really About AI

“AI” is both a thing and a narrative. It’s a thing insofar as the latest generations of parallel-processors and large language models and fast read/write DRAM and cheap mass storage have come together to allow machines to pattern-recognize a lot more data than they used to, and to be able to generate image, text, and audio-format patterns which are an order of magnitude more compelling than was the case say a decade ago. AI is also a narrative insofar as it is the meme du jour as to why stonks may go up. Of course every bull market has its meme; in the 1990s it was dot-com, in 2020 it was free-money. But these are just memes, an easily-digested message to encourage the masses to keep buying until euphoria finally topples the bull. AI fits the bill perfectly. There is enough truth about the story to carry plausible deniability as to it being some kind of scam; the precise nature of AI is fuzzy and hard to pin down, and in particular the break from what came before is difficult to explain. But everyone knows that AI is the future. So, buy. Right?

Now comes a deeper level of analysis. When, demands the querulous investor or analyst, when will AI show up and make a difference to company financials for those names that aren’t Nvidia? Will Microsoft CoPilot get its own breakout analysis in the financial statements? Will Google divide its reporting into “legacy search” and “AI prediction”? Will Pacific Gas & Electric trade like an AI stock the way that AT&T traded like a dot-com stock, because picks and shovels?

Want my take? The above is a fool’s errand. If you have long ridden the rise of the machines, as I have, then AI is just the next step in compute and one which is driving a capex refresh cycle through the datacenter - all other things being equal that’s good for stocks. Soon I suspect it will be a marketing nudge used to induce demand for the next generation of iPhones and other endpoint devices. And that’s good for stocks too. I have not, however, spent any time scanning the MSFT 10-Q for AI-ness. Why bother? The numbers were just about good enough to keep the stock up in the face of general equity market weakness, and were not bad enough to overshadow the blowout numbers printed by Google on the same day. Whether MSFT stock climbs higher from here is I think a function of general demand for US equities, not anything specific to do with AI.

We consider fundamental, valuation and technical analysis of MSFT stock below.

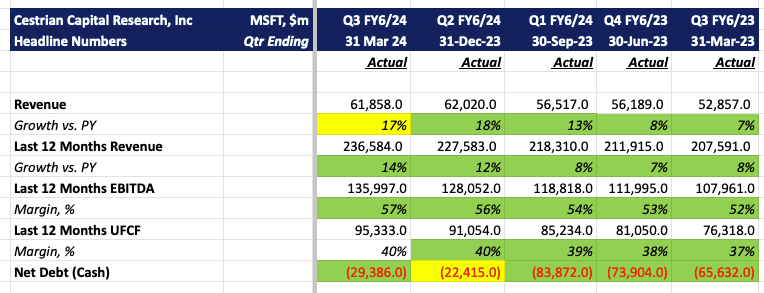

Headline Numbers