Microsoft Q1 FY6/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitationof an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Where Microsoft Goes, The Market Follows

by Alex King, CEO, Cestrian Capital Research, Inc.

Whether you look at the S&P500, the Nasdaq or the Dow right now, they are in something of a holding, sideways-trending pattern. Markets don’t go sideways forever, they tend to break out of the range and then pursue an actual direction for some time. You can make a bull- or bear- argument for markets right now. You can say well, fundamentals all look good and the Vix is likely to drop post election and so that means stocks up; or you can say, well, there are problems in the real economy, and the Fed cutting rates tells you that, and a recession is coming so, stocks down. And you can use the same charts to make either argument.

The Microsoft chart is the same chart as the Nasdaq. Usually Microsoft leads. So if Microsoft breaks to the upside, likely good things are going to happen in the market, and the converse is also true.

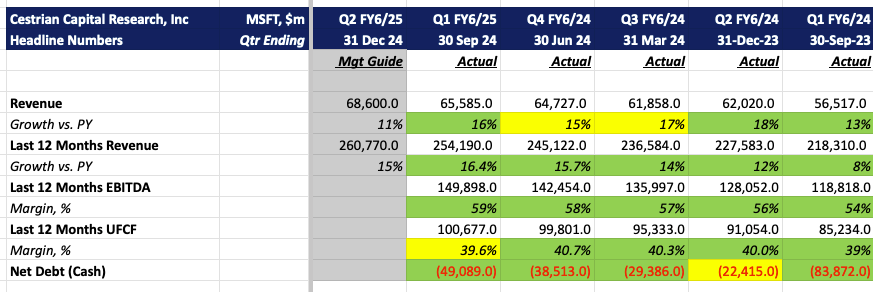

The numbers were good by the way. I don’t think that really matters right now. But for good measure here's the Q1 headlines:

Detailed numbers, valuation and chart follow for all paying subscribers regardless of service tier.