Micron Q2 FY8/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Can Resistance Become Support?

by Alex King

We opened coverage of Micron (MU) stock this week with a Hold rating. If you missed the note, you can find it here.

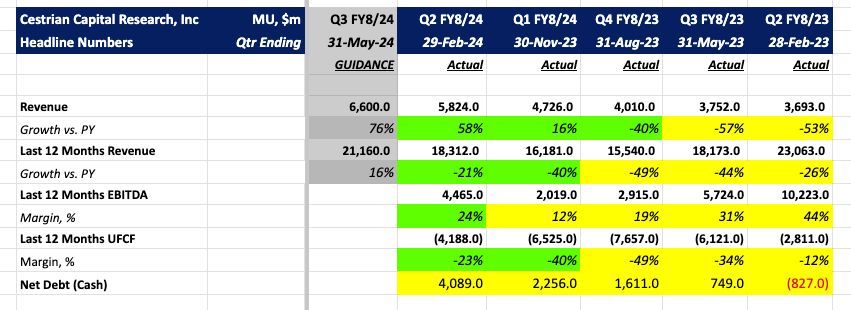

The earnings print saw a swing upwards in revenue growth, gross margins, EBITDA margins and cashflows. Remember this is a highly cyclical business so these are just normal ebbs and flows, not a fundamental and lasting improvement. With cyclical business models, "on fire" is when you have to worry because they can be approaching peak-good and be about to cool off. I don't think we're there yet with Micron but a relaxing stock to own, it is not, so if you do own this one or are thinking of doing so, keep your wits about you.

Anyway, let's take a look at the fundamentals, valuation, our more detailed and recent technical analysis, and so on.

(Here's the headline numbers by the way).