Micron Q4 FY8/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Boom!

by Alex King, CEO, Cestrian Capital Research, Inc.

If you read our work, you’ll know that we’ve had a really nice run in recent years with semiconductor. Nvidia, Intel, Marvell, AMD and plenty of others have been successful buy and in some cases sell calls in our Inner Circle service. We’ve also been able to navigate sector ETFs - in this case, $SOXX and its nitro-injected Top Fuel cousin $SOXL - pretty well. Never perfectly of course, but pretty well.

September 6th we said loud and clear in our service for Registered Investment Advisors that we believe semiconductor was ripe for accumulation. Our RIA service helps our RIA subscribers grow their assets under management by using sector rotation to try to beat the market. Accumulate sectors when they are unloved by the masses (but being accumulated quietly and slowly by the largest asset managers); distribute sectors when social media bullishness is peaking (ie. when retail is happily providing exit liquidity to bigs).

Here’s our semiconductor “Accumulate” call.

If you own or run an RIA business, if you work as an RIA, if you run your own money seriously, if you run other people’s money seriously, sector rotation is an excellent method with which to try to outperform without taking crazy risks. No leverage needed; no small-cap-hero-stories required. Just buy at the lows and sell at the highs of each sector, rinse and repeat. We explain the method all day long in our RIA service and our subscribers will tell you how powerful a method it can be.

We flagged Micron as a buying opportunity on weakness lately.

We have also been flagging SOXX and SOXL as accumulation opportunities in our Market On Open notes daily.

Like this (click here for a full page version of this chart):

Well, we’ll have to see what happens tomorrow but right now it looks like Micron Q4 numbers (their fiscal year ends August) may be the catalyst to kick semiconductor up to the next level.

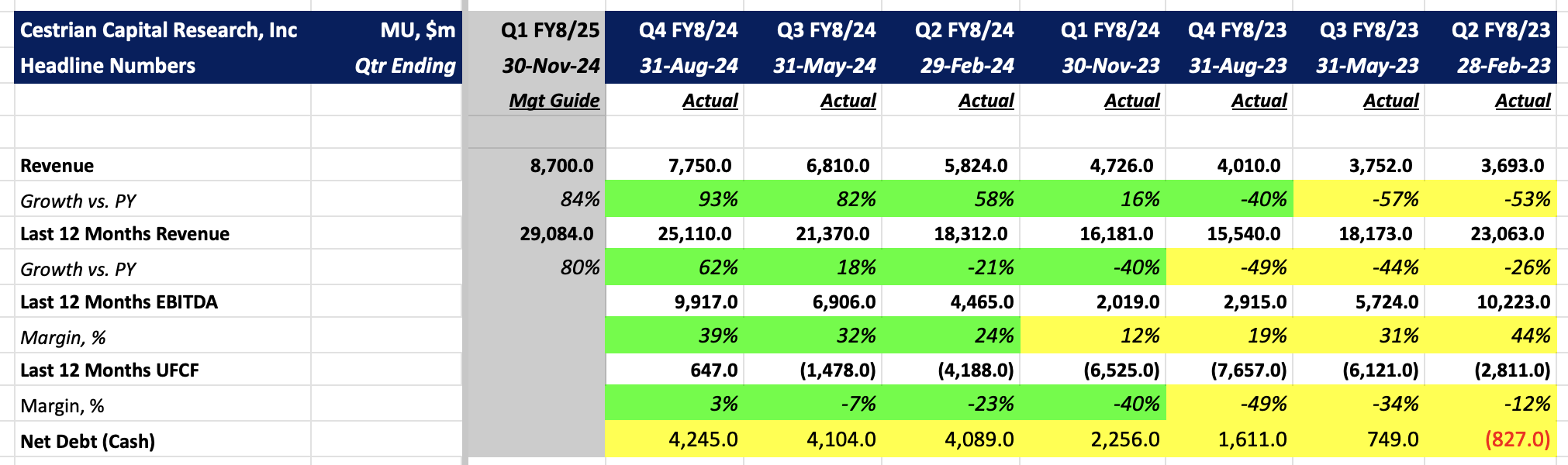

The numbers were great by the way. Here’s the heads up - you can see more detail below.

If you’ve missed out on the sector rotation work we’ve been doing, stop missing out. Sign up right here for the service of your choice. If it’s our premium Inner Circle service you’re interested in, prices rise 1 October for new joiners - sign up in September to lock in the current low prices for as long as you remain a subscriber.

Micron, A Second-Order Beneficiary Of The AI Boom

These are the building blocks of why I believe Micron stock has a bright future.

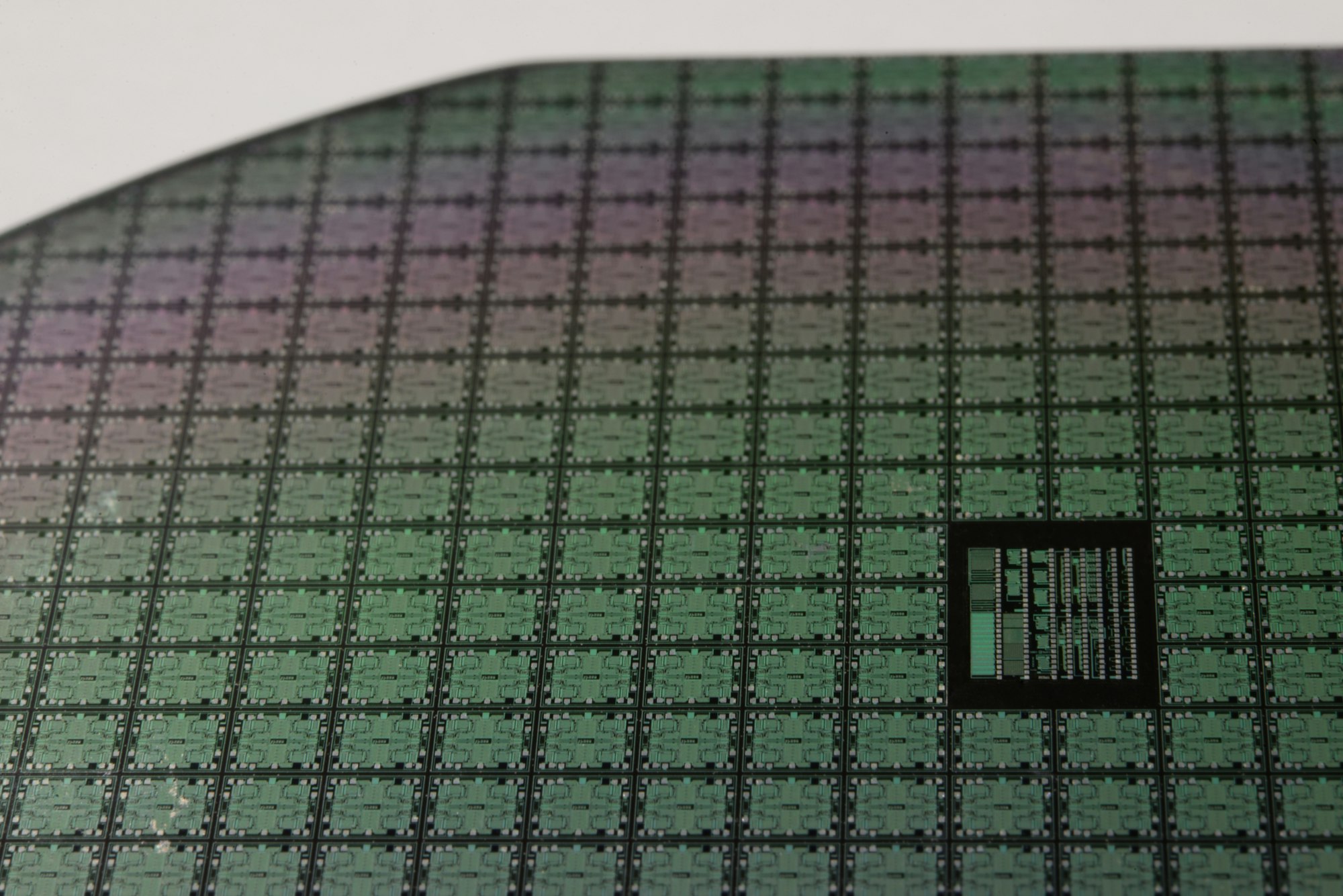

- Micron is one of three at-scale global producers of DRAM and NAND memory. Both these categories matter, but the most important one right now is DRAM, which is bigger, uglier, and lives in servers and client-side computers. NAND features in small form factor devices for the most part.

- The AI boom is here to stay. The flood of capex washing through Nvidia’s financial statements is going to pour into other companies’ coffers too. Memory is second in line to processing. You may have noticed that AI computing is wildly inefficient. Yes you read that right. If it was efficient, Microsoft would not need to hard-reboot the Three Mile Island nuclear power station just to make CoPilot a little more chatty. AI eats resource of all kinds. This will change over time; the vendors that will come in the second wave will have entirely different math underpinning different transistor layouts and that will mean you don’t need to cool your datacenter with a passing piece of crumbling ice shelf. But for now, AI voraciously consumes silicon and power and cooling and everything else. Including memory.

- Micron is the only US-based provider of DRAM in any scale. You may have noticed a huge effort by the Federal government to re-shore semiconductor; Micron manufactures its chips in the US, designs them in the US, it is a national champion already. Federal dollars will flow its way.

- The stock has been all beaten up and the technical positioning into earnings was very bullish. If the current price holds into tomorrow we may see another move up in Micron stock beyond its prior all time high of $156. Yes really. No not tomorrow.

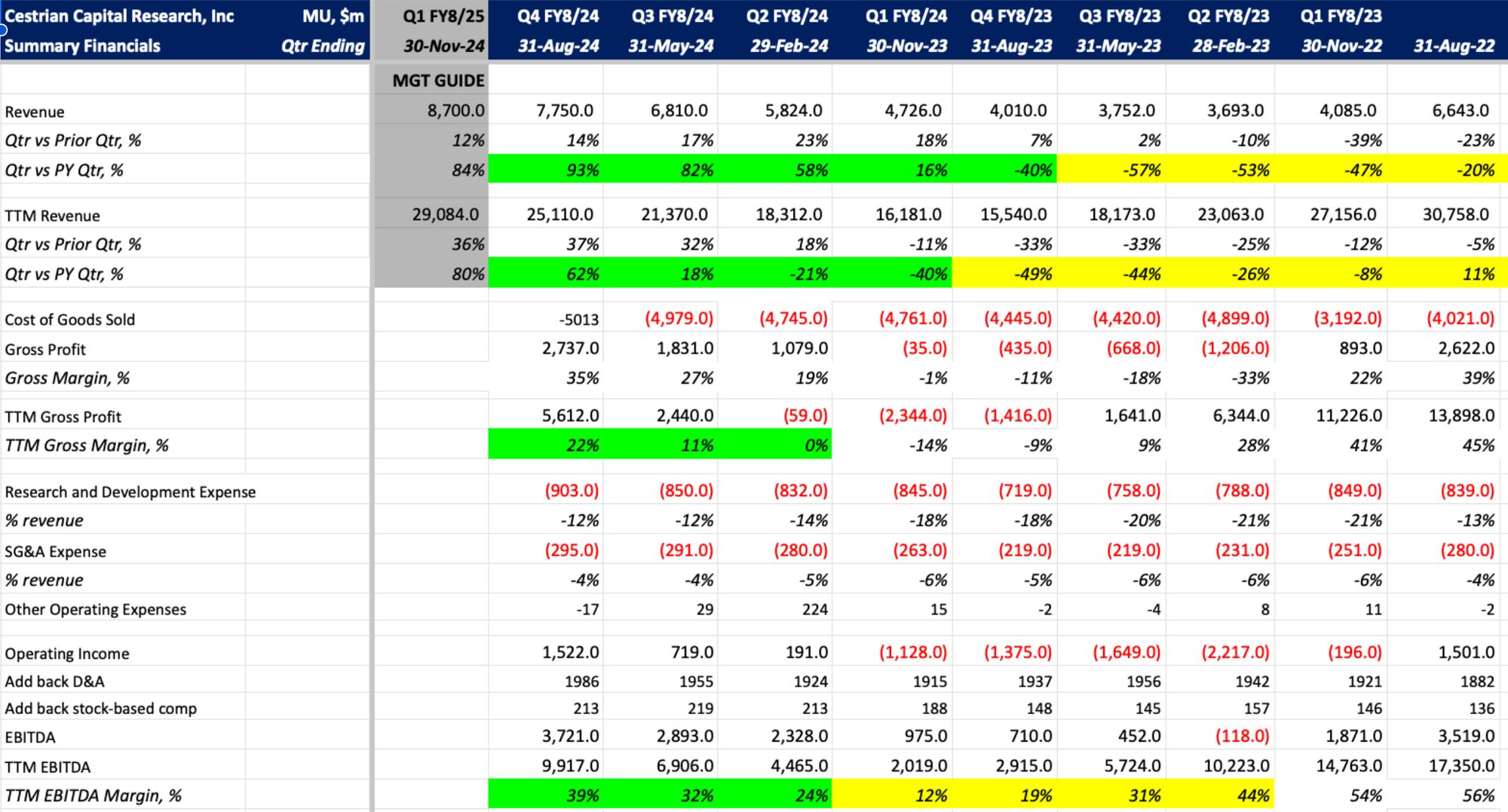

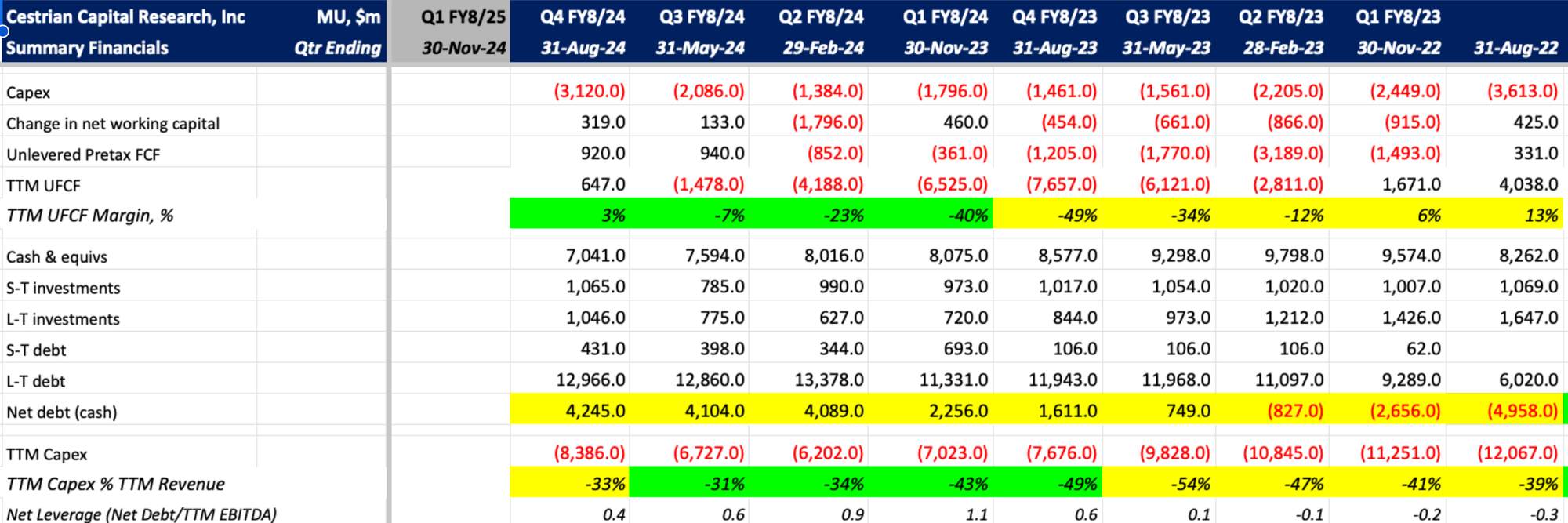

Financial Fundamentals

Cashflow finally turned positive; revenue growth accelerated; EBITDA margins continue to ramp. All good. (Net cash got worse, but not by much, and if the company follows the typical DRAM cycle, there should be a move up in cashflows in the coming year to pay down that net debt, before the company flips cashflow negative once more. Anyone tells you that “semiconductor isn’t cyclical anymore”? Ask them to see me after class).

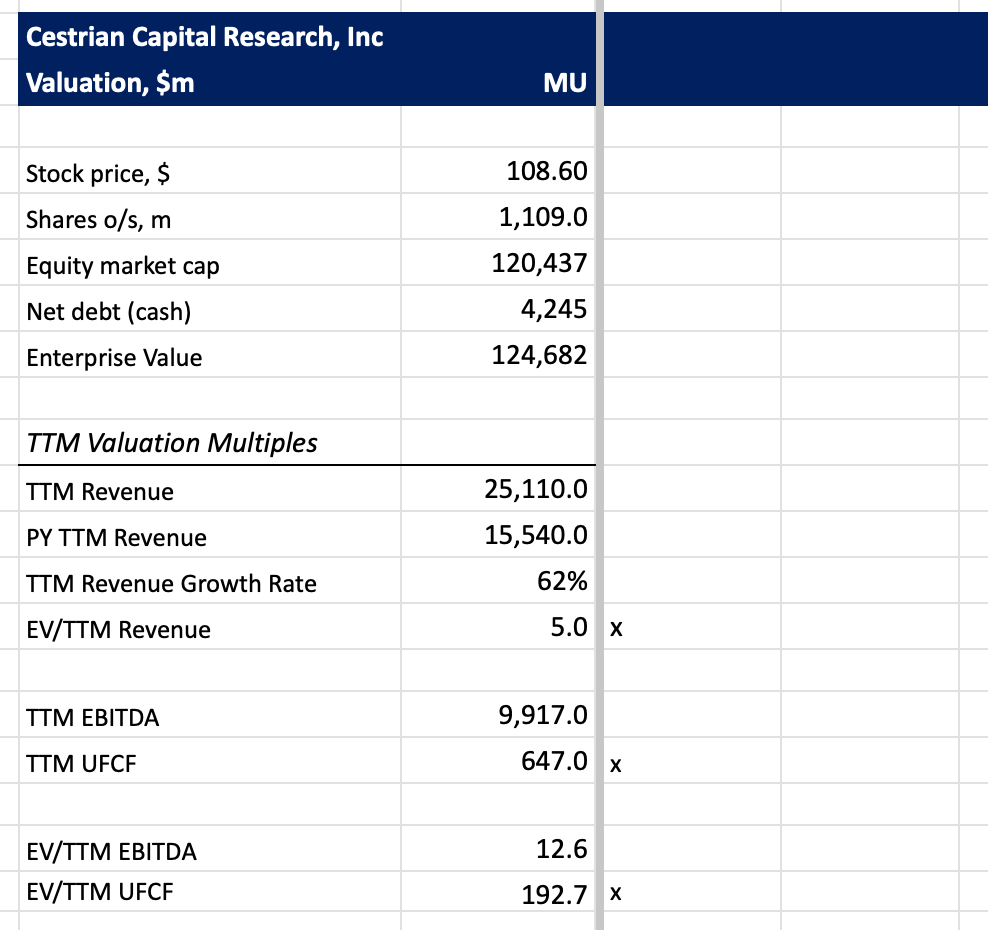

Fundamental Valuation Multiples

I don’t believe it makes any sense to buy or sell semiconductor companies on fundamental valuation multiples; particularly not cyclicals like MU. You may disagree. Here’s those multiples anyway.

Technical Analysis

This is how to buy and sell semiconductor stocks, if you ask me.

You can open a full page version of this chart, here.

We rated MU at Accumulate between $48-71/share, and indeed flagged a short-term support level, ie. further Accumulation opportunity, in the $90 zip code.

Rating

We rate $MU at Hold per the above chart.

Cestrian Capital Research, Inc - 25 September 2024.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, $MU, $NVDA, $INTC, $SOXX, $SOXL.