Micron Q2 FY8/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Numbers Good, Stock Meh So Far

by Alex King, CEO, Cestrian Capital Research, Inc.

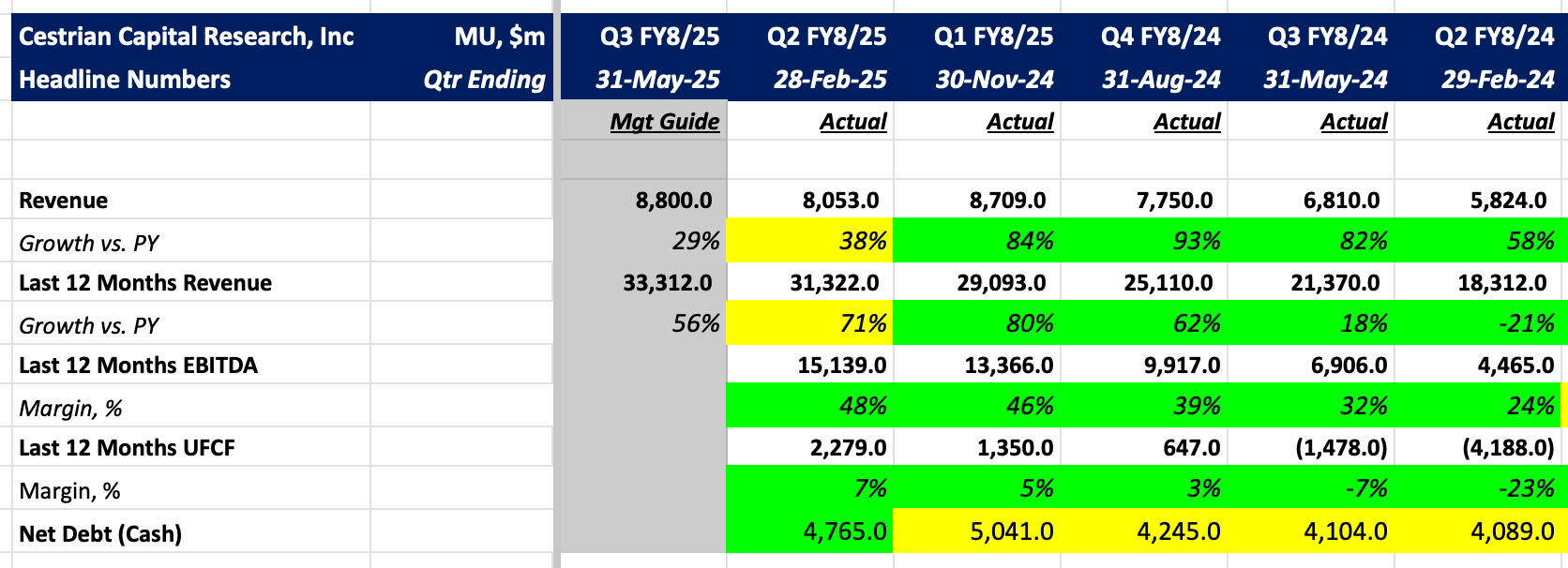

Micron printed its Q2 of FY8/25 after the close today. A solid quarter on fundamentals in my view. Revenue growth slowed to +38% vs the same quarter last year, with the guide for next quarter a further slowdown to 29% vs the prior year quarter. Cashflow margins moved up to +7% on a TTM basis, vs. a cycle low of -40% in the middle of 2023. Last time around cashflow margins peaked at around 18% (in the February 2022 quarter) so it may be there is still some margin upside available. The stock is pricey on cashflow, inexpensive on revenue and EBITDA in my view. The initial stock reaction was very positive; that has faded somewhat at the time of writing. $MU is now sitting right on top of its 200-day moving average. What happens next is important not just for MU but also for the semiconductor sector and therefore for the market indices.

Here’s the headlines:

Now the heart of the matter: