Micron Q1 FY8/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Unpopular Opinion - Pretty Good Quarter

By Alex King, CEO, Cestrian Capital Research, Inc.

Micron had the misfortune to report today after Fedmaggeddon and Vixpiry and a bunch of other reasons which cause equities to commit ritual suicide in the last couple hours of trading. So of course the stock is halfway to Hades and still diving.

The quarter was really very good. The guide is for a material deceleration in growth but then MU isn't a smooth-sailing kind of name anyway. Two things nag at me.

1) The CEO statement in the press release referred to the consumer segment being weak, but the company expecting to see growth re-accelerate in H2. I don't love how MU management handle capital markets, they tend to the jam-tomorrow story which today had echoes of.

2) Before everyone got permabull on semiconductor because it was going up and to the right forever, this is what semiconductor looked like at the top; peak growth AND peak cashflow margins. So that the top had low valuation multiples b/c even if the price was big, the denominators were bigger. Whereas the bottom had huge valuation multiples because even if the price was small, the denominators were tiny. I wonder if we're at trough trailing multiples here - the valuation metrics are really not high, as you will see below.

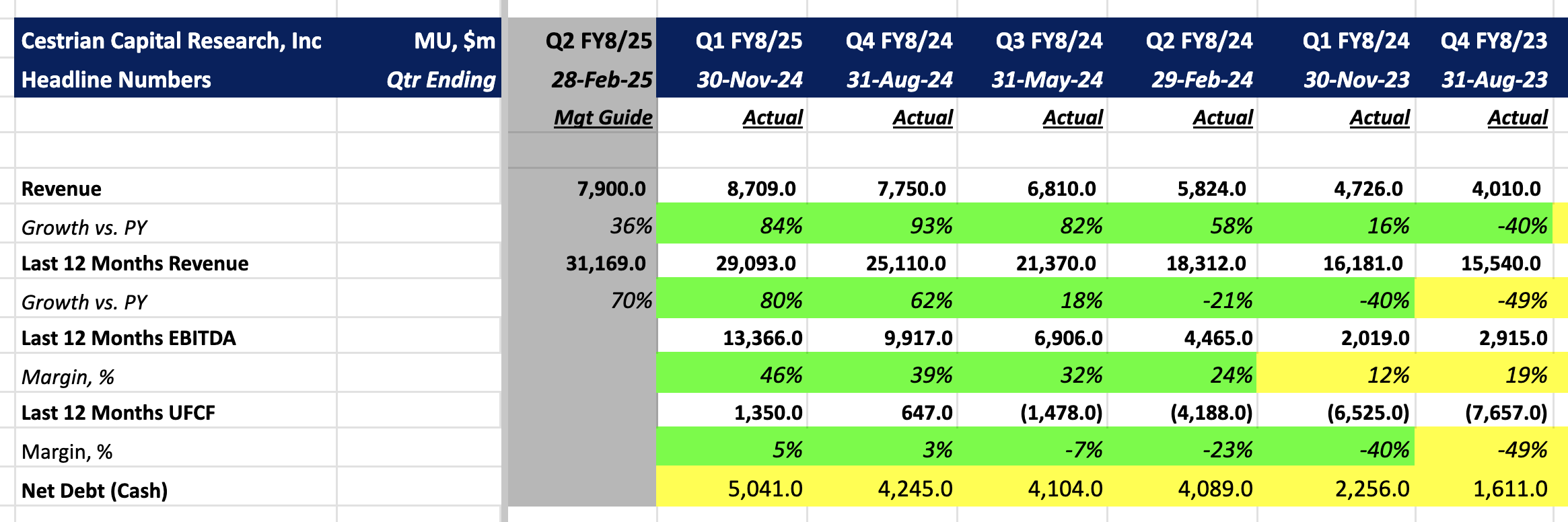

Financial Summary

Here’s the headlines.

Now, for our paying subscribers of all tiers here, we go on to look at financial fundamentals, valuation analysis, our rating and price targets.