Meta Platforms Q4 FY12/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Keeps On Keepin’ On

by Alex King, Cestrian Capital Research, Inc

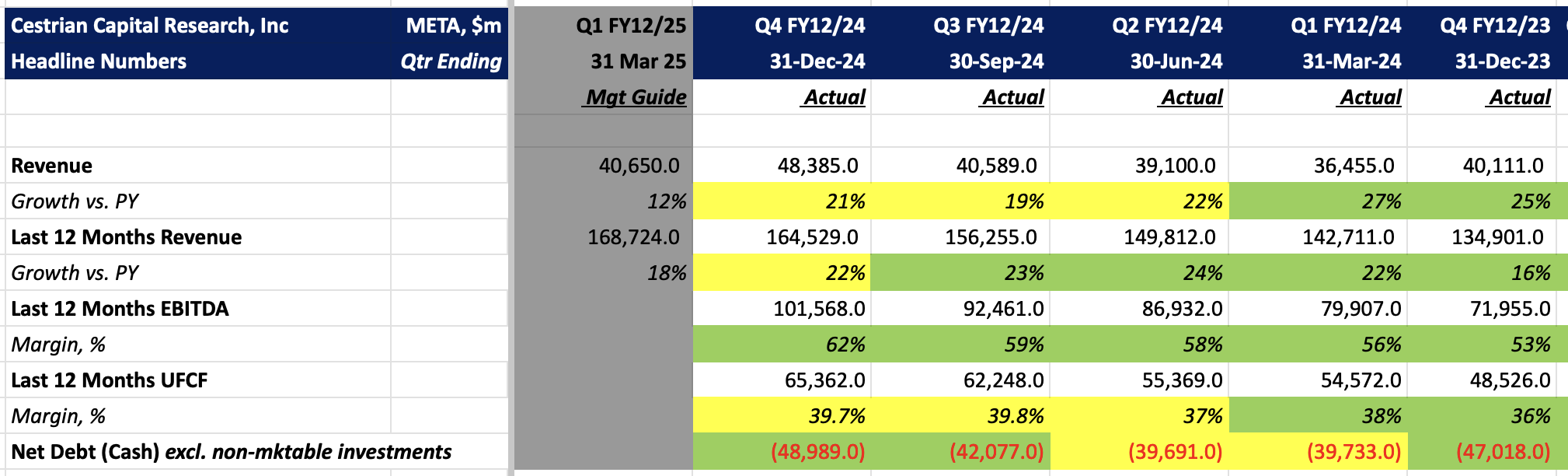

The Zuckerberg Juggernaut keeps on truckin’. Excellent numbers. Guidance is for decelerating growth, which nobody seems to worry about too much right now, but you can see from Meta’s numbers in 2022 that when it slows, the economy slows (or vice versa, doesn’t matter which).

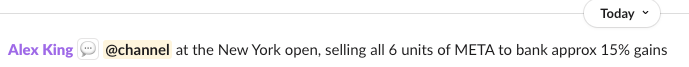

The stock looks elevated at the moment; personally I sold at the open this morning and banked solid gains on a sizable position. I figured that if the stock mooned on earnings I could live with it, but if the stock dived I would be kicking myself for not taking gains. I have plenty of indirect exposure to Meta via $TQQQ, $UPRO and $SPY, so if we see heavy buying tomorrow I would expect to benefit.

Here's the headlines. Below the paywall we dig into our rating, stock price target, and full financials analysis including valuation multiples.