Meta Platforms Q2 FY12/24 Earnings Review (No Paywall)

The Reductionists' Take

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Google It.

by Alex King, CEO, Cestrian Capital Research, Inc

The entire Internet now features:

- Quasi-expert discussion of the ROI achieved by Meta on its AI investments

- Analysis of what hyperscaler capex means for Jensen Huang's retirement plan

- An emerging science of Zuck's gold chain count vs. earnings beat potential. (I like this one. It's in the same vein as what-color-tie-is-Chairman-Powell-wearing-at-the-FOMC-press-conference). Semiotics in action!

As regards Meta Platforms stock, in all honesty it doesn't matter, or in any event I don't think it matters.

I think what matters is:

- Revenue growth is still pretty good, slower than it was but still pretty good

- Cashflow margins took a slight hit from the capex frenzy but they are still pretty good

- Even after a monster run from the bear market lows, the stock stil trades for about the same multiple of cashflow you'll pay for a defense contractor.

If you want to cut to the chase, we continue to rate at Hold (we rated at Accumulate between $96-157/share, the stock is now $510, so it's up 3-5x vs where we said Accumulate), and we have a price target of $676.

If you want to get into the weeds, here's the weeds.

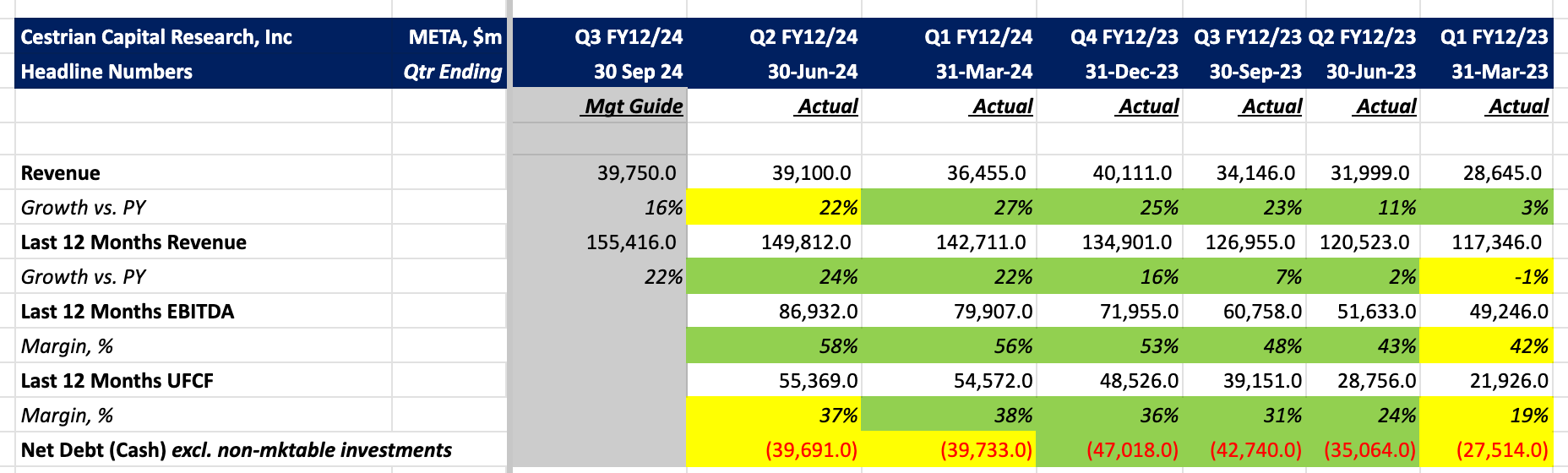

Headline Financials

In short:

- Revenue growth ticked down a little to +22% vs PY on the quarter; that's a nag in my view because $PINS also saw a slowdown. Nobody cares yet though; so it doesn't matter to the stock yet.

- EBITDA margins continue to climb - now 58% on a TTM basis.

- Unlevered pretax free cashflow margins dipped a point to 37% on a TTM basis; this is mainly due to capex ticking up.

- The balance sheet now features just shy of $40bn net cash - more net cash than any major nation state I can think of - and more than Microsoft, post their Activision acquisition!

Let's turn to more detailed financials, valuation analysis, our stock chart and how we get to that price target.

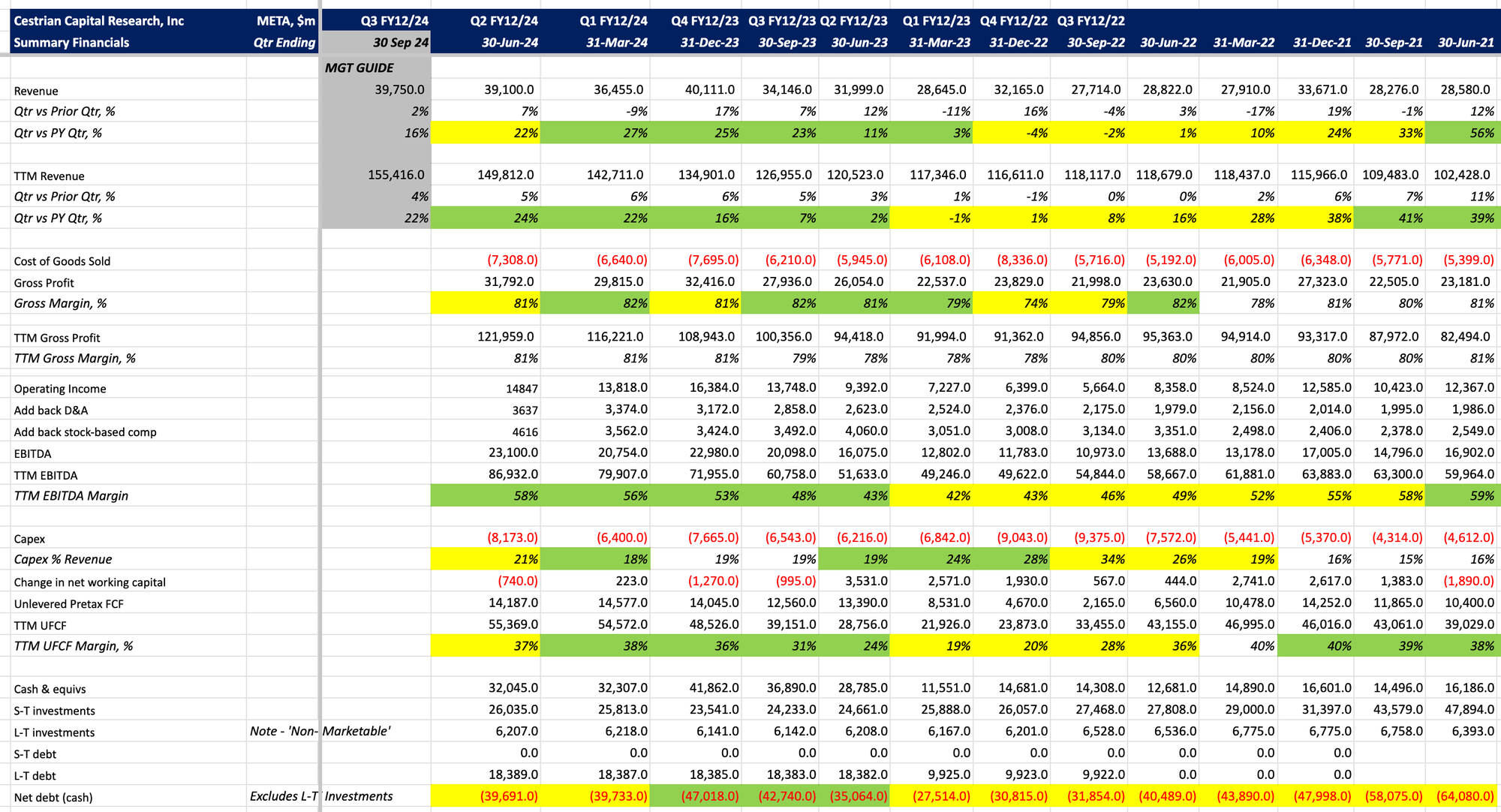

Fundamental Analysis

Here's our detailed take on Meta Platforms fundamentals.

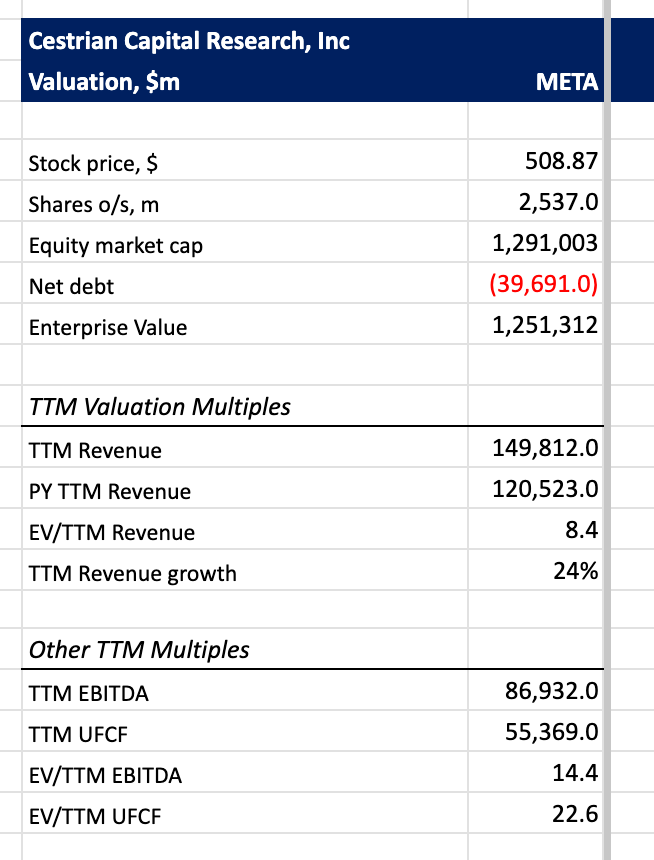

Valuation

The stock is inexpensive on fundamentals in my view - I think it can be a justifiable buy on the cashflow multiple alone.

Technical Analysis

I think the price is headed to $676, the 1.618 Wave 3 extension of the Wave 1 that ran from the post-IPO lows to the 2021 bull market highs, placed at the Wave 2 low.

You can open a full page version of this chart, here.

Stock Rating

We rate META at Hold.

Questions?

If you have questions about any of the numbers, charts, anything, reach out in comments to this note or on social media (Twitter here, StockTwits here, LinkedIn here).

Cestrian Capital Research, Inc - 31 July 2024

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold no positions in $META save via $TQQQ, $UPRO, $QQQ3 and $3USL.