Meta Platforms Q1 FY12/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Not Only Only-Up

by Alex King

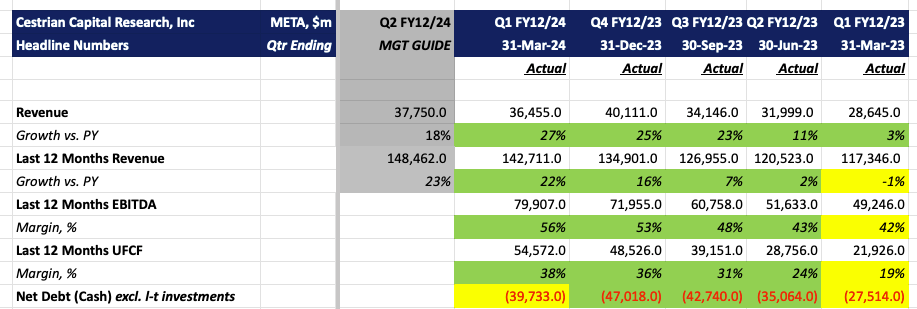

Meta Platforms reported its Q1 of FY12/24 after the close yesterday. The stock headed for the basement and kept digging; down 17% at one point during post-market trading hours. At the time of writing (5am Eastern) it’s now down ‘only’ 13%. On the surface, the numbers were good. Revenue growth accelerated, margins were up, cash levels dropped some but it still has more net cash resources than most small countries, so the wolf won’t be at the door anytime soon.

Here’s the headline numbers - we go on below to discuss the stock outlook, our rating and target prices (for paying members only)