May Yet Become A Good Business! (Sentinel One Q1 FY1/25 Earnings Review)

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

No Longer A Money Burning Pit Of Despair

by Alex King

SentinelOne, from IPO to, er, around now, held great promise as a lower-priced product offering vs CrowdStrike, meaning it could grow quickly among smaller companies and/or those who just preferred to spend less on cybersecurity. In addition the company made great play early on about its AI capabilities, presumably in the form of pattern recognition to get ahead of threat vectors before slower-witted products cottoned on. (And this was before just saying AI got you a share price bump!). The problem has been that the thing has just eaten money every quarter, and not been able to sustain growth at a level high enough to justify the cash burn. And whilst I will be the first to say that stock prices bear only a passing relationship to fundamentals, when the fundamentals are poor it certainly makes it harder for the stock to fly. (Not impossible. As $GME proves!).

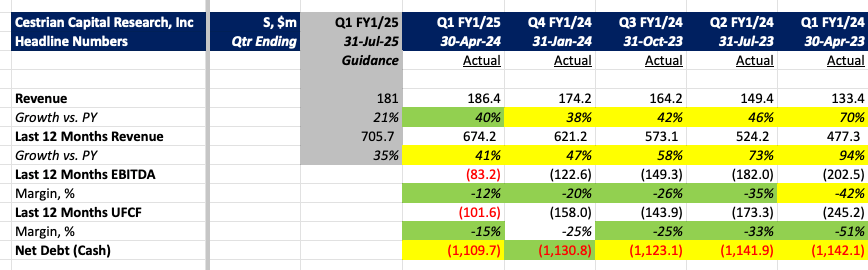

This quarter though, things improved. First up, revenue growth accelerated; if that means that revenue growth now holds at this rate, or increases, then S will be amongst a small handful of enterprise software companies that are actually increasing their growth rates - pretty much every other name we cover, with only 1-2 exceptions, continue to see slowing growth rates. And secondly, the company generated positive unlevered pretax free cashflow in the quarter. Not much - just $9m on $186m of revenue - but some. And that’s a watershed for the company. It probably isn’t sustainable yet, because it was driven by a big inflow of working capital (meaning a lot of customers paid them upfront, as is normal in their Q1, and they didn’t have to pay many suppliers). But perhaps over the next 3-4 quarters the company can trend to cash breakeven. It has $1bn net cash in the bank, so it has time.

So, let's look at the numbers, the valuation, the stock chart and our rating.

Headline Financials