Marvell Technologies Q4 FY1/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Not As Broken As It May Appear

by Alex King, CEO, Cestrian Capital Research, Inc

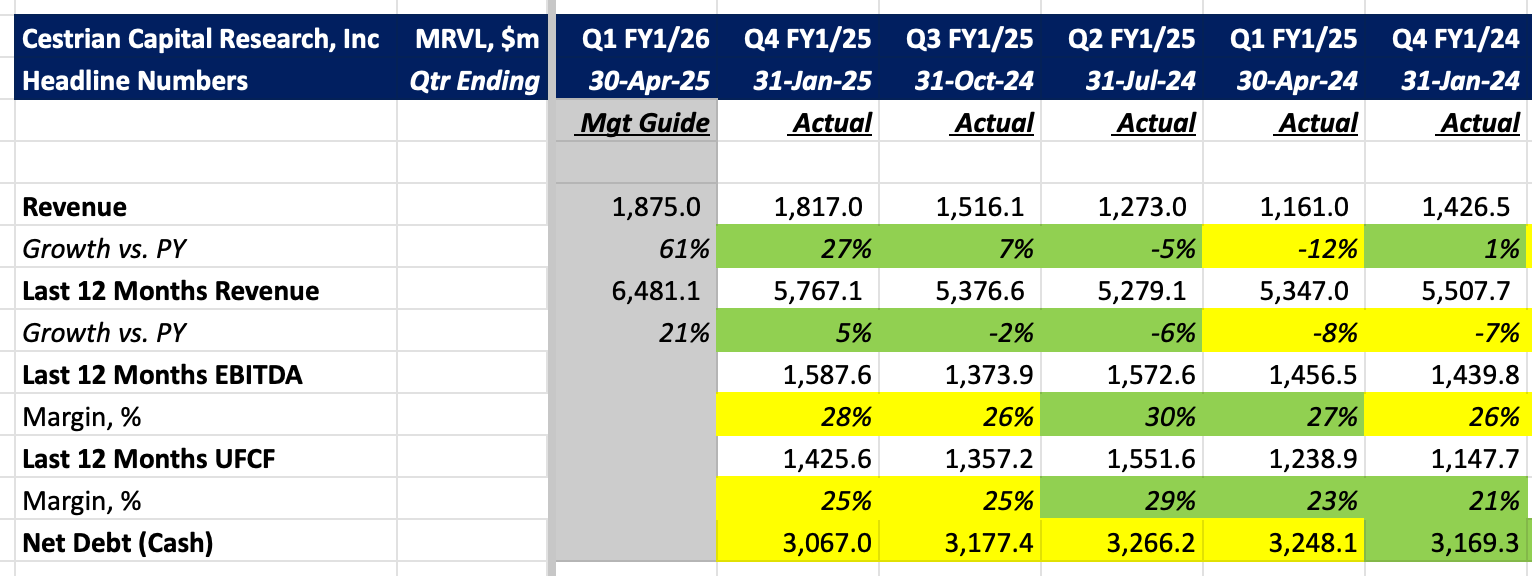

Marvell’s Q4 was perfectly good. Revenue growth improved, cashflow margins held flat, and the balance sheet strengthened. The guide for next quarter’s revenue implies further acceleration in growth rates.

None of this stopped the stock from dumping with gusto on the print. And as the quarter wore on, the price was ground down further because - well, all the reasons everything has sold off in the last six weeks or so.

If you step back and look at the fundamentals and the chart setup today though, against the backdrop of a Fed trying very hard to sound dovish and the first of the indices - the Dow - to be challenging its 200-day moving average from below - well, things don’t look so gloomy at the company.

Below our headline numbers.

Let's take a look at the full financials, valuation analysis, and our stock chart & rating.