Marvell Technologies Q3 FY1/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Here Comes The Flood

By Alex King, CEO, Cestrian Capital Research, Inc.

First of all, a big thankyou to our longtime contributor “FredFrog” for first bringing Marvell ($MRVL) to my attention in early 2023. Being old and wizened I knew the Marvell of old - a dominant supplier of hard disk drive controllers - but not the new. Marvell’s current product setup places it squarely in the way of a coming flood of capex, driven by yes you guessed it, AI.

To deliver AI computing in the datacenter you need GPU cycles and you need power and cooling. This much has already reached the mind of the investing public, hence boomage in $NVDA, $VRT and others. But then you need a lot more capacity and speed and low latency everywhere downstream of the GPU, all the way to the client device. So that means that datacenter interconnect, storage, local- and wide-area networking componentry, systems and service - all this stuff has to be dragged into the Matrix Algebra Age.

MRVL is guiding to a major step up in growth next quarter, evidence I think of the coming flood. Capex like this will make its way to other vendors too, and you see that in the generally positive response from across the semiconductor sector to MRVL’s print today. (Intel is dancing to its own tune as you know).

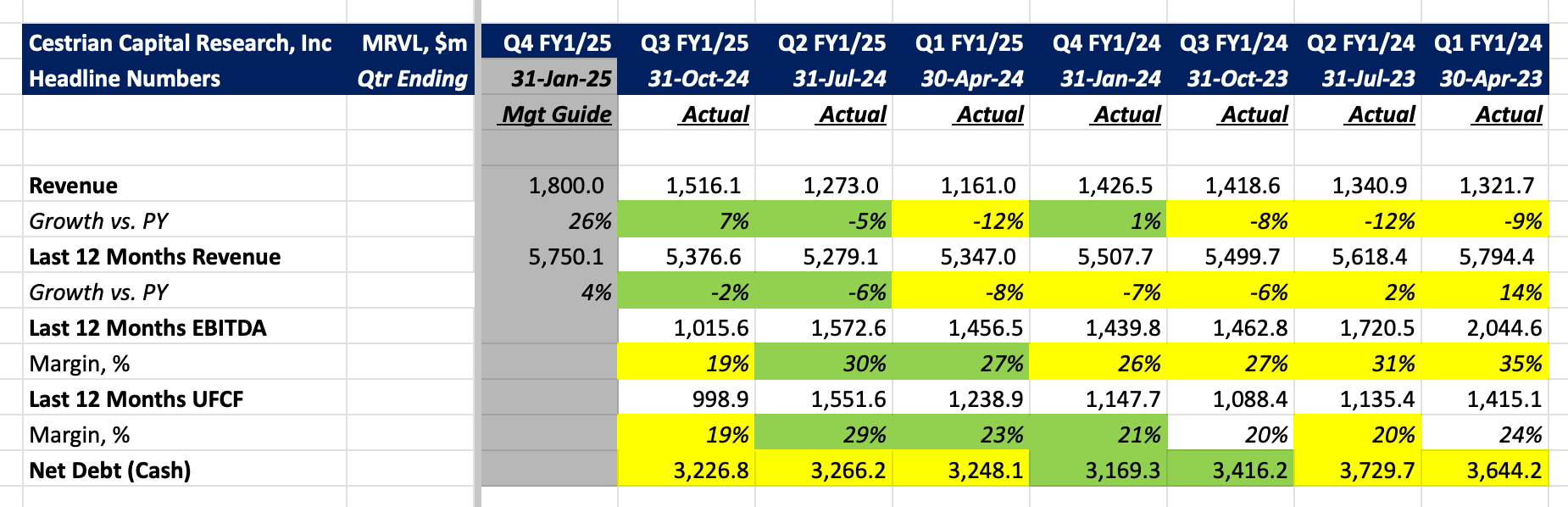

Here's the headlines. Note that EBITDA and cashflow are depressed by a large one-time restructuring charge (and cash cost) and are likely to rebound quickly in the next 2-3 quarters.

Financial Summary

Now, for our paying subscribers of all tiers here, we go on to look at financial fundamentals, valuation analysis, our rating and price targets.