Marvell Q2 FY1/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Spillover Benefits

by Alex King, CEO, Cestrian Capital Research, Inc.

For all the chatter that AI is a hypefest, that Jensen Huang is selling stock so it must be game over for $NVDA, that there are no commercial use cases … I personally think this is missing the point entirely.

AI isn’t a new-new thing that came out of nowhere that will either be- or not-be. It is simpler than that in many ways. It’s the latest platform refresh in tech, which means it’s the latest wave of capex in tech. This happens every decade or so; mainframe gave way to minicomputers, then to client-server, then to the original hosted-application software, then to the native multitenant environment we all know today as the cloud. AI is next up.

For this next generation of software to work as intended, it needs resource in the network. And when I say resource, I mean capitalized R-E-S-O-U-R-C-E. And that’s because this thing goes about its business with brute force. AI compute isn’t subtle. If it was, it wouldn’t require an oil tanker sized battery of GPUs to produce generative eating-pets memes, and it wouldn’t need the major utility providers in the developed world to consider rapidly accelerating capacity and connectivity projects in order to satisfy this new client demand. AI eats resource.

That means that capex will be ramping to, inter alia,

- Other parts of the datacenter - for now GPU, memory and cooling are known beneficiaries, but soon we will see spending spillover into connectivity, power management and other corners of the semiconductor market that Nvidia alone cannot reach.

- Telecom - specifically we will see the big telcos and cable MSOs spend big on new fiber backbones and fiber tails to accommodate the rapidly increasing bandwith guzzling that is going to arrive soon. (Wait till the iPhone does even baby-AI and wait for the cellular telephony companies to squeal about lack of CDMA network capacity, choked backhaul etc etc).

- Software - database, integration, monitoring, you name it, all the plumbing that sits beneath and between applications is going to see an uplift in deployment rate and complexity of deployments.

Marvell, to my mind, is a high probability beneficiary of this trend. The company produces semiconductor devices in the storage and networking segments and stands to benefit from the wave of capex I believe will wash through these markets.

Oh, and Q2 was pretty good by the way.

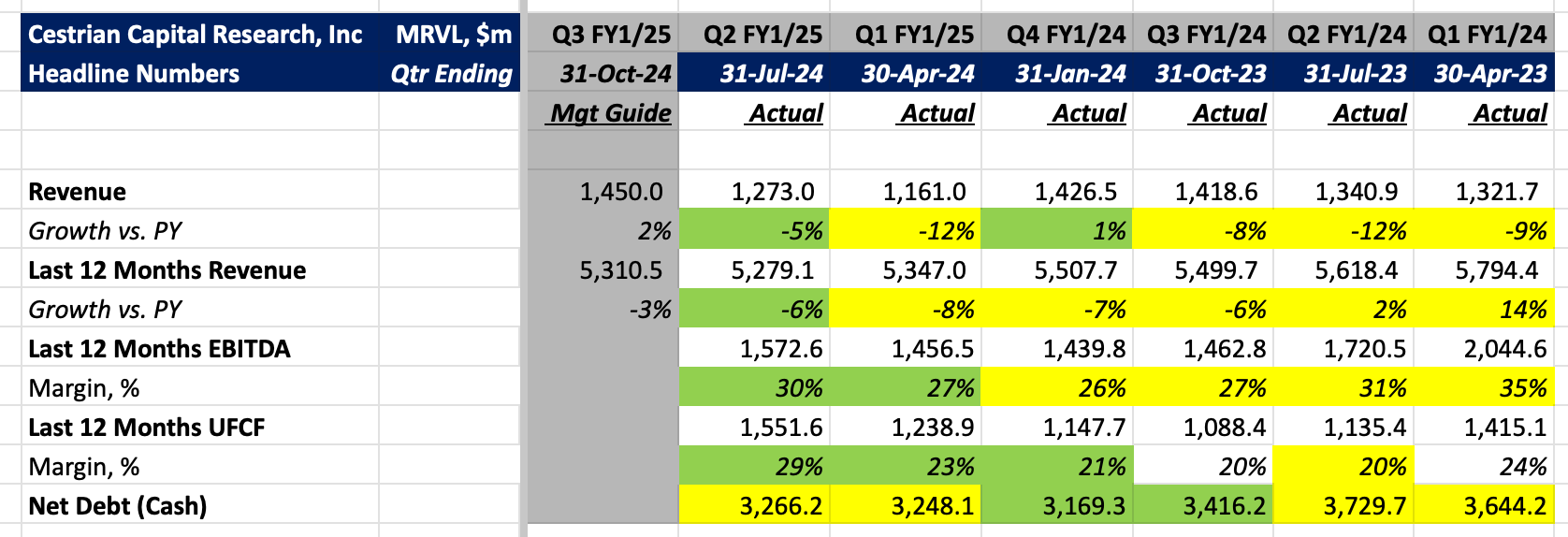

Here’s the $MRVL headlines.

Read on for the financial detail, valuation, our stock chart and rating.