Market When Open - Wednesday 8 May

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Nothingburger Days Are Not Nothing

by Alex King

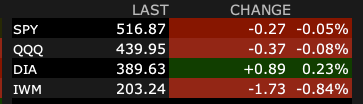

At the time of writing, around 11am Eastern, the four US equity indices look like this vs. yesterday’s close.

A nothingburger, save for the Russell 2000 (IWM ETF) which is down a little. If you’re an Inner Circle member you may have followed the trade disclosure alerts, hedging with TZA yesterday and cashing that short position for gains today, then cashing the prior long TNA position for gains. Personally I am now all out of the Russell with another set of gains cashed on the long side and on the short side.

Nothingburger days are designed to bore dopamine addicts to death. Whilst overstimulated 0DTE types are looking for a buzz, and failing to find it, Big Money is usually quietly planning a directional move. The trick is to figure out which direction. The options market is a useful source of information for this. If any of the major, liquid sector ETFs have high-open-interest calls or puts selling, with a low implied volatility rank, it is a fair bet to say that likely large account players are accumulating directionless bets in those sectors. This happened in oil and energy stocks and ETFs in H2 2021 - cue the massive runup in oil and energy stock and ETF prices in 2022 following the Russian invasion of Ukraine. And it happened in tech in H2 2023/ Q1 2023, and you know what happened after that.

So if it’s all quiet on the Western front? Probably there is a lot going on back at Big Money HQ, even if the footsoldiers in the trenches are unaware.

And with that in mind, without further ado, let's get to that daily market analysis. As always we cover all four primary US equity indices (the S&P500, Nasdaq-100, Dow Jones-30 and Russell 2000); bonds (TLT), volatility (the Vix), oil (USO) and sector-specific ETFs. We provide long- and short-term insight daily and we include coverage of leveraged ETFs which - if you have gotten sharp at the rotation and hedging methods we teach - can be used to very good effect. All of this features daily in the pay version of this newsletter.

Yet to sign up?

For an entry-level subscription, choose “Market Insight”.

If you want the full story, choose “Inner Circle”.

Monthly and annual subscriptions available - right here.