Market When Closed - Wednesday 12 March

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Step By Step

by Alex King, CEO, Cestrian Capital Research, Inc

In the human world, the important thing today was the CPI print, which came in a little light. That’s the first piece of news supportive of equities for some weeks. You can see other potential upside catalysts waiting in the wings. Some kind of respite in the Russian invasion of Ukraine which markets consider bullish (reality doesn’t matter for our purposes - we are talking about securities markets here where imagined reality is all that matters). More signal and less noise in the tariff policy. A bullish reaction to PPI.

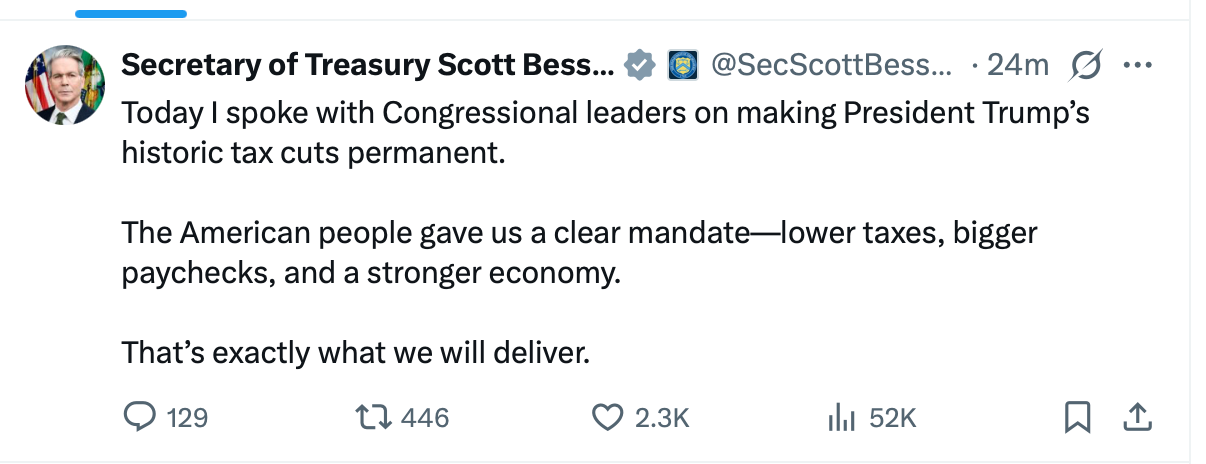

As I mentioned in this note yesterday, global liquidity flows are beginning to look supportive of risk assets too. And like it, love it or don’t care, tax cuts in the US are a kind of liquidity injection for rich people - ie. risk-asset-owning-people. Tax cuts remain high on the Administration’s agenda. Here’s the signal just now.

If you remove less money from the private sector by way of taxes, the private sector has more money to put to work in securities. Again you can argue about the real-economy impact of this and you can believe it to be a good or a bad thing. Doesn’t matter. Our job here is - number go up? Or number go down.

Let’s check in on risk assets after the CPI print. Markets have had a full trading day to digest the number, so any stop-hunting shenanigans are largely washed out now.

Before I go - in machine world, nothing is known about invasions, tariffs, taxes, inflation, or anything else that isn’t a pure number. Which is why machines can be so useful in managing money - particularly in times when the wetware’s emotions are running high.

Read this if you missed it:

Short- And Medium-Term Market Analysis

If you want this daily dose of (human-authored) pattern recognition, and you aren’t yet a subscriber of course, you can read about and choose from all the subscription services that include this note, here.

US 10-Year Yield

Re-testing last week’s highs.

Equity Volatility

I wouldn’t call that a vol crush yet, but it’s certainly supportive of a further bull move in equities.

Disclosure: No position in volatility-linked securities.