Market When Closed, Tuesday 8 April

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Zero Day

by Alex King, CEO, Cestrian Capital Research, Inc

Well, tomorrow the Administration’s reciprocal tariffs go into operation. As is now widely understood, the tariff rates themselves have been calculated on the basis of trade deficits, not upon actual inbound tariffs; and as regards China they have been escalated further since Liberation Day.

We're at the event horizon.

If these tariffs hold, I know of no independent economist who does not believe a US recession will be ushered in as a result. I also think that the Microsoft announcement today - cutting a $1bn capex commitment in Ohio - will be the first of many, with companies choosing to not invest due to the cost of capital in doing so vs. the uncertainty of economic outlook. This, I believe, will usher in a new bear market.

In the alternative, some set of negotiated settlements are reached such that the major players - the US, China, the EU - can de-escalate and get on with doing business. In which case cue a very large and rapid recovery in both equities and bonds, I think.

There’s not really much more to say; the outcome of the above is the primary driver of all markets right now.

This Is Our Quant.

Subscribers to our SignalFlow AI family of services have been very happy of late. Here’s three testimonials we received after the current market turmoil. The SignalFlow AI model declared “Risk Off” in the S&P on March 3rd; the index has dropped some 15% since then - a drawdown the model could have helped you avoid if you were a member.

- "I am wildly thrilled with SignalFlow AI for $SPY! I have been following the signals and moved almost completely to cash with the most recent change to risk off. Absolutely incredible for me, mentally and financially. Thanks so much to the team for developing this service.” - April 2025

- “The long/short service paid for itself in one day overnight by the way! Thankyou.” - April 2025

- “Rather than a day that could have ruined the weekend, I was able to watch the market tank knowing that I had the knowledge to weather the storm and come out far ahead.” - April 2025

The latest SignalFlow service provides long/short signals for the S&P500 and Nasdaq-100. This is a very easy to use service running on a quantitative model; complex below the waterline, simple above it. This is pure machine logic driven by price alone, not by the news, not by narrative, not by fear or greed.

Please do take a moment to read about what I believe to be a truly excellent service - here.

Short- And Medium-Term Market Analysis

If you want this daily dose of pattern recognition, and you aren’t yet a subscriber of course, you can read about and choose from all the subscription services that include this note, here.

US 10-Year Yield

Still climbing today, and with some vigor I must say.

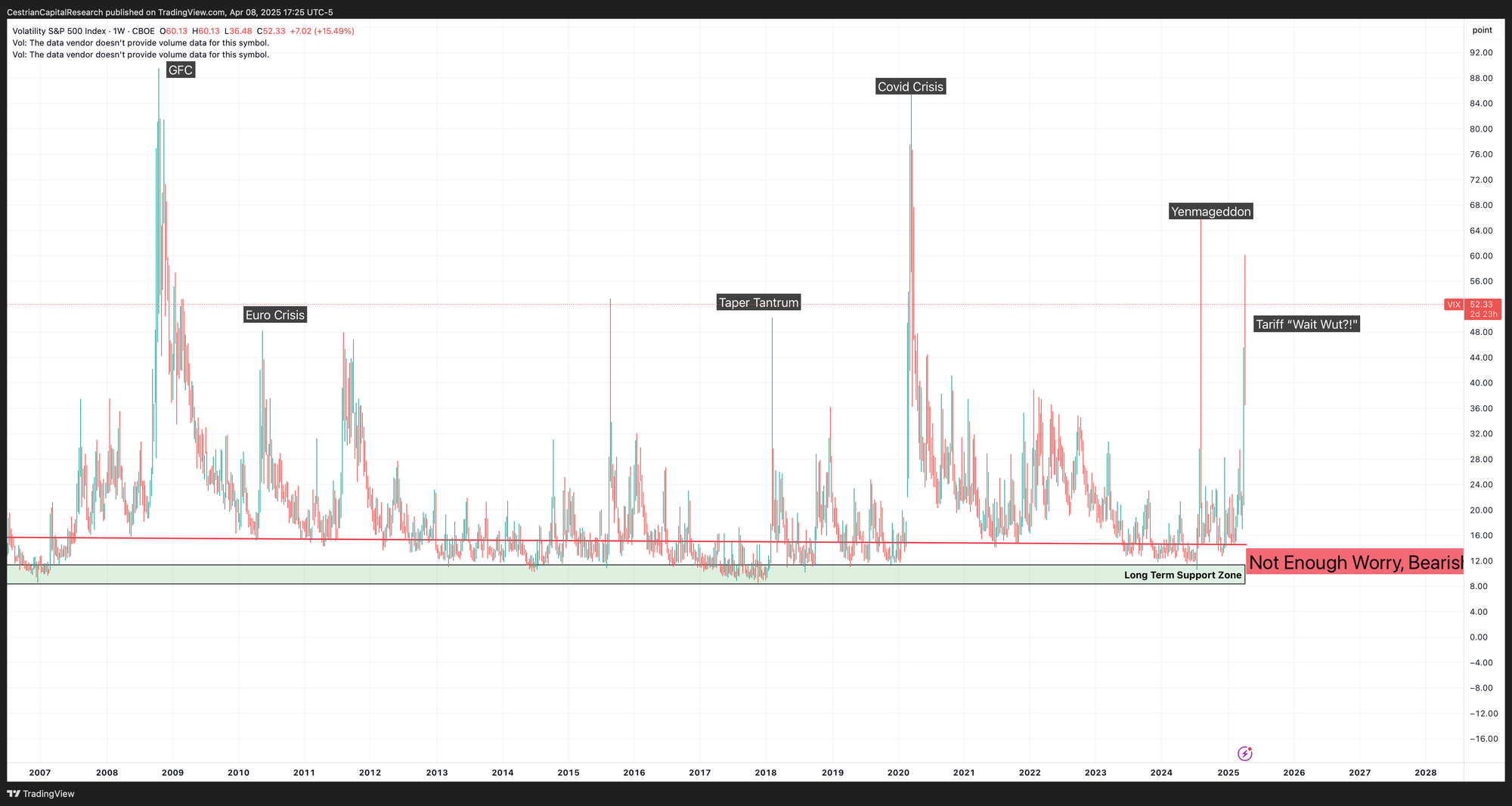

Equity Volatility

Although it ran up, the Vix did not make a new high today.

Disclosure: No position in volatility-linked securities.

Now, for our paying subscribers we move on to bonds, the S&P500, the Nasdaq, the Dow, and key sectors.