Market When Closed - Tuesday 18 March

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Two Pivot Points Remaining In March

by Alex King, CEO, Cestrian Capital Research, Inc

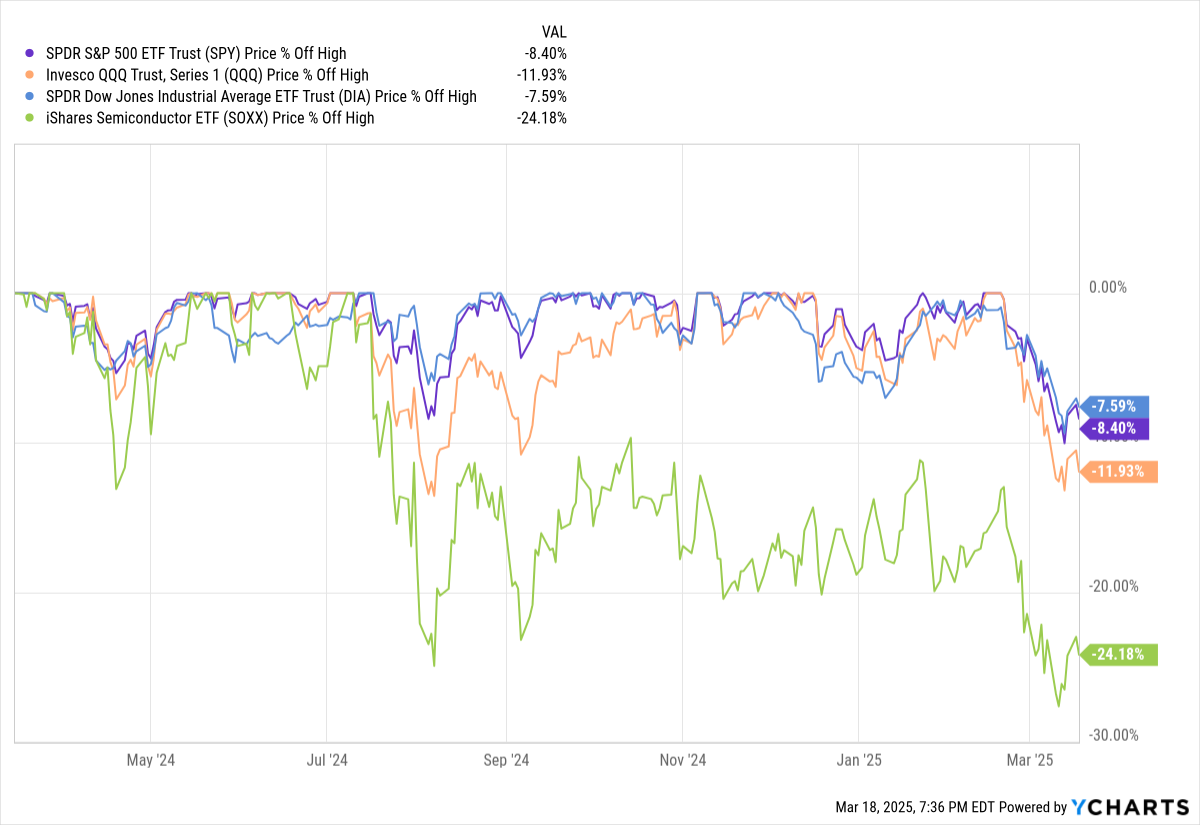

The current selloff in equities is well within “normal, healthy correction” levels. The S&P500 is down some 8.4% from its highs, having touched a 10% drop earlier this month. The Nasdaq remains 12% below its ATH. Semiconductors, some 24%, but that’s how high beta is in a downturn. (The price of admission to enjoy the run in the upturn). The Dow, down 7.6%. Nothing of this is remarkable. File it under “when prices run up, prices have to come down”.

Despite this, people seem to be losing their minds. Finance Twitter is a ghost town where just six weeks ago it was full of people posting YTD return charts. (No, I don’t know why they do that either). The professional long-only equity market is looking for some kind of White House Put even though it apparently believes in free markets rather than government-supported markets. Gold continues to climb and crypto continues to linger.

It could be that we are in a new bear market, I don’t know. As I’ve said in our weekly webinars, if this is a bear, it will have started after only a very weak bull market from the 2022 lows to the 2025 highs. For now though, I think it is best treated as a correction.

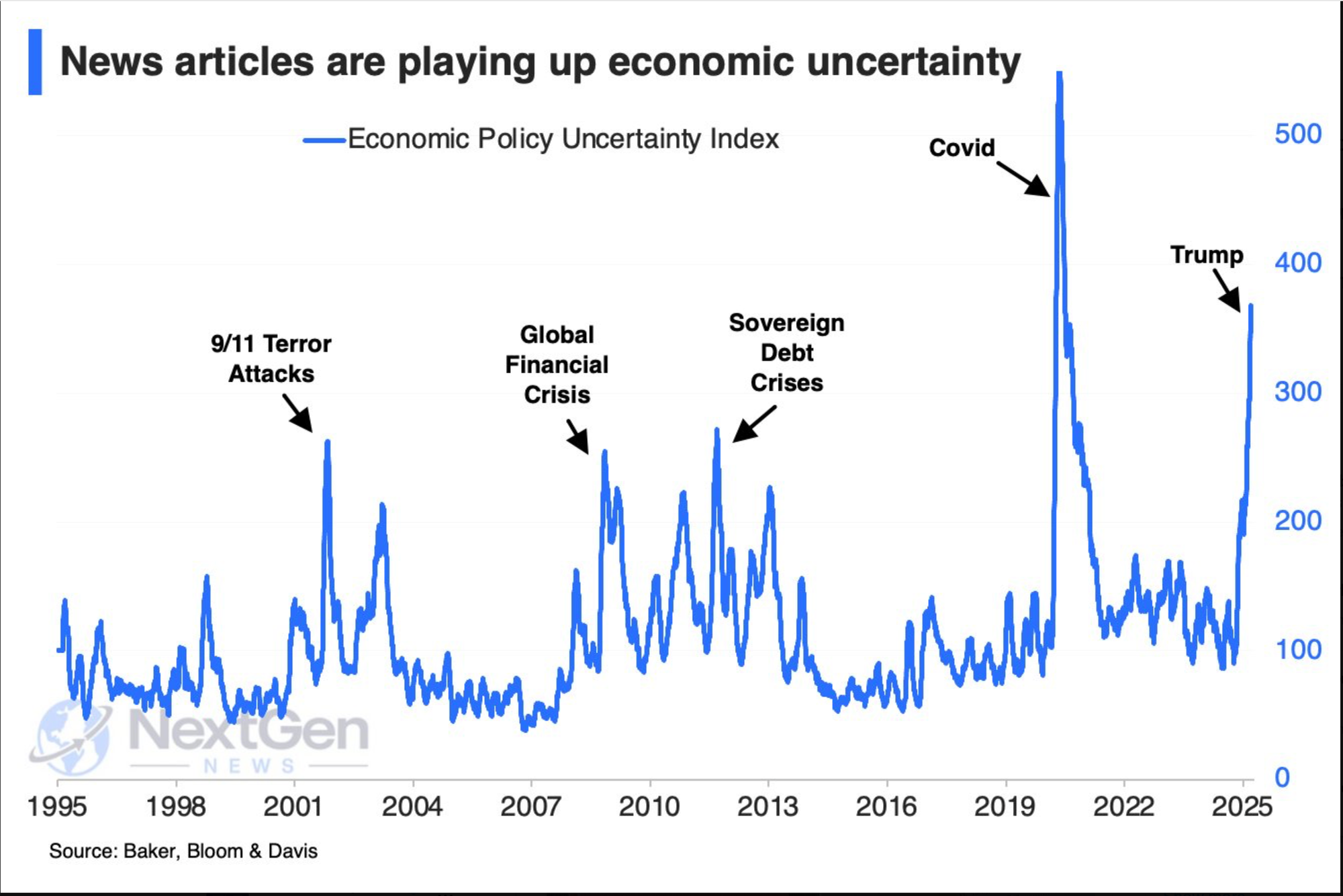

There are two events this week that will tell us a lot more about what the market intends to do next. The first is the FOMC press release and statement to the press tomorrow, Wednesday 19 March. The second is Q1 options expiry which happens Friday 3/21. To my mind either the 1-2 punch of these two events either drives the market up (perhaps a selloff after FOMC then a reversal as put-heavy opex sees dealer re-hedging flows spark a short-squeeze rally), or simply fails to arrest the malaise and it continues down. If down, I am not sure what the next catalyst for potential reversal will be at this stage. Most likely it will in fact be some sort of government intervention, probably more subtle than much of the market is hoping for. Sellers, it seems, are motivated at least in part by policy uncertainty.

For a markets point of focus in the present Administration I would point to Treasury Secretary Bessent, who is a lifelong market participant and is now doing the rounds of major and minor media outlets to communicate to other market participants. If you don’t already follow him on X, it is worth doing so. Sometimes you can find the cheat codes in plain sight. One is reading Nick Timiraos’ commentary in the runup to FOMC, and another is actually listening to what Secretary Bessent is saying to the market. Bessent, here; Timiraos, here.

I hope that by using our work here at Cestrian you are navigating the current selloff well. Nobody can ever call tops or bottoms perfectly but we have a host of tools here to help you do it better than most. If you are sat with plenty of cash and/or margin capacity at hand, if your index longs are hedged, and if you don’t have armfuls of high-beta names that you hope will go back to the ATHs at which you bought them - then you are doing way better than most.

If I can point you to two simple tools that I think can improve anyone’s investing and trading, it is these:

- All investors & traders: To get a machine’s reading on when the market is likely entering a period of weakness, and when entering a period of strength, SignalFlow AI is our quant service. It went from long Nasdaq to cash on 2/25 by the way. Which was a righteous call.

- Registered Investment Advisers: To get that same machine risk on/risk off call in the S&P500, and then a further quantitative assessment of which are the top 3 sector ETFs to hold - this all geared to help you grow client assets under management - take a look here:

And with that - let’s get to work.

Short- And Medium-Term Market Analysis

If you want this daily dose of pattern recognition, and you aren’t yet a subscriber of course, you can read about and choose from all the subscription services that include this note, here.

US 10-Year Yield

Equity Volatility

Disclosure: No position in volatility-linked securities.