Market On Open, Wednesday 8 January

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

And The Winner Is …

by Alex King, CEO, Cestrian Capital Research, Inc

The bond market.

We can all argue between ourselves about our favorite flavor of Administration. We can argue about this or that policy implemented by the Administration of the day, whomever that may be. But what we can’t argue about is whether the bond market will permit policy X or Y from Administration A or B to actually proceed, because all policy needs to be funded. And an indebted nation, like a leveraged business, when it needs funds, needs to tap the bond market for that funding.

This means that all governments everywhere want moderate yields on their bonds, because the yield on traded bonds influences the coupon that has to be paid on newly issued bonds.

So whether you have an expansionist, pro-growth, de-regulating, tax-cutting agenda, or a progressive, re-regulating, tax-hiking agenda, it doesn’t matter. You need money. And the price of money, at the moment, is going up.

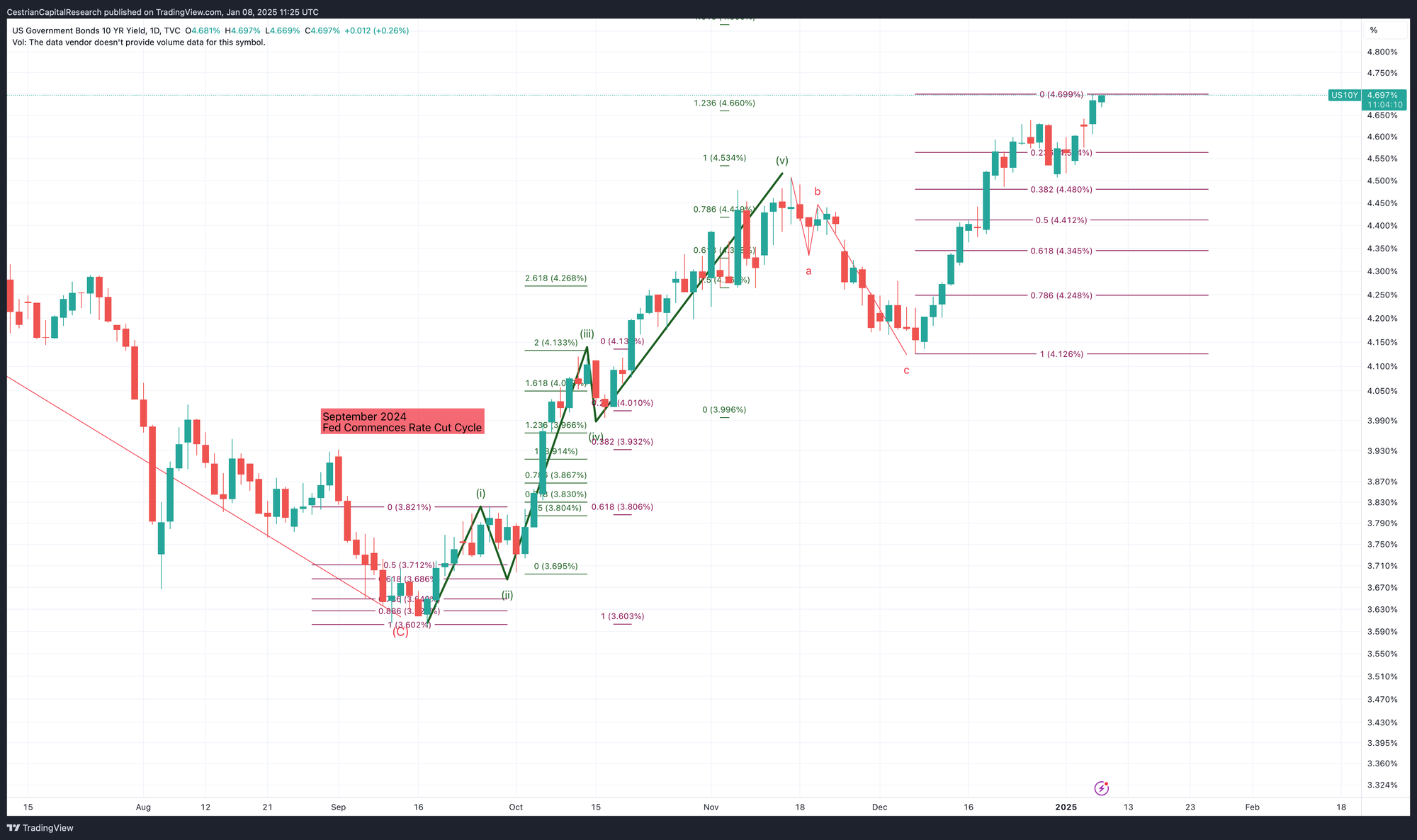

A useful proxy for the price of money is the 10yr yield. In September last year, when the Fed opted for a 50bps cut because inflation was beat, the 10yr yield stood at 3.6%. Not too bad. Right now? 4.7%. Which means money costs 30% more now than it did in September, kind of.

You can open a full page version of this chart, here.

Whose fault is this? Someone should pay - right? Well, if you like, you can say it’s the fault of the current Administration because it remains on their watch, or if you prefer, you can say it’s the fault of the incoming Administration because of the planned policy agenda. But more likely it’s the fault of the Fed, at root. The Fed is in a real bind at present in my view. They appear to have cut too hard into a world where the standard measures of inflation remain elevated vs. the Fed’s own targets, and worse, appear to be climbing. If the bond market fears inflation and another rate hike cycle then it is going to throw a tantrum, which is what you see in the yield chart above. On the other hand there is evidence that the consumer is suffering, working multiple jobs and still unable to get on top of credit card debt, which if true is likely to lead to less spending which is likely to bring inflation down but in a bad way. In which case the Fed has not cut enough. Urgh. It’s almost as if one single variable, the Fed Funds Rate, is insufficient to try to manage both economies, the labor economy and the asset economy.

Bonds look to be under accumulation; per chart below (for subscribers) covering the 20+yr Treasury bond ETF, $TLT. That big volume at the lows is unlikely to be institutional selling. So you have a wall of money that is expecting bonds to rise (meaning yield down); but you have other forces in the market that keeps driving yields up (meaning bonds down). This is where the action is right now. Crypto, equities, quantum, Nvidia, that’s all Sideshow Bob territory. Want to know what’s going to happen in markets? Watch the yield. It cannot keep climbing without harming the show ponies; and if it collapses too fast it means something is broken in the economy which will, er, harm the show ponies. Man, it’s almost like this stuff is difficult.

Well, the easiest way I know to navigate markets and try to make money from them is to measure their moves. We publish these charts every single day in order to help make sense of market direction. You can use them in your short-term trading and your long-term investing. They are the same charts I use personally, which is why I rather like penning them every day - no better way in my view to keep a handle on matters.

So let’s go!

Short- And Medium-Term Market Analysis

Any paid subscription here gets you access. You can read about and choose from all our subscription services, here.