Market On Open - Monday 11 March

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

A Heady Brew! Fearful Bulls vs. Expectant Bears vs. Triple Witches

by Alex King

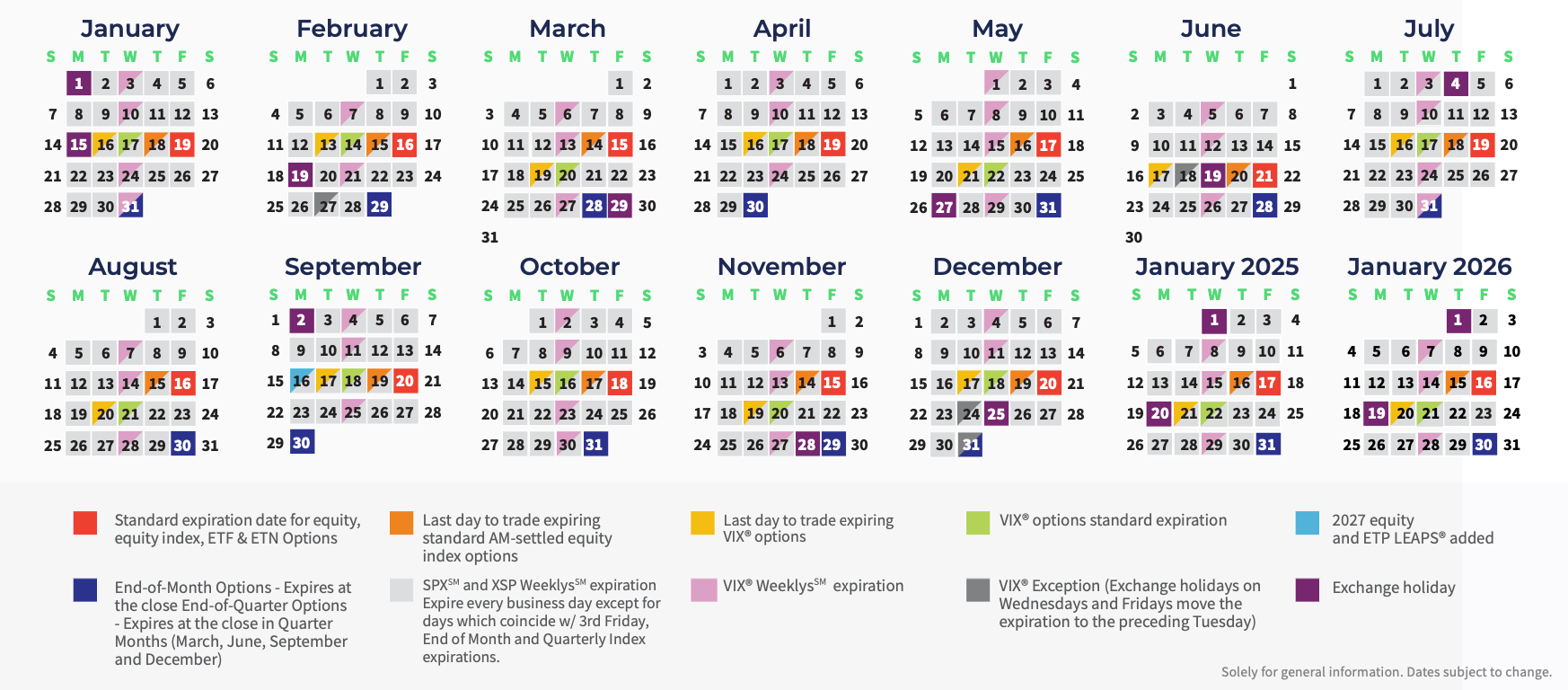

The end of Q1 is an important time in equities markets; typically the March options expiration (“opex”) features a very large volume of single-stock options, index options and futures contracts expiring all at around the same time. All such opex dates are worth noting, even if you don’t trade options or futures, because as we never stop going on about, options markets - which feature much more capital than equities markets - frequently drag equities markets around, so it’s good to know the dates when this is most likely to happen. Here’s the opex calendar for 2024 - you can find a cut out & keep version here.

This Friday, 15 March - the third Friday in the month - sees the expiration date of equity index, ETF / ETN and single-stock options contracts. This means that hedging flows will be meaningful to the underlying equities, ETFs/ETNs and equity indices. If you’d like to understand how this works and how to trade to take advantage of this phenomenon, take a look at our Jay’s Options service - you can read all about it, here. It’s important. Don’t let it be all Greek to you.

In addition to the volatility caused by the roiling ball of hot plasma of opex, we also have two emotional factors at work right now, and they are:

- Hesitant bulls

- Angry bears

Hesitant bulls think that the market has been on a wild ride up of late, and don’t believe that it can really continue. They are looking to unload equity positions to reduce risk, but aren’t fully committed to doing so in case the bull train continues apace.

Angry bears are consumed with rage. They believe that the 2022 lows could and indeed should be revisited, because - well, I don’t know why they think this. Because they are positioned incorrectly; sure, but they are positioned incorrectly because they think the lows were not in at that time. Many of these folks have themselves tied up in knots about Fed policy, US economic policy, US social policy, and so on and so forth. Perhaps most of them aren’t in fact real people but are just narrative-bots sent out into the wild to scare the civilians. Anyway, from SPX3500 to almost SPX5200 is a long time to be wrong, so you can only imagine the fury amongst those of them that are in fact real.

Where hesitant bulls and angry bears coincide is in looking for the cracks in the bull run whenever there is a modest selloff, as we saw Friday last week. The week was more or less flat for the indices but the worry levels rose palpably. Despite NVDA trading at a lower multiple of cashflows than most all high growth enterprise software stocks, hesitant bulls and angry bears are convinced that NVDA is the poster child of a bubble which is getting ready to burst. And from that point of opinion they then create a cascade of fear (bulls) and vengeful joy (bears) in their own minds that has them reaching for the SELL button.

It’s possible that these folks are right, of course. If you have been watching our Inner Circle service webinars (you can find the whole archive here), you’ll know that the Nasdaq at least is bumping up against a key technical level which could mark a major market reversal. So one should not be too quick to dismiss these folks.

As always, though, my own view is, just watch price. Ignore everything else; the news, one’s own feelings and opinions about what may happen to price but which has yet to in fact happen to price; just-watch-price. Price will tell us whether markets are going up, down or sideways. For now, up is the dominant theme. There will be some gyrations into March opex and into the next trading day, as market-maker hedges are then re-set. These don’t happen in the blink of an eye. Lows are not struck nor tops established in a heartbeat. They are tested and re-tested before becoming fact. One almost always has time to react if only one allows oneself to take the time.

Below we dive into our usual charts where we walk through the S&P500, the Dow, the Russell 2000, the Nasdaq-100, and then a clutch of specialist ETFs, being SOXL (semiconductor), FNGU (tech majors) and TECL (also tech majors). Today we add SOXX as the unlevered underlying ETF for SOXL - this will be covered in all these Market On Open notes going forward.