Market On Open, Wednesday 31 July (No Paywall)

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

The Light Was Down There All Along

by Alex King

It remains to be seen whether FOMC delivers a rug pull, a moon shot or a meh. Regardless, you have to say the last 24hrs in equities have been slap-your-knee hilarious.

You can call that “oh, just ignore the volatility and ride the market up”, or you can call it “ye gods, free money from the heavens!” depending on how engaged you are with markets. Personally I missed the dump yesterday because I wandered off to do something more interesting instead, but I managed to buy the lows in reasonable size and so far have yet to be made to feel a fool with that move. As always, all such personal trades (SOXL, TMF, NVDL and TQQQ) were disclosed ahead of time in our Slack alerts system for Inner Circle subscribers.

Before we get to the charts of the matter, just a reminder that we have a price rise coming TOMORROW in our Inner Circle service. The price for new joiners rises from $2499/yr to $2999/yr, or $299/mo to $399/mo. You can sign up right here to lock in today’s price for as long as you remain a subscriber.

So Let’s Get To Work

As always in our market notes, we deal with long- and short-term charts covering the main US equity indices - that’s the S&P500, Nasdaq-100, Dow Jones-30, and the Russell 2000 - plus bonds, volatility, oil, and key sector ETFs. You can use these daily notes to help you navigate long-term investments, and/or to help you action short-term trading. Any paid-tier subscription here gets you these notes every trading day.

Short- And Medium-Term Market Analysis

US 10-Year Yield

Continuing to fall.

Equity Volatility

Relatively elevated heading into FOMC is probably a bullish look.

Disclosure: No position in Vix-based securities.

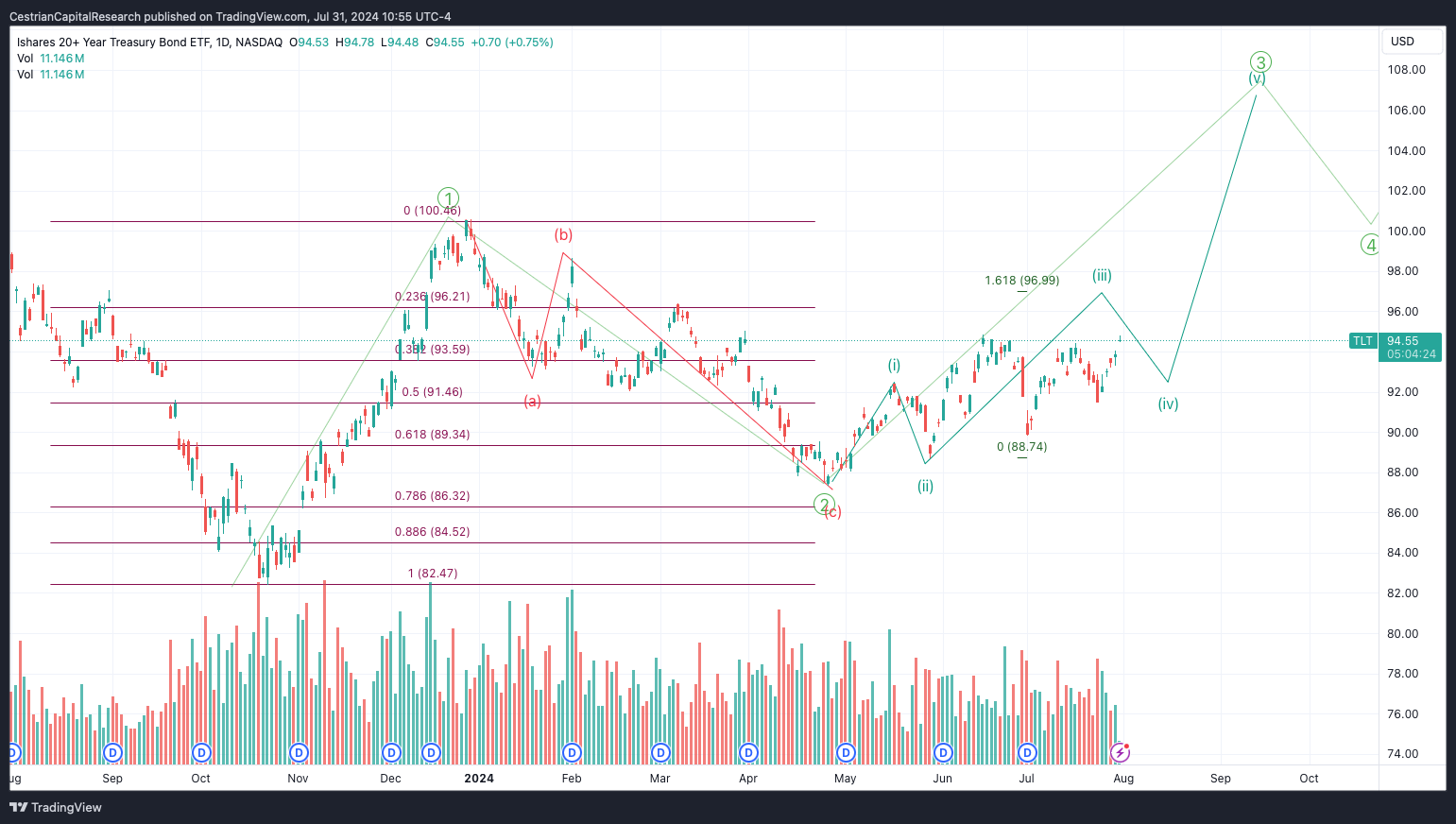

Longer-Term Treasury Bonds (TLT / TMF)

Continues to look bullish at this level of zoom.

TLT>95 and holding 95 as support, bullish. Now $94. Almost a breakout, but not yet.

A break up and over $54 and holding that level as support would be a clear bullish sign for TMF in my view. Currently $52. Not a confirmed bullish breakout until over $54 in my view.

Disclosure: I am unhedged long $TMF.

Oil (USO / WTI / UCO)

CL<72 breaks this chart. Personally I am long UCO at present; CL<72 would likely see me wind on SCO hedges.

Same commentary as USO. Has to push up and over $37 and hold it as support to prove bullish in my view. A break below $25 is bearish.

Disclosure: I am unhedged long $UCO.

S&P500 / SPY / ES / UPRO

July is green on the month at the moment; FOMC will determine August I think!

The current moonage has to retrace, I think; because either it’s a Wave (i) up, so we will get a Wave (ii) down in an overall bullish move up; or because it’s a larger b-wave and a proper dunking is coming in a c-wave. I don’t know. I do know one should be on one’s toes as regards equities right now.

I suspect UPRO has a date with $66-67, but I suspect that’s a c-wave down after a b-wave up. This is purely my opinion and should be disregarded in favor of actual price action!

Disclosure: I am unhedged long $UPRO.

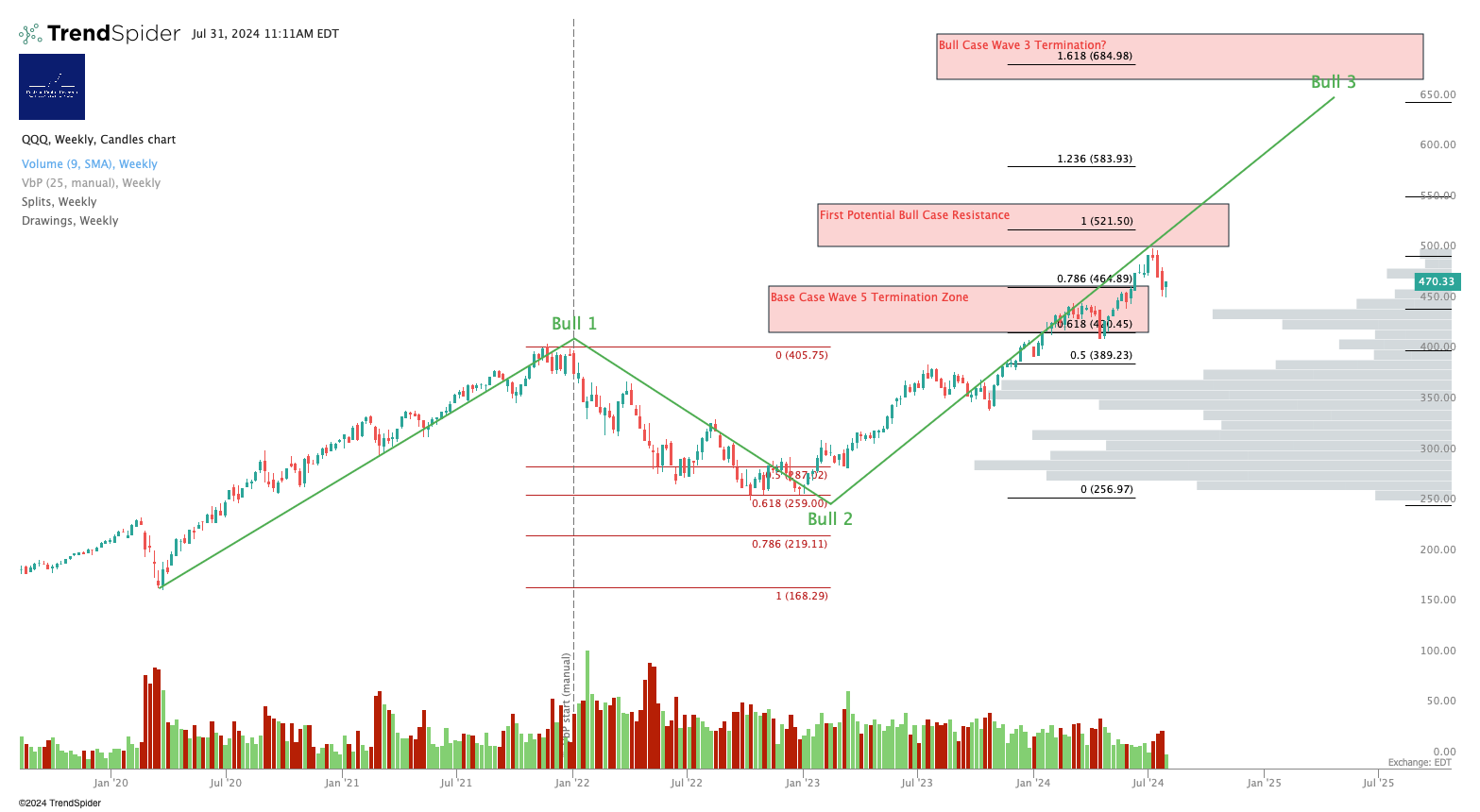

Nasdaq-100 / QQQ / NQ / TQQQ

Plenty of room to move up in my view.

Same as ES. Beware the B-Wave!

As always I prefer to trade TQQQ by watching NQ short term and QQQ long term.

Disclosure: I am unhedged long $TQQQ and unhedged long $QQQ3.

Dow Jones / DIA / YM / UDOW

Again plenty of upside I think.

Looks bullish on this timeframe.

Holding over $85, bullish.

Disclosure: No position in the Dow.

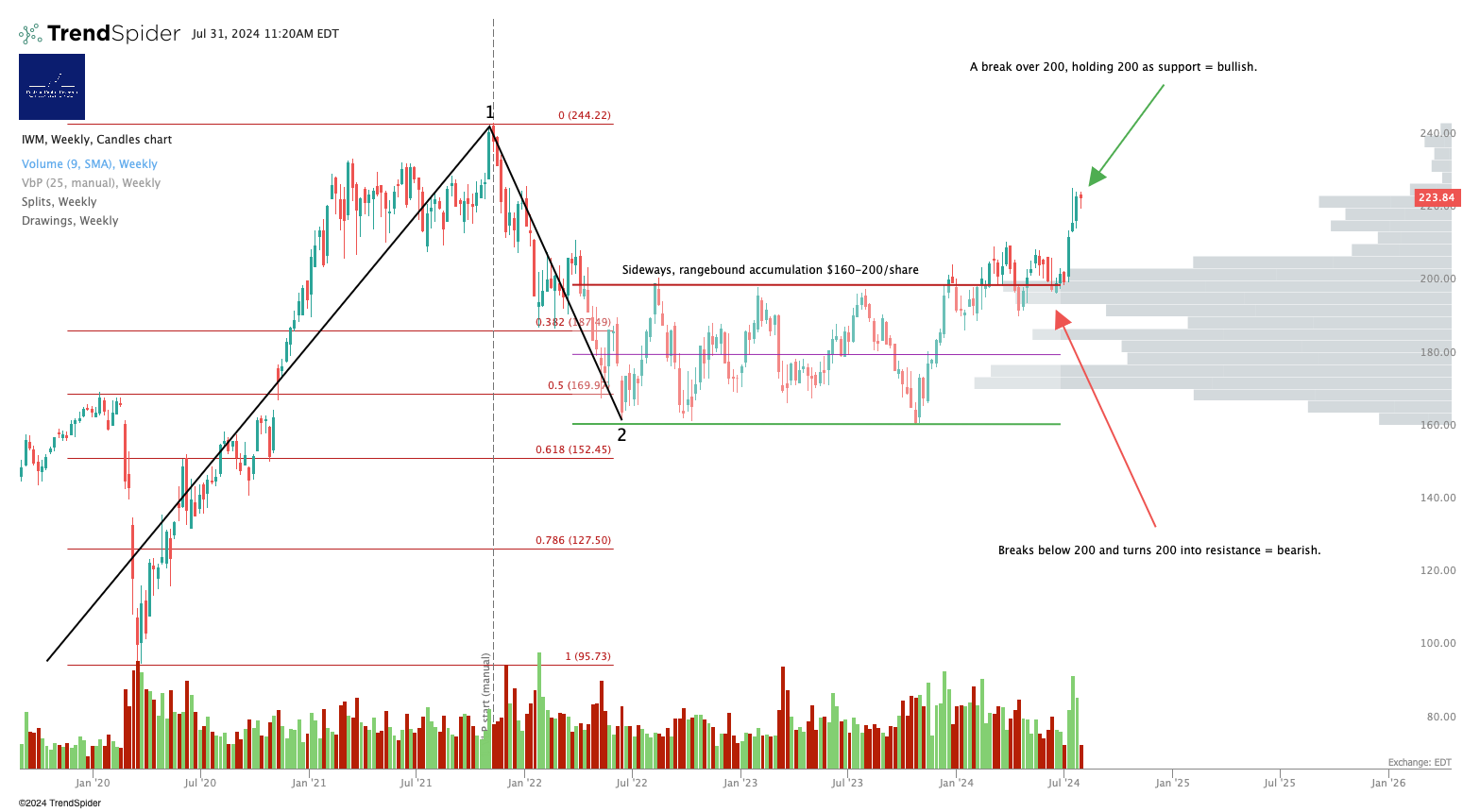

Russell 2000 / IWM / RTY / TNA

Apparently one is not allowed to call time on the smalls’ rally. That may be. Personally I think there is better risk/reward to be had owning the Qs after the dump than owning the smalls after the runup. But maybe I am just sore at missing the smalls’ moonshot!

What a c-leg down may look like.

Disclosure: No position in the Russell.

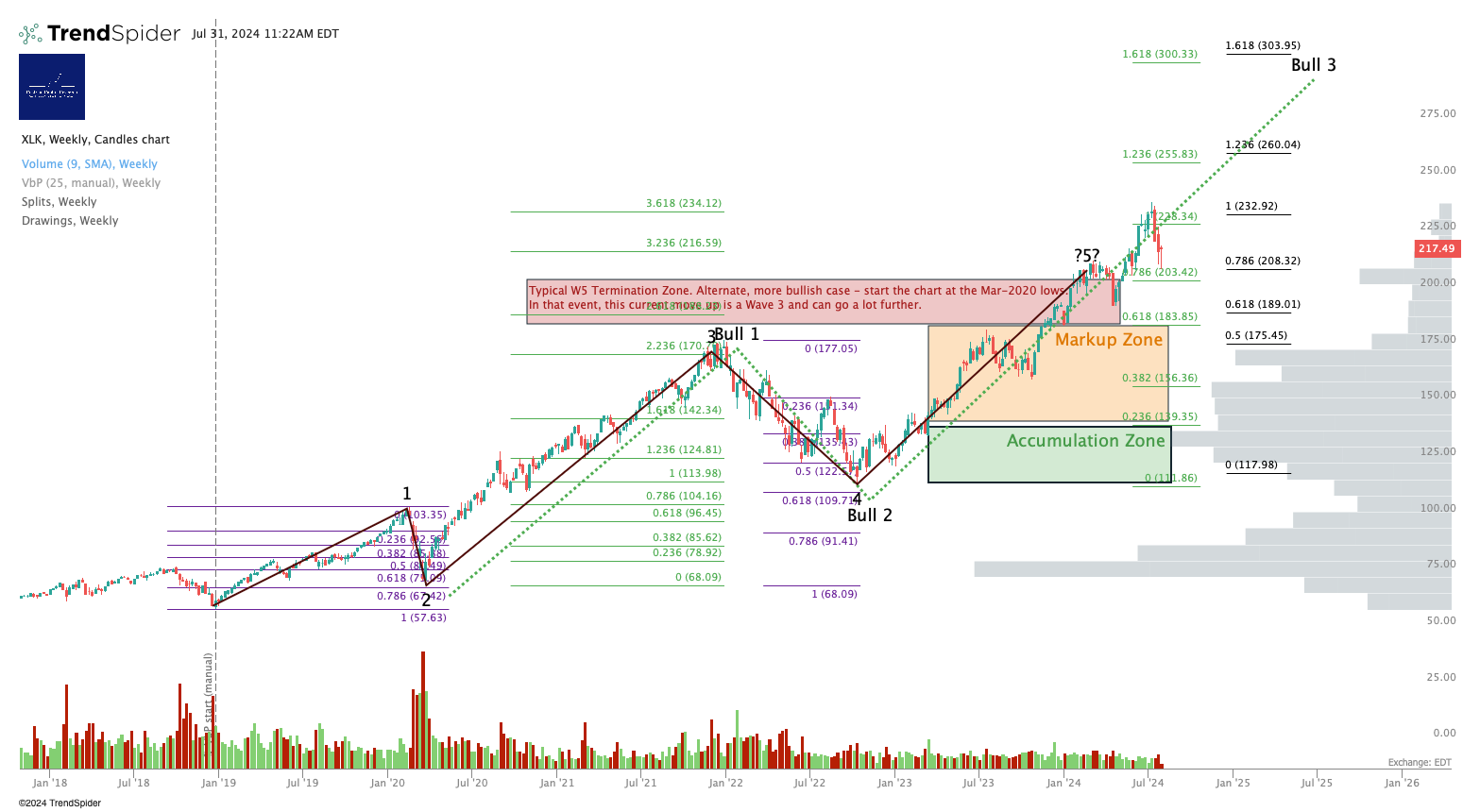

Sector ETFs

XLK can hit $260 and maybe even $300 particularly if everyone keeps falling for the Small Cap Summer ruse.

3x Levered Long XLK (Tech) - TECL

The support box held. A Wave (iii) up in TECL may follow.

Personal Trading Plan Disclosure: No position in TECL or TECS

SOXX (Semiconductor Sector ETF)

Upside to $306, downside to $207; now $231.

3x Levered Long SOXX (Semiconductor) - SOXL

A nice buy in post-market yesterday on the MSFT (bearish) and then AMD (bullish) print. Let’s see if it holds!

Disclosure: I am unhedged long SOXL.

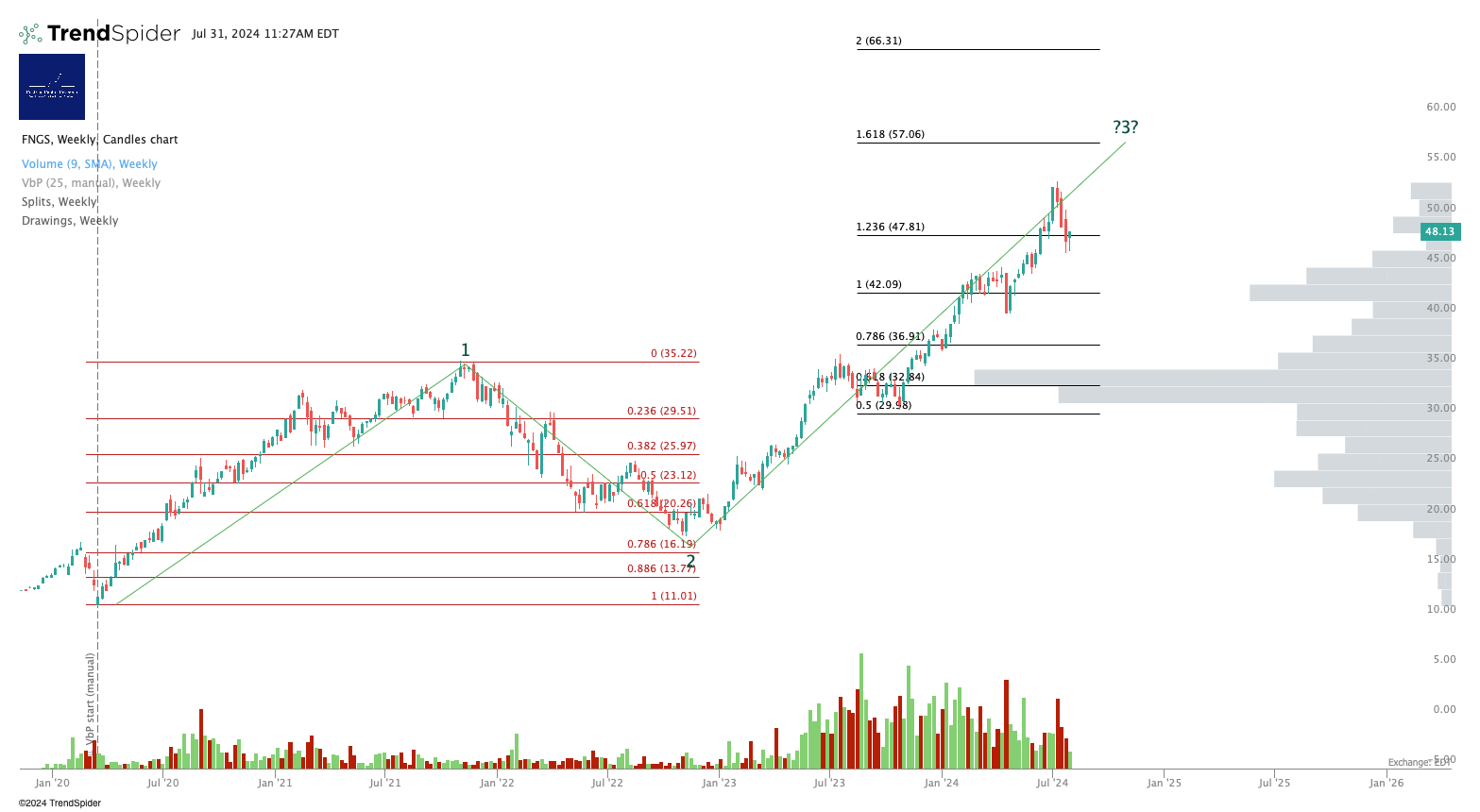

I would be surprised if $57 wasn’t hit.

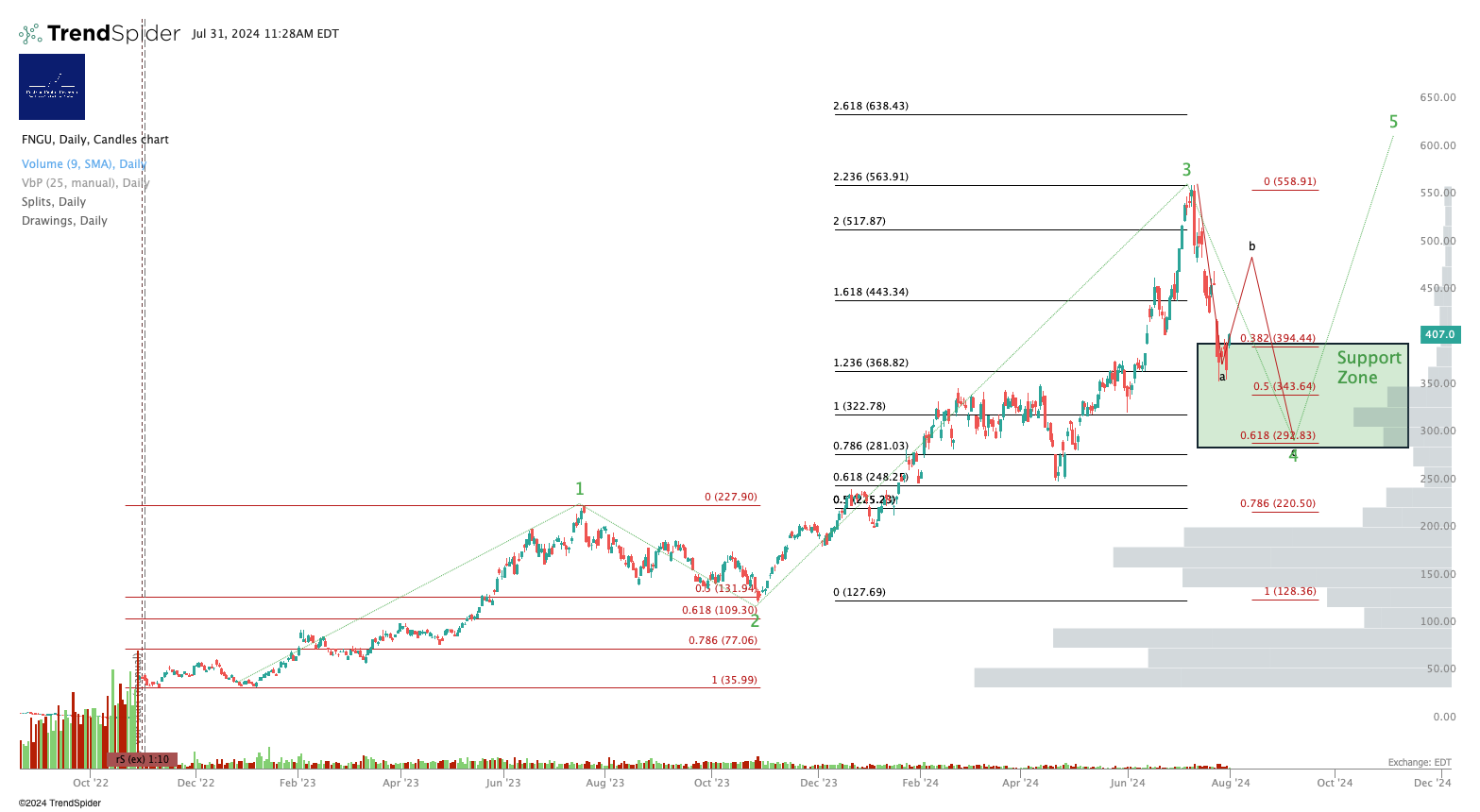

3x Levered Long Megacaps - FNGU

Here’s another illustrative a-b-c move. If this is correct we’re in the b-wave up.

Disclosure: No position in FNGS, FNGU or FNGD.

Alex King, Cestrian Capital Research, Inc - 31 July 2024 DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, TQQQ, QQQ3, UPRO, SOXL, UCO, TMF.