Market On Open - Tuesday 11 March

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

“Why Didn’t I See This Coming? Why O Why????"

by Alex King, CEO, Cestrian Capital Research, Inc

If the current market conditions have tripped you up, don’t worry, they have tripped most people up, and anyone says that they are acing it, isn’t. Bears will be bearish for too long and bulls won’t believe the selling can continue from here. The only mind virus in investing is rigidity ie. the belief that one’s own thesis will play out regardless of what the market in front of us is actually doing.

I clearly have an interest in selling subscriptions and I’m an insufficiently good marketeer to re-cast the message “please buy a subscription” in a convincing form of “we’re here to help”. But I will say that everything we do at Cestrian is designed to be market-neutral. Our approach is not to try to capitalize on bull or bear markets per se, nor to argue that one or another is in fact playing out. Our goal is to correctly identify the dominant direction of markets in the medium term and then spot counter-trend moves in the short term. And that approach means we never suffer from Investor Mind Virus. We always consider the “what if we are wrong” case. And we always explain what investors and traders can choose to do in any given market condition.

We also try to cut through narrative and focus on price. Because the reason investors fall prey to the Mind Virus is that they believe the stories that people tell themselves as to why the market is doing this or doing that. Very often these are just useful narratives which less experienced investors and traders find psychologically comforting. When in fact the simplest explanation is often the most persuasive.

So a couple things you might like to do.

First, take a look at this webinar when we hosted Alan Longbon who came to talk to us about the impact of global liquidity on risk asset prices. (Don’t forget to subscribe to our free YouTube channel by the way). Spoiler alert - global liquidity is a bigger and more important driver of risk asset prices than is any individual policy, technology shift, international power rebalancing, or anything else.

Secondly, allow us to help you in your investing and trading endeavors. We get things wrong all the time of course, but one thing I can say with confidence is that whatever your level of experience, you’ll be able to raise your game as part of our community. If you’re a longtime pro, we’ll bring you new tools, methods and ideas. If you’re earlier in your investing career, we’ll help you master the core principles. (You see? Here to help!)

Technical Analysis Services

- Long/short e-mini futures, here

- Long/short ETFs and options, here

- Long/short Nasdaq, S&P, Dow, Bonds and Semiconductor, plus 80+ stocks under coverage, personal account trade alerts plus daily long form market analysis, live chat and weekly live webinars, here.

Quantitative Analysis Services

OK - so let’s get into the weeds.

Short- And Medium-Term Market Analysis

If you want this daily dose of pattern recognition, and you aren’t yet a subscriber of course, you can read about and choose from all the subscription services that include this note, here.

Note - if you’re a free member here and thinking about joining our lower-cost Market Insight service, it’s a good idea to do so sooner rather than later. We’re going to be restructuring it for new subscribers so that it is split up into market analysis and earnings analysis, and we’ll be ramping up prices as a result. There will be no change for anyone who is a subscriber prior to the restructuring & price increase. So if you’ve been thinking about joining it, consider doing so now. (If you’re an Inner Circle or RIA Insight Pro service member, you can ignore this - you don’t need Market Insight as you get all that content in your existing subscription).

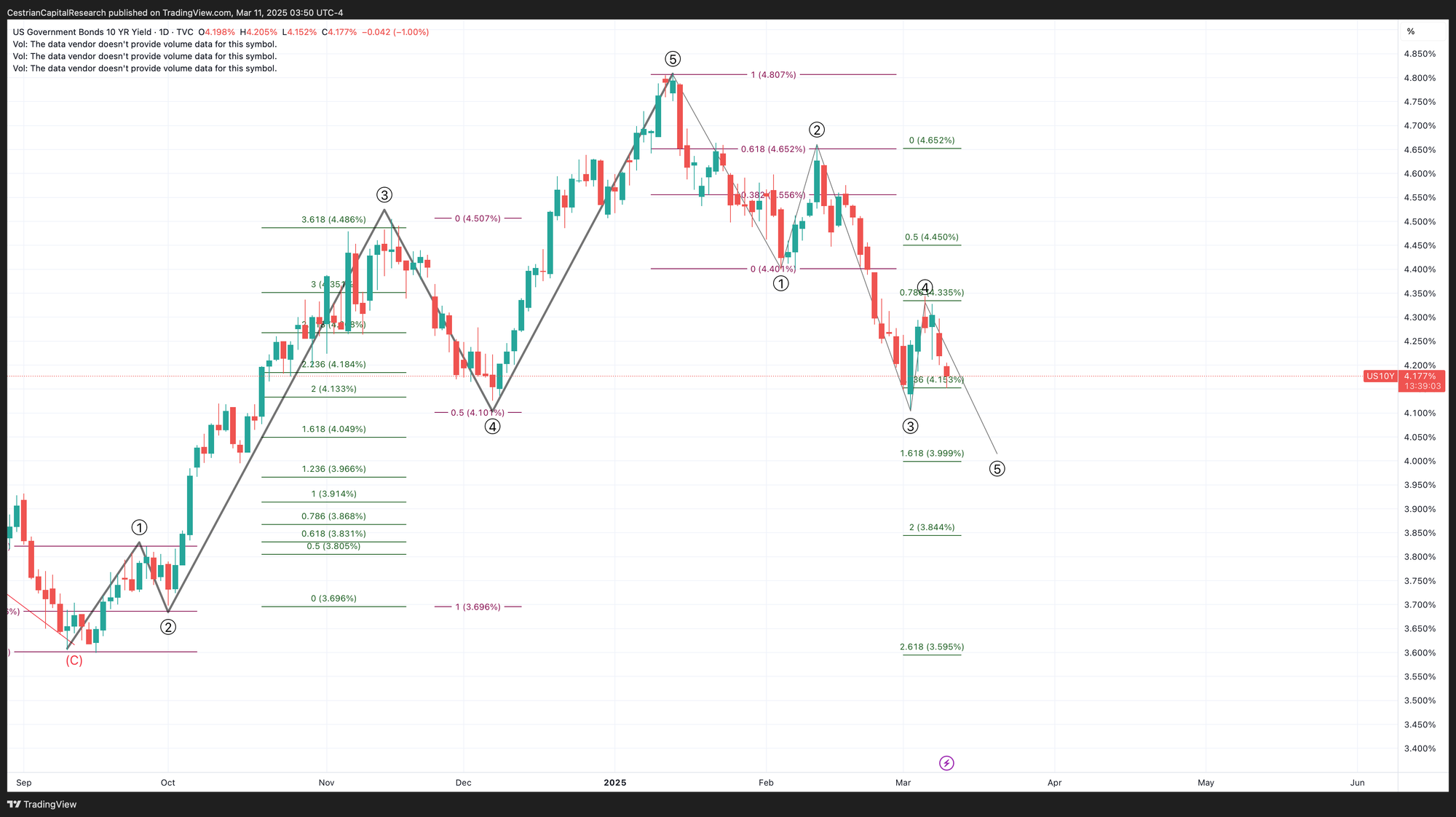

US 10-Year Yield

So far the yield has followed a potential 5-waves-down path nicely. Anyone who has been listening to what the Administration has been saying will know that lower yields and higher government bond prices are their priority. They have said this multiple times. They have not said they are particularly looking to support equities. Sometimes the easiest way to interpret things is to take them at face value.

Equity Volatility

Equity investors are now more alarmed than during the DeepSeekMageddon incident, but less alarmed than during the August 2024 YenMageddon crisis. Vix up means demand for S&P500 puts with >30 days to expiry. I myself think this is setting up for a potential reversal around the 3/21 Q1 options expiry but we shall see. Usually a Vix this elevated sees a “vol crush” at some point, to the benefit of equities - that has yet to happen.

Disclosure: No position in volatility-linked securities.