Market On Open, Thursday 20 March

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

It All Comes Down To Opex

by Alex King, CEO, Cestrian Capital Research, Inc

One of this week’s major catalysts, the FOMC decision and press conference, is now behind us. This was, in my view, a masterclass by Chairman Powell. If you cut through the noise he said:

- Trade policy is unclear and so the direction of the economy is unclear

- Tariffs tend to be pro-inflation and anti-growth but any such impact is likely to be transitory

- We have to hold rates where they are because of the above, but to cut everyone some slack we will ease monetary policy by way of all-but-stopping QT.

This is as close to a sensible critique of the Administration’s economic policy as you will find. What Powell is saying is, if there is a sensible set of tariffs in place and they remain in place at not too punitive a level, then the economy can deal with it after a re-adjustment period. The Fed isn’t taking a religious position on the for-or-against tariffs question, which I think is a sensible line. Tariffs exist all around the world all the time and they don’t in and of themselves kill economic growth nor are they structurally inflationary if set at a sensible and stable level. I continue to believe that the market can absorb the impact of tariffs and still move up, once the presumably-sensible levels are set in place.

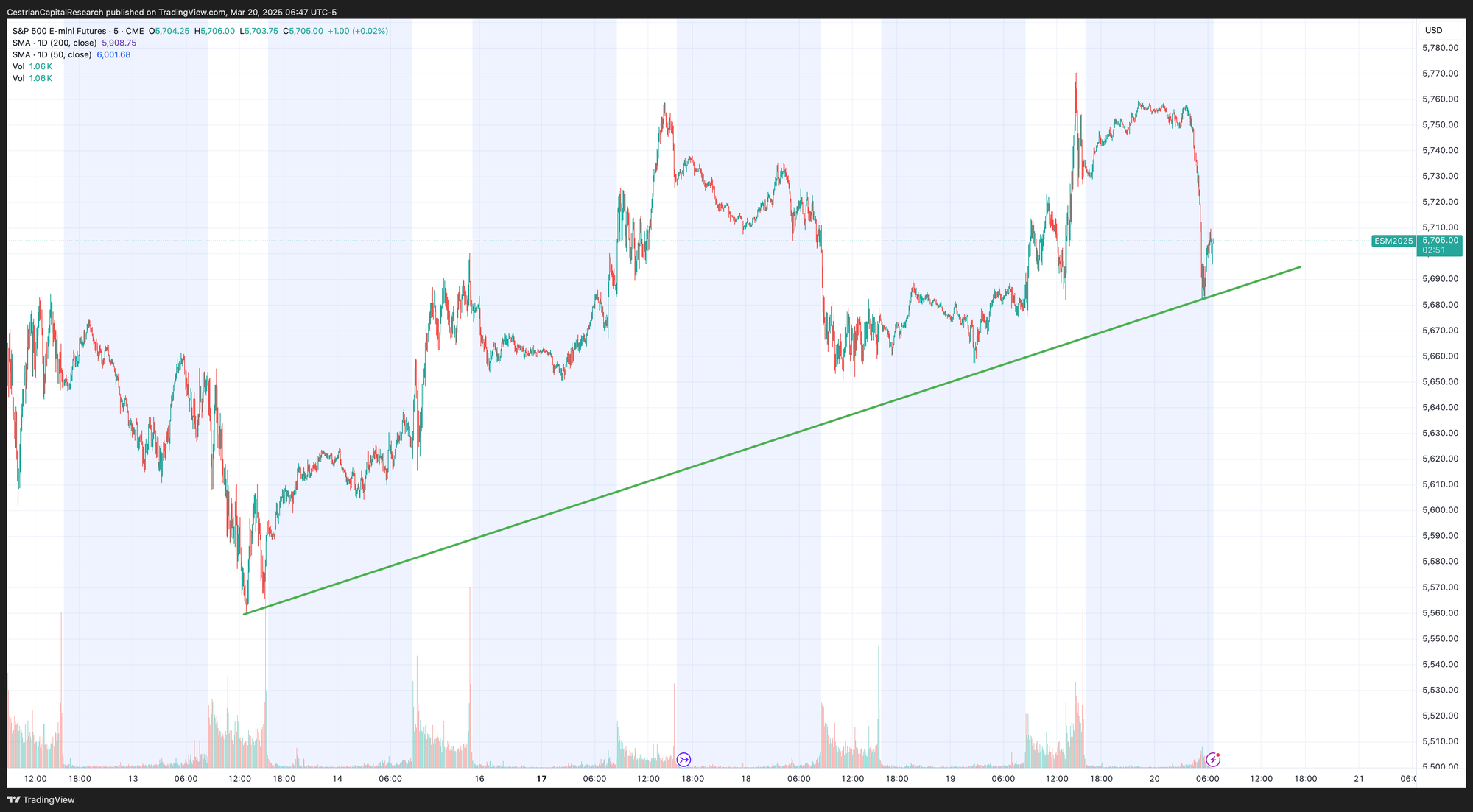

The market response to Powell was initially bullish although not wildly so - the highs of Tuesday were not breached on Wednesday. There is some weakness in the pre-market session but nothing ruinous so far. Here’s S&P500 e-mini futures (ES) for instance.

Holding the uptrend from last week’s low.

The bull vs. bear fight though lies above this level, at the 200-day moving average, which all three major equity indices remain below. Dow futures / ETFs put their heads over the 200-day parapet in early trading today but were shot at by bears and have ducked back down for now.

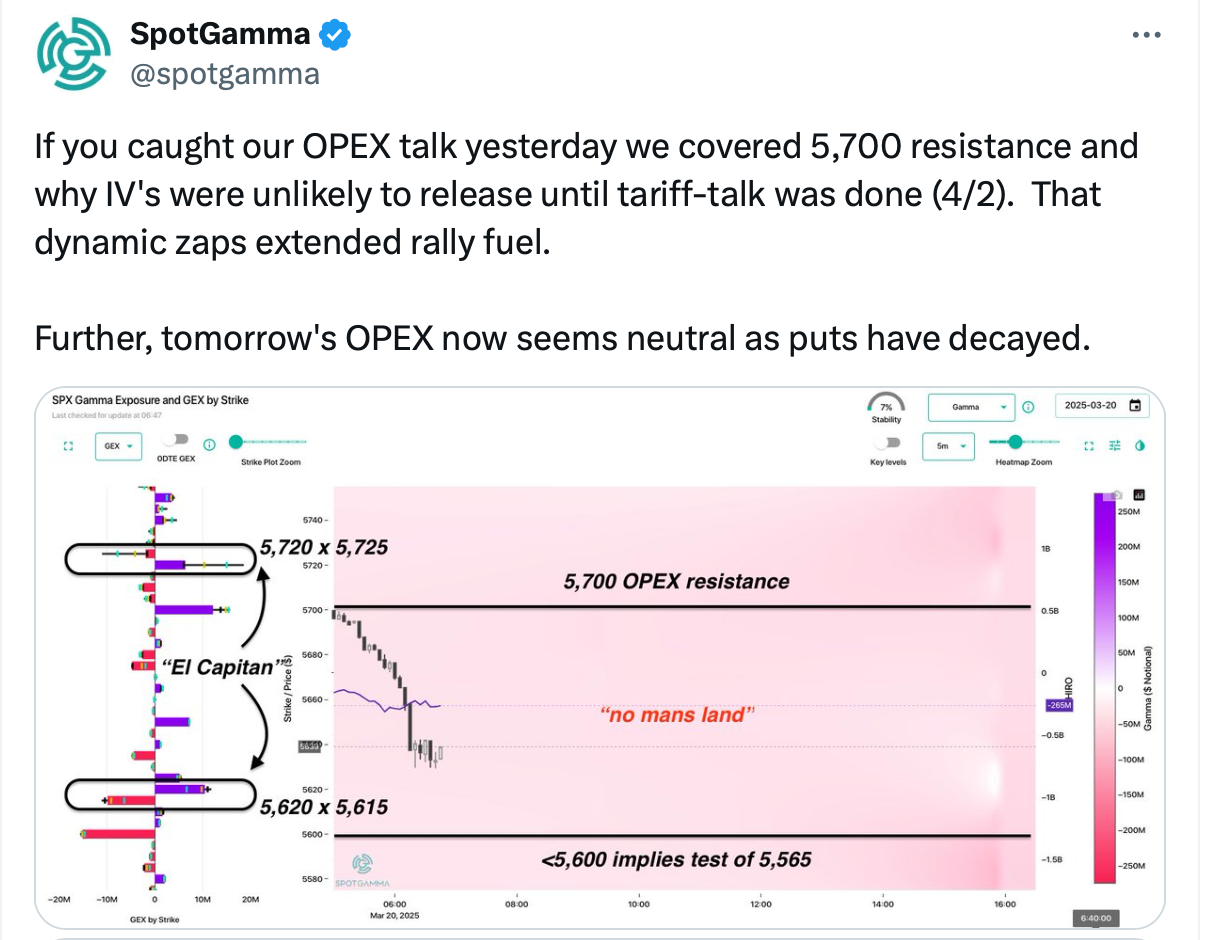

If the market is to regain its confidence then the last major catalyst remaining this quarter is options expiry tomorrow. There is what is professionally known as a Yuge Amount Of Options expiring and my guess would be that the preponderance of them will be puts, so spooked have been investors of late. As per Q1 2020 and Q1 2009 and indeed Q4 2018 that sets the scene for a possible rebound caused by dealer re-hedging flows. (If this is all Greeks to you then I suggest you check out the good folks at SpotGamma who taught me this stuff).

So let’s check in to see where we stand. Here’s the latest from SpotGamma by the way.

So - direction from here is unclear I would say. My guess is we see at least a relief rally but I am far from certain there is enough oomph to get up and over the 200-days.

Before we get into the weeds here, a word from the machines:

Get A Robot Buddy

If I can point you to two simple tools that I think can improve anyone’s investing and trading, it is these:

- All investors & traders: To get a machine’s reading on when the market is likely entering a period of weakness, and when entering a period of strength, SignalFlow AI is our quant service. It went from long Nasdaq to cash on 2/25 by the way. Which was a righteous call.

- Registered Investment Advisers: To get that same machine risk on/risk off call in the S&P500, and then a further quantitative assessment of which are the top 3 sector ETFs to hold - this all geared to help you grow client assets under management - take a look here:

Please note that our RIA service pricing will rise from $2k/yr right now to $3k/yr on 31 March - as always our price rises apply only to new members. So if you have been thinking of signing up, now’s a great time. You can reach me personally at alex.king@cestriancapital.com if you’d like to discuss the RIA service.

And with that - let’s get to work.

Short- And Medium-Term Market Analysis

If you want this daily dose of pattern recognition, and you aren’t yet a subscriber of course, you can read about and choose from all the subscription services that include this note, here.

US 10-Year Yield

Equity Volatility

Still no true vol crush. This means as yet no outright bullishness at this stage in equities.

Disclosure: No position in volatility-linked securities.