Market When Closed, Sunday 23 February

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Opex Be Like That Tho

by Alex King, CEO, Cestrian Capital Research, Inc

OK, so, today’s exam question:

Why did the market self-immolate itself on Friday?

- Because the economy

- Because politics

- Because bats

Well, it could be any of those things but in my humble opinion the primary reason was a call-heavy monthly options expiry. To simplify for dramatic effect, when an options expiry date coincides with a period of bullish sentiment it is often the case that investors have been buying call options in size. The market makers creating and selling those options have to remain ‘delta-neutral’ meaning their book value has to be independent of price movements in the underlying equities. So as they sell calls (which is bearish) they have to buy stocks or futures (bullish) to render the book delta neutral. As those calls expire, the bearish side of the book evaporates leaving only the bullish side remaining. The bullish side has to be sold down to return the book to a market-neutral position. That means futures and stocks have to be sold; selling can beget more selling, particularly in a market that is a little jumpy, and before you know hit you have SPY down 2% on the day.

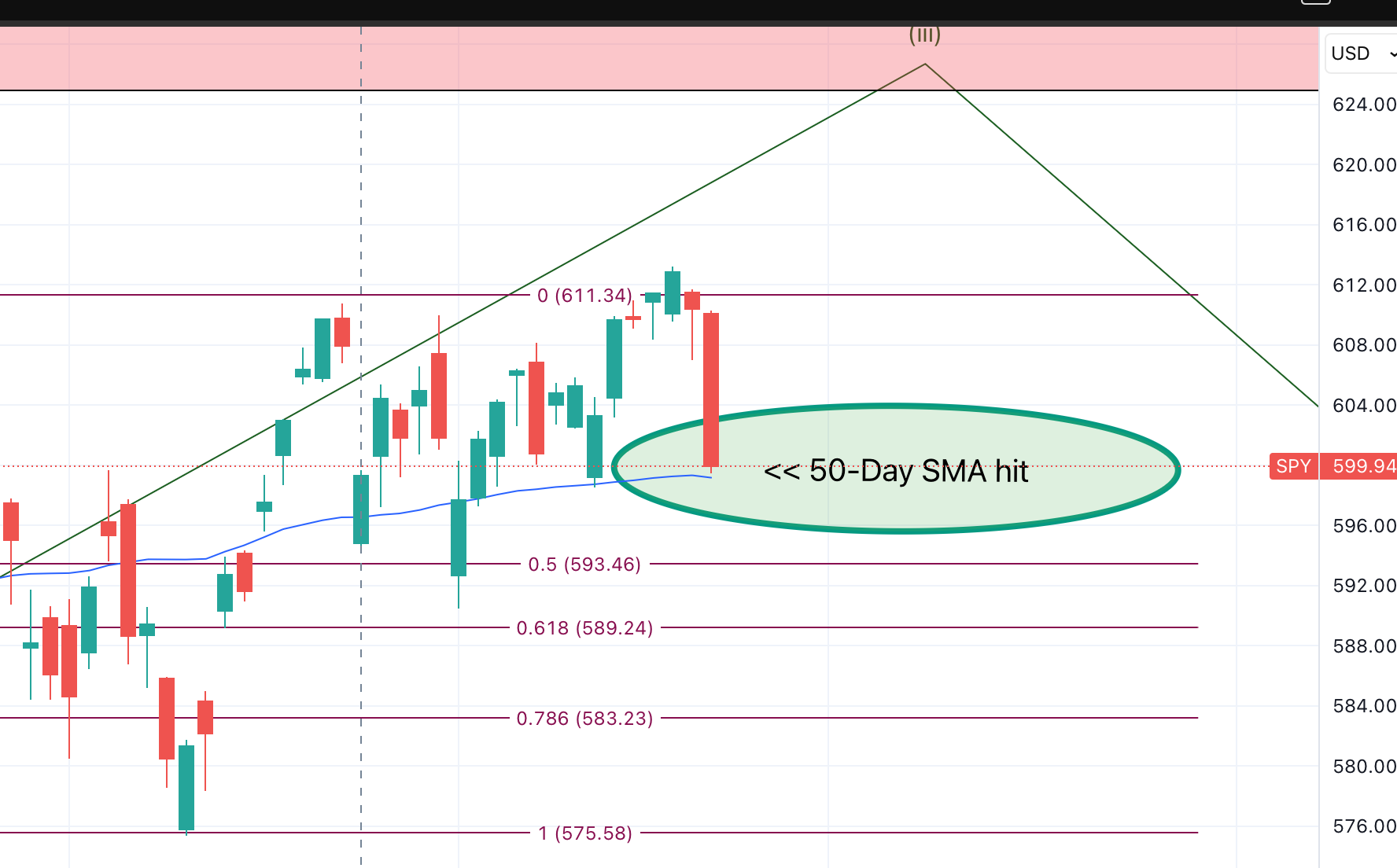

Friday, $SPY touched the 50-day simple moving average and held over it.

If that holds? We can expect Monday to be bullish. Gives way? Look out below, for many algorithmic sell programs are always set to sell below the 50-day.

Now, if you had played your hedging methods correctly, Friday was a superb day, because your hedges would have made you money. And if you were brave and actually sold them and/or put sell-stop-loss orders under them to lock in profits, well, we’ll know Monday whether that was a good idea or not - but if it wasn’t wise, you can always re-hedge.

Want to know who was punching the air Friday? The good people in our Trading Gains service, that’s who. This is a long/short ETF trade ideas service that I’m delighted we host. You can read all about it, and take a 7 day free trial, here:

Now, let’s get into it.

Short- And Medium-Term Market Analysis

If you want this daily dose of pattern recognition, and you aren’t yet a subscriber of course, you can read about and choose from all the subscription services that include this note, here.