Market On Open, Thursday 17 April

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Breathe. Focus. Breathe.

by Alex King, CEO, Cestrian Capital Research, Inc

As everyone knows, the only sensible emotion right now as regards markets is FEAR. BIG OLE FEAR. Because - well, if I need to spell that out then you haven’t been paying attention.

As always though, emotion is of no use whatsoever when it comes to investing and trading. Since the purpose of the gut/brain axis is to cause you to flee, and fast, at the sight of impending danger - charging woolly mammoth, trade war, whatever - it’s not very helpful when it comes to making money. Because you won’t see the danger at the top - you’ll stick around for the decline - and by the time the fear is overwhelming and you finally bolt, it’s probably near the bottom. Rational analysis may not be of much use when it comes to Jurassic(*) threats but it is of great value as regards securities markets. The patterns in securities markets are designed to inspire fear and greed at the exact inverse of the time those emotions would be useful. That is the job of a market-maker; induce greed so that you buy what they are selling, and induce fear so you sell what they are buying. Don’t like it? Don’t play, for those are the rules of the game. Your counter is not bravery or foolhardiness but cold, hard analysis. Technical analysis of price patterns and fundamental analysis of company financials. These disciplines together plus a commitment to a calm and emotionless approach to markets remain the superpowers that any committed investor requires.

Taiwan Semiconductor Manufacturing Co reported earnings today before the New York open. $TSM is in the crosshairs of, oh, everyone. The US, because it is the pre-eminent manufacturer of advanced semiconductor devices and yet it is based in, you guessed it, Taiwan. Which is not the US. And China, because it is the pre-eminent manufacturer of advanced semiconductor devices and yet it is based in, er, Taiwan. Which is not China. Unless you ask China, in which case it is China. So the US wants this company to make its stuff in the US - and TSM is investing hard in the US to do so - and China wants this company to make its stuff in China, which may get resolved by Taiwan becoming, well, China. That makes for some pretty interesting board meetings I would think.

Here’s the thing. The company reported very strong earnings and guidance, and though I assume there is some pull-forward revenue in the guide to try to dodge whatever tariff grenade ends up going off in their faces, the strength of the guide is at a level where I don’t think all the benefit is pull-forward demand. Remarkable. The stock chart is also putting in a bullish setup, which of course it shouldn’t be. You can read our analysis of $TSM earnings, here:

So I don’t know where Trade Wars 2.0 settles, I’m not sure anyone does. And my own gut needs a talking to from time to time. But I do know that the reality of company performance - and, as you will see below, stock charts - is looking a lot more constructive than anyone feels right now.

(*) I look forward to the flurry of corrections from fossil wonks stating the precise geological period in which Woolly Mammoths in fact lived.

Emotional Rescue

Our SignalFlow AI family of quantitative signal services are the best antidote to Microbiome Investing that I have yet found.

Here’s three testimonials we received after the current market turmoil began.

- "I am wildly thrilled with SignalFlow AI for $SPY! I have been following the signals and moved almost completely to cash with the most recent change to risk off. Absolutely incredible for me, mentally and financially. Thanks so much to the team for developing this service.” - April 2025

- “The long/short service paid for itself in one day overnight by the way! Thankyou.” - April 2025

- “Rather than a day that could have ruined the weekend, I was able to watch the market tank knowing that I had the knowledge to weather the storm and come out far ahead.” - April 2025

The latest SignalFlow service provides long/short signals for the S&P500 and Nasdaq-100. This is a very easy to use service running on a quantitative model; complex below the waterline, simple above it. This is pure machine logic driven by price alone, not by the news, not by narrative, not by fear or greed.

Please do take a moment to read about what I believe to be a truly excellent family of services - here.

Short- And Medium-Term Market Analysis

If you want this daily dose of pattern recognition, and you aren’t yet a subscriber of course, you can read about and choose from all the subscription services that include this note, here.

US 10-Year Yield

Possible path lower (I believe lower is the dominant trend in the 10yr, with moves up being counter-trend rallies).

Equity Volatility

Thinking about another move up I would say.

Disclosure: No position in volatility-linked securities.

Now, for our paying subscribers we move on to bonds, the S&P500, the Nasdaq, the Dow, and key sectors.

Longer-Term Treasury Bonds (TLT / TMF)

Due a pullback would be my guess. That’s not necessarily negative on a longer timeframe.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

I know it’s all over for Treasuries &c but …. that doesn’t look like selling by bigs down here. It looks more like buying. Prove me wrong.

Disclosure: I am unhedged long $TLT and similar EU UCITS ETFs.

Bitcoin

In some ways it’s easy to overcomplicate Bitcoin. It’s a pure risk asset which moves up according to (i) global liquidity ie. how much cheap money is available to dump into scary things and (ii) the desire for people to bet on - er, I mean invest in - things outside their parents’ financial world.

Yesterday equity markets were like, ALL IS LOST, ABANDON HOPE ALL YE WHO COME HERE. But Bitcoin was up. Not much, but up. On a day when the Chairman of the Federal Reserve was issuing not-very-deeply-coded messages about Smoot-Hawley and the Great Depression and the Executive Branch was telling Nvidia that they were going to have to stop selling its China-specific stuff to, er, China. And in the middle of this mano a mano standoff? Bitcoin was up. And it’s thinking about getting up and over the 50-day moving average. And its 200-day moving average, whilst above still, remains upward-sloping. This is all much more bullish than it "should be".

Disclosure - I am long $IBIT personally.

Now read this on Bitcoin. NOTE we will be launching a Bitcoin-specific service soon - we’ll let you know when it’s live.

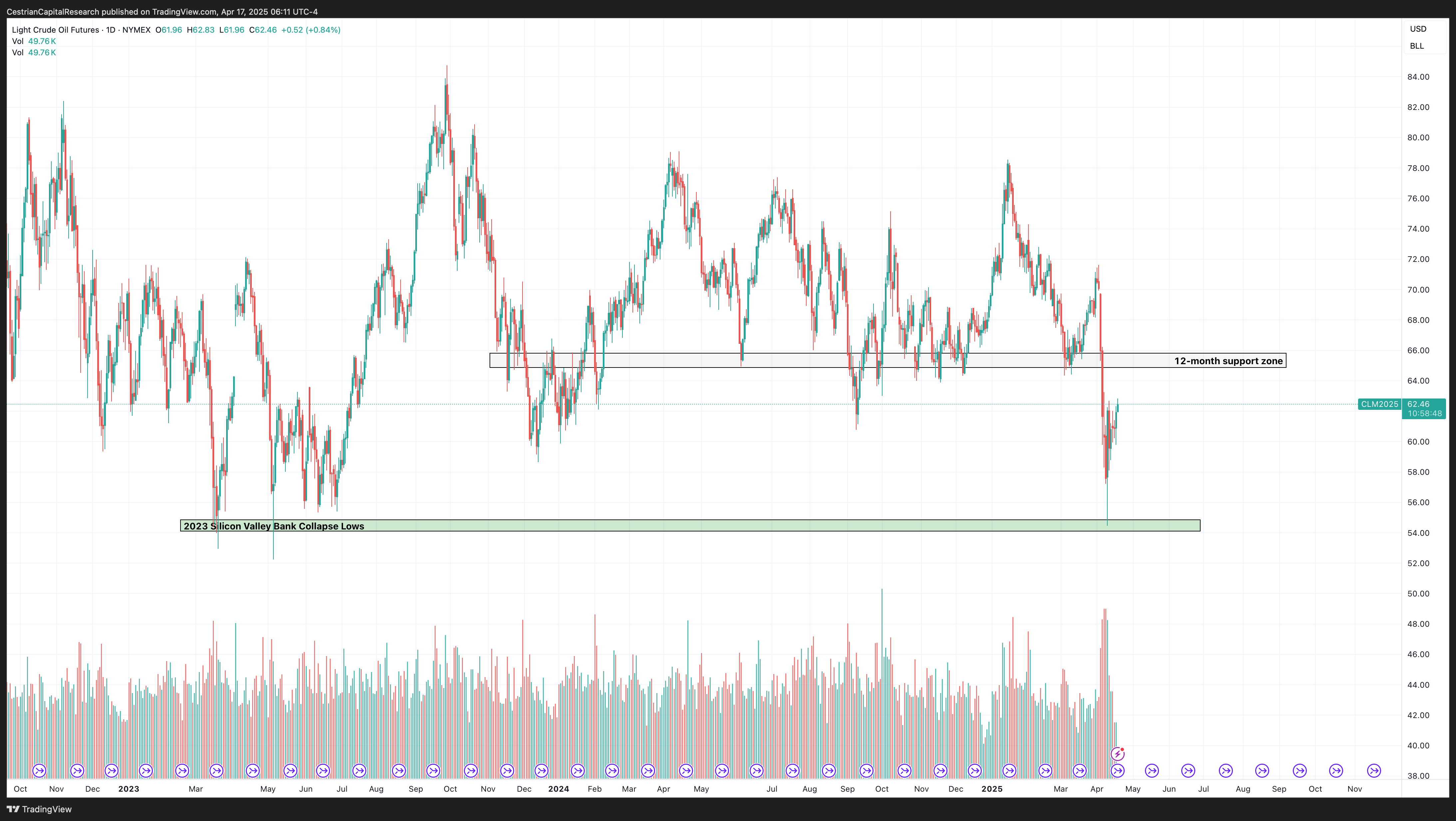

Oil (USO / WTI / UCO)

Prior to Tariff Bomb a couple weeks ago, oil was in a wedge formation making higher lows and flat highs. Price looks to me like it is thinking about getting back into that pattern. USO is sat at $67 right now; $70 puts it back where it was.

A different way of viewing the same issue:

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Much like TMF I think there is some bigs’ buying going on down here.

Disclosure: I am unhedged long $USO.

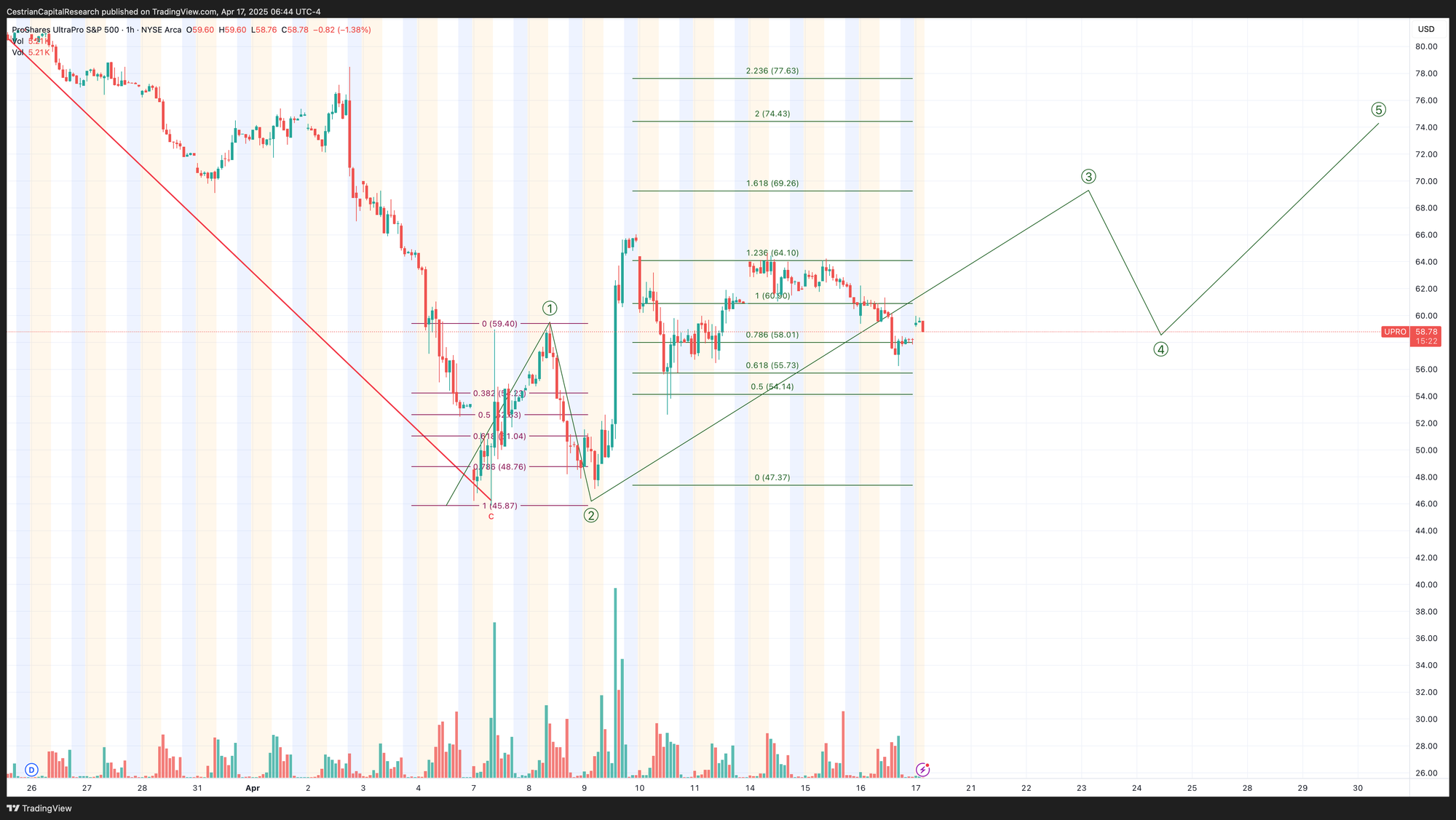

S&P500 / SPY / ES / UPRO

Since nothing matters right now except Money vs. Ideas, here’s where ES stands between Peak Ideas and Peak Money.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Of course there could be a new low below the 6/7 April dump. Of course there could. But a lot of charts suggest that is unlikely. UPRO is one of them.

Disclosure: I am unhedged long $UPRO.

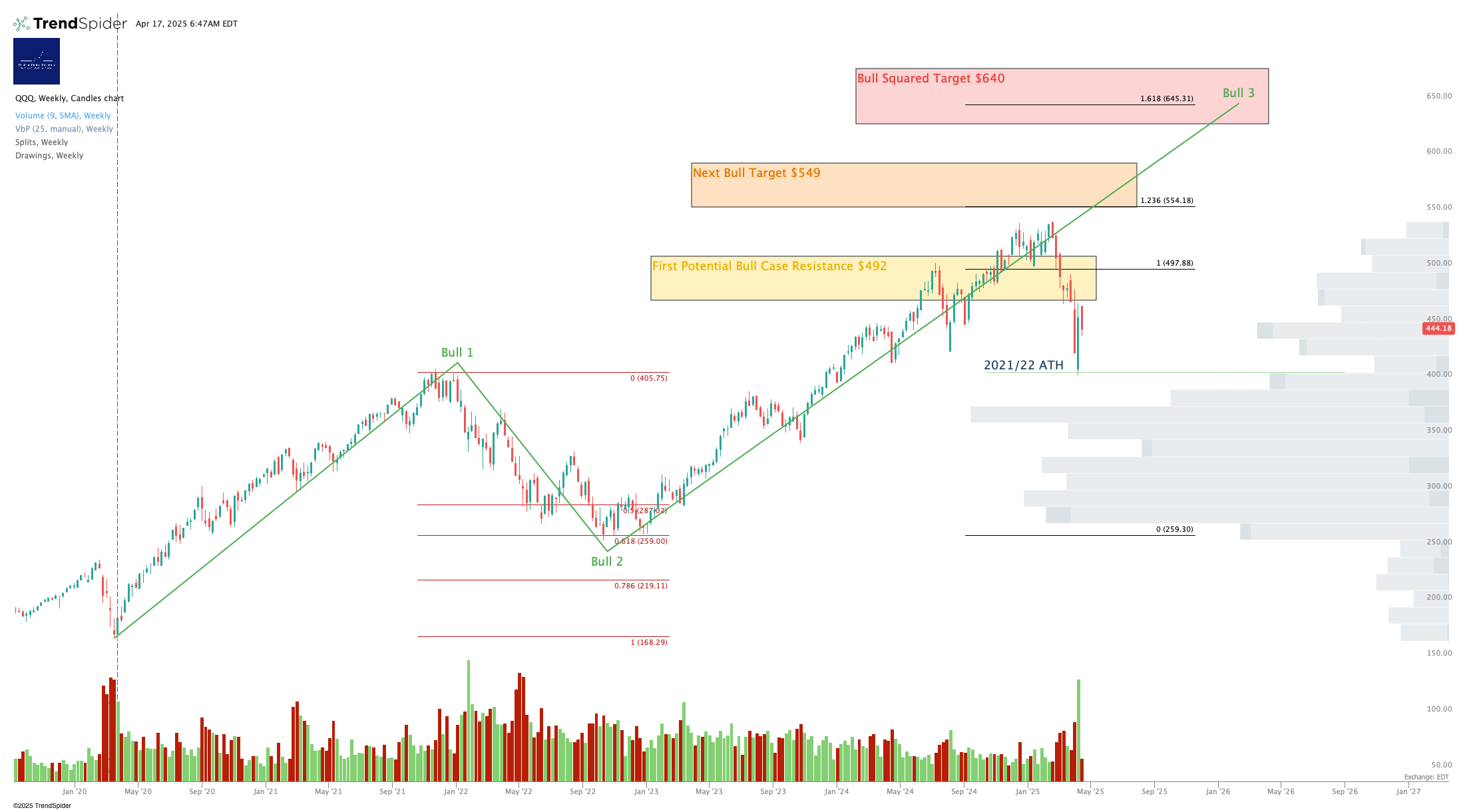

Nasdaq-100 / QQQ / NQ / TQQQ

A different take. Again it looks like QQQ wants to hold over the April 6/7 lows & is waiting for not-terrible news about tariffs. I continue to believe that any set-in-stone sensible tariff regime now will catalyze markets higher.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Same story as QQQ I think.

Disclosure: I am hedged long $TQQQ / long $PSQ - overall net long the Nasdaq.

Dow Jones / DIA / YM / UDOW

United Healthcare ($UNH) has dealt a severe blow to the Dow’s health today but even with that, the setup looks, dare I say it, bullish.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Disclosure: No position in the Dow.

Sector ETFs

You can see this bounce from space. It’s just unclear whether it’s a dead-cat variety and if it is a dead cat whether it was Schrodinger’s or not.

3x Levered Long XLK (Tech) - TECL

Note - TECL and its inverse TECS tend to be illiquid outside RTH with relatively wide bid/ask spreads.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

If I were brave and/or foolhardy I might be tempted to be long TECL. As it is I dislike the lack of liquidity in this name and know that if you need to get out in a hurry you will have some problems, so, I am sitting back.

Disclosure: No position in TECL or TECS

Semiconductor

SOXX (Semiconductor Sector ETF)

Again support held at the start of the high volume nodes. This is what the start of bull markets look like. I don’t know if this moons or dumps from here but I am saying that since everyone is Eeyoreish everywhere you look … that is also a reasonable precondition of a new bull move.

3x Levered Long SOXX (Semiconductor) - SOXL

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Who is selling down here?

Disclosure: I am unhedged long $SOXL

Alex King, Cestrian Capital Research, Inc - 17 April 2025.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, TQQQ, PSQ, UPRO, SOXL, TLT, USO, DTLA.