Market On Open, Thursday 13 June

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

It Was The Purple Tie

by Alex King

As everyone knows, there is no point doing all this fancy analysis fandango when it comes to FOMC days. Chairman Powell dons the purple tie? Boomage. Simples.

Well, that was the case yesterday. CPI came in light - 0% month on month, so inflation is no longer a thing of course; and then the post-FOMC press conference did nothing to persuade anyone to dump. The whole day was very strange in fact, no spike in the Vix beforehand (see yesterday’s market note where we commented extensively on this before the open), a big move up on the CPI print (OK, to be expected) but then no dump either during or, as is more common, after the Powell speech. Personally I snagged a few short gains between Powell finishing his speech and the market close, but I was too chicken to fully hedge out (being fearful of trapped shorts in this bully-o-bull market) so, having opened only 1:10 short:long hedges I merely chalked up some small-money gains. But gains are gains, particularly on the short side on a big green day, so I am not complaining. Longs obviously took care of themselves.

Personally I took some profits in the day on oil too, and opened a new position in $AAPB (a structured product designed to deliver 2x daily AAPL performance) which quickly mooned. Up over 10% on the day at one point!

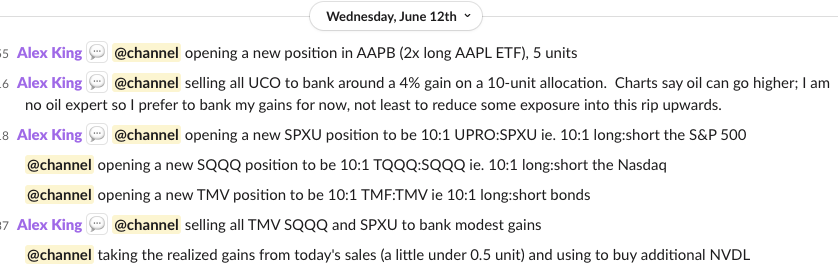

Here’s the log of disclosure alerts through the day yesterday as sent - before each trade was placed - to our Cestrian Inner Circle service members.

Anyway, today is a new day. Our charts below take a look at how equities, bonds, oil, volatility and sector ETFs are looking after the free-money-bonanza day. Will there be a hangover, regret, and a retracement-of-shame today? Or are there still drinks in the back of the cabinet to be raided?

Read on!