Will Semiconductors Get Hit In Q3? Market On Open, Monday 24 June

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

A New Dawn

by Alex King

Welcome to Q3. Yup, not quite calendar Q3 but we’re over the major Q2 options expiry hump now and so to all intents and purposes, the new quarter is upon us. This is a time to look for changes in the market; 30 June will mark the half-year point for institutional investors, who will be reporting on their portfolios and praising or chastising their portfolio managers accordingly. The game is then, don’t not outperform in Q3, regardless of how you did in Q2. And what this means is that rotation may be upon us - capital flowing out of the names that propelled the market in Q2, and into new names with upside opportunity into Q3.

Speaking personally I don’t expect the overall indices to drop back from here by 2024 year end - indeed I think we will finish the year higher than here - but it’s always possible to see sector rotation cause a drop in single-stock and ETF names in the sectors that are providing a source of funds for such a rotation.

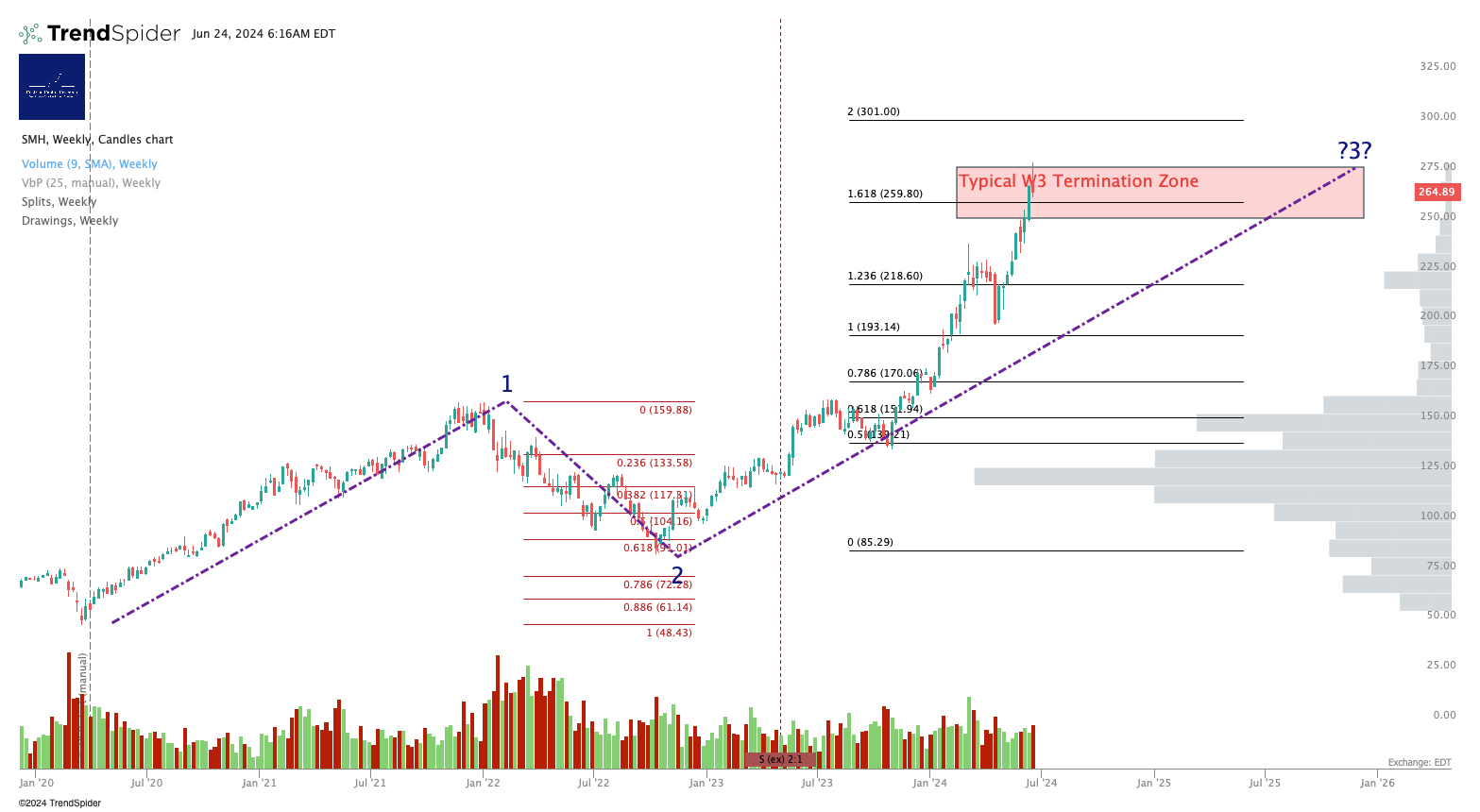

Chief candidate as a source of funds heading into Q3 has to be semiconductor I think. Here’s $SMH (which is heavily weighted towards $NVDA - 20% of holdings as of 21 June 2024).

(You can open a full-page version of this chart, here).

Wave Threes can go way higher than a 1.618 extension, but that’s an extension of an already-big Wave 1, so there is risk here.

Here’s $SOXX which is more evenly balanced among semiconductor stocks - 8.7% NVDA as of last week. You can open a full-page version of this chart, here.

$SOXX is yet to hit that 1.618 extension, and I think it’s because of that more balanced distribution between the underlying names. So if Micron ($MU) and/or $AMD start to see capital inflows, $SOXX probably won’t be as badly punished as $SMH and it could even push up to that 1.618 extension before rolling over.

But.

If you own semiconductor ETFs and/or stocks, particularly the leveraged kind, it’s time to consider taking gains if you follow market rotation logic, if only due to the recent vertical runup in $NVDA. Will $NVDA be higher than here at year end? My own view is yes. Could it take a beating into say the end of October? I believe it could. So timing - and leverage - matters.

Recent bulls piling into $NVDL, which I hear is a retail favorite, may find out what being on the wrong side of a levered ETF feels like; most probably won’t be set up to think about hedging with $NVDS. $SOXX is down from its all time highs and it is, of course, dragging down $SOXL and pushing up $SOXS as a result. If semiconductor does end up as a source of funds for a rotation into, for instance, energy - which by the way will be the sector of choice for our latest Inner Circle model portfolio, starting this week - then NVDA, SMH and even SOXX could see a material drawdown, the better to shake out recent bulls before a resumption upwards.

Now, for our paying subscribers here, let’s get to work. If you’ve yet to join up as paying member and you’re wondering what all the fuss is about? Well, you can use these charts to trade short term and/or invest long term in the instruments covered. If you just want the notes, no interaction, sign up for our Market Insight tier. If you want the whole nine yards with a live, real-money analyst service, it’s Inner Circle.

Read on!