Market On Open, Friday 6 December

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Did Santa Get Front-Run Already?

by Alex King, CEO, Cestrian Capital Research, Inc

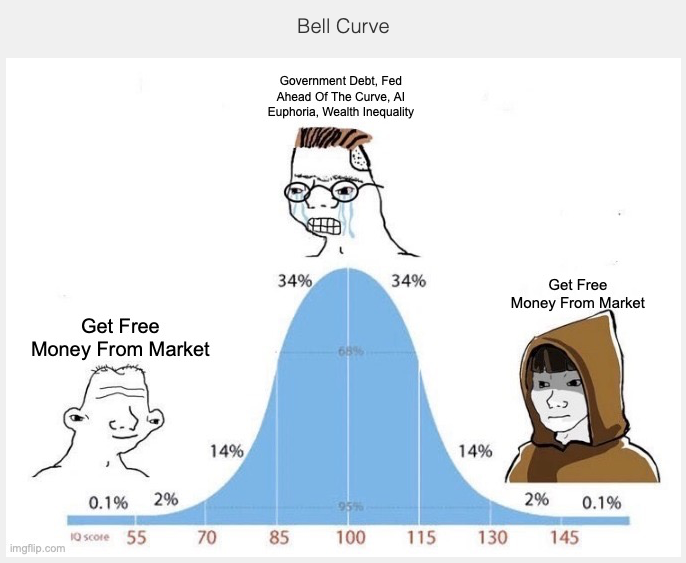

I think we can all agree that the move up from the lows of October 2022 to the current lofty heights have been a remarkable ride. All the more remarkable for how much mid-curve folks have hated the rally.

This pretty much sums up the equity market experience since the 2022 lows.

So are we done? Is the river of free money about to dry up? If everyone becomes a Bitcoin HODLer does that mean rotation of capital out of tradfi equities and into the Brave New World where David Sacks is the Crown Prince? Will it ever be the same again?

There’s one way to find out, and it isn’t by doomscrolling X or BlueSky or attending business school. It’s much simpler and easier than that.

The charts will tell us.

How will we know if price is falling? Because, er, price will be falling.

How will we know if price has not yet started to fall? Because, well, … price won’t be falling yet.

(Stay tuned for a post I am thinking about called B-Waves, The Bulls’ Redemption Arc - a way to get out of harm’s way even if the top rolls over and you missed it).

Before we get to the good stuff, just a word. Don’t sleep on our AI signal services. We have two now, one for the S&P500 and one for the Nasdaq-100, and they are shaping up very nicely. Yes they are really AI. Yes it means you can outsource part of your thought process to a machine. Yes that is what machines are for. Yes it helps you not be mid-curve. Learn more here.