Market On Open, Friday 28 February

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

So Over, As It Turns Out

by Alex King, CEO, Cestrian Capital Research, Inc

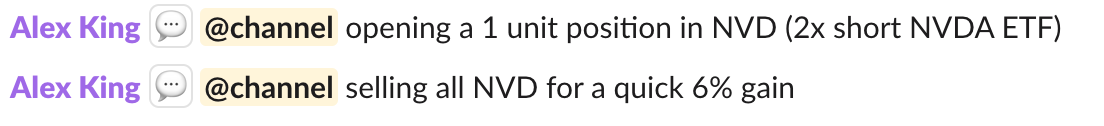

Yesterday was, at best, a dress rehearsal for how to play the market when it does turn from bull to bear. And at worse it was a few days into a new bear cycle. We shall see. In Q1 2022 you knew the market had changed because the winning move was no longer buy dips, but instead, became sell rips. This week has been the same. If you saw green? Selling it was the thing to do. Personally I have been selling small green positions for some days now, nothing dramatic but just a way to keep some realized profits rolling in whilst - for now - eating some unrealized pain on longer term equity holdings. (Bond ETF holdings are working out just fine). My assumption - which is still holding up, just - is that we remain in a bull market so I have been too queasy to hold short hedges for very long. In a bull market one should be nervous of short hedges and protective of their gains. When they go green it is better to not wait around too long before selling and garnering the spoils. Of course dips can dip deeper than expected, and your sale of the hedge may prove too early, but in a bull market that mistake is preferable to being stuck with a slew of trapped shorts. Today, for instance, I scored a nice quick win on $NVD.

Woot. Would that (1) it had been a bigger position and (2) that I had held it through to the close.

In a bull market that doesn’t matter. Free money cashed on the downslope is just that, free money from the market gods.

In a bear market, selling shorts too early is a dumb move that will punish your account if you let it.

We’re on the edge of a breakdown here I think. Seasonality can explain the market weakness for sure, and plenty of charts look like this is just a “100pc normal and to be expected period of weakness” to quote the always-calm Chris Ciovacco. But. That was one mighty selling run this afternoon and it is not to be ignored. We have PCE tomorrow, a potentially important datapoint and certainly an important place for the market to decide whether equities are still in vogue or not.

So I can describe our house stance as Bullish, With A Real Chance Of Bear.

Let’s get into the weeds.

Short- And Medium-Term Market Analysis

If you want this daily dose of pattern recognition, and you aren’t yet a subscriber of course, you can read about and choose from all the subscription services that include this note, here.