Market On Open, Friday 22 November

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

1) What

by Alex King, CEO, Cestrian Capital Research, Inc

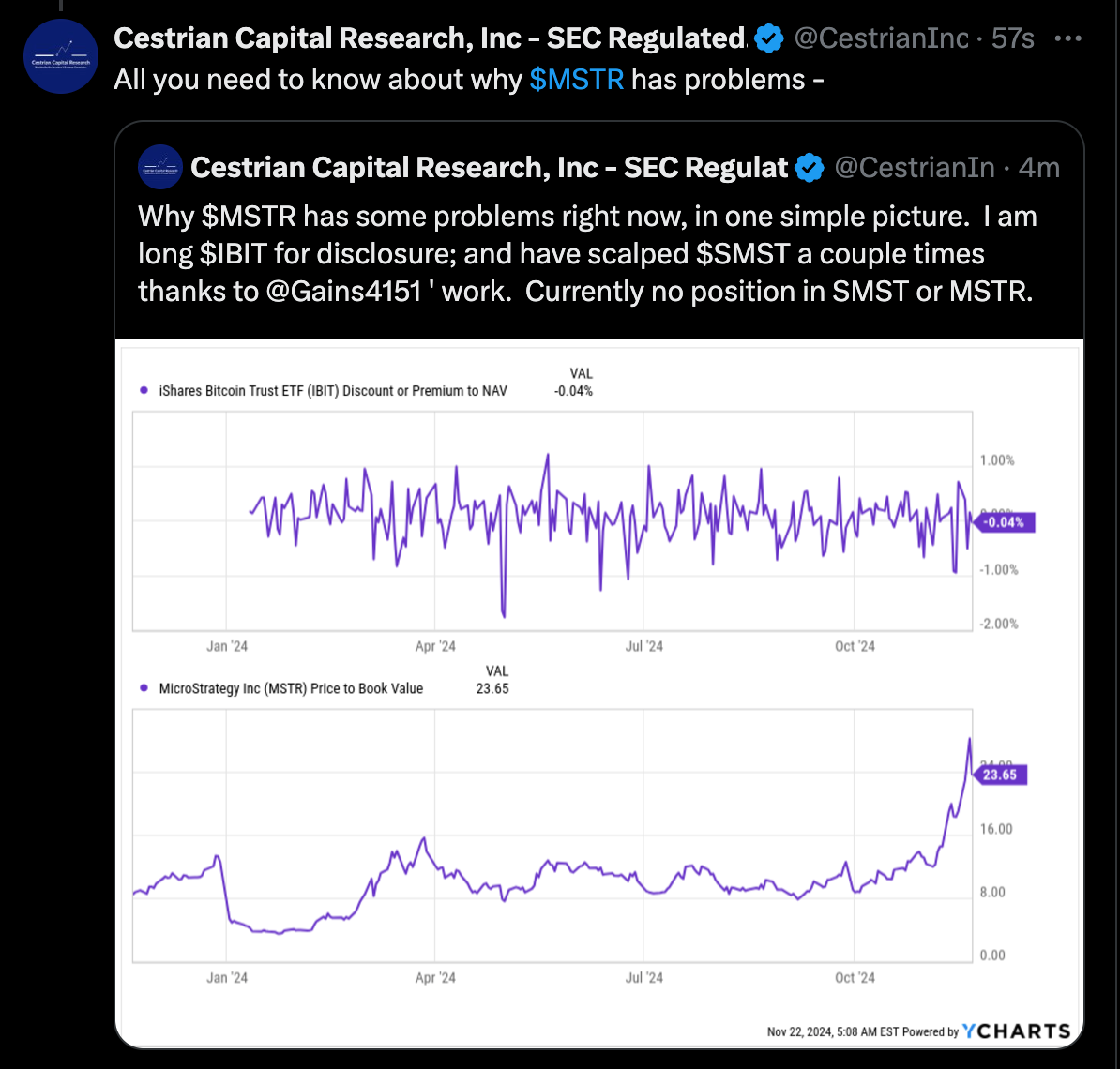

Yesterday, Microstrategy ($MSTR) broke. It might make like Humpty Dumpty and put itself back together again today, I don't know, but yesterday it broke. If you're not familiar with the name, fear not, for all that matters here is that the craziest most speculative names are starting to hit trouble. Exxon is fine. Microsoft is fine. Even Nvidia is fine, as you can see in our earnings note (here). But the craziest of crazies just hit the wall.

When there were no Bitcoin ETFs, to own Bitcoin you had to either store them on your "wallet" (= flaky old USB drive liable to disappear when your shady cousin came to visit) or store them at an online "custodian" many of whose executives came to be in the custody of the local police department, not actually providing custody for your hard-earned. If you didn't want to do this there were other kinds of quoted stock "wrappers" that gave you access to Bitcoin without ever owning, you know, Bitcoin. Microstrategy, once a software company now a digital wallet with some code attached, was one such wrapper.

Well, along came Bitcoin ETFs to spoil MSTR's party. If you can buy $IBIT from Blackrock at around 1x NAV, why buy $MSTR from Mr. Saylor at around 3x NAV or indeed 23x book value?

Personally I had a whale of a time yesterday watching my long $IBIT position climb whilst my short MSTR exposure (via the inverse ETF $SMST) also climbed. I took gains on SMST and moved up stops on IBIT. Happy days.

$SMST was a gift courtesy of the Trading Gains swing trade service that we're delighted to host. The same Trading Gains service also came up with a super-successful $SOXS idea recently too. If you've yet to try it out? You can read all about it here.

As always, if you have any questions you can reach us anytime using this contact form.