Market On Open, Friday 14 June

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Has To Be A Breather Sometime. Right?

by Alex King

Markets have been only-up in recent days, and even on days when most stocks have been down, somehow still indices have been up. Magic! With the good-news CPI and PPI in the rear-view and folks now digesting what Chairman Powell actually said rather than what folks thought they heard, it may be time for some consolidation in markets.

The standout movement at present is the drop in the 10yr yield, which means US government bonds are rising fast. $TLT and/or $TMF have been excellent winners in recent days, as we flagged in Slack Chat earlier today. (For disclosure, I am long TMF personally).

In theory we may expect equities to follow suit, but in truth stocks already roared away to the upside so perhaps it is bonds which are lagging this time.

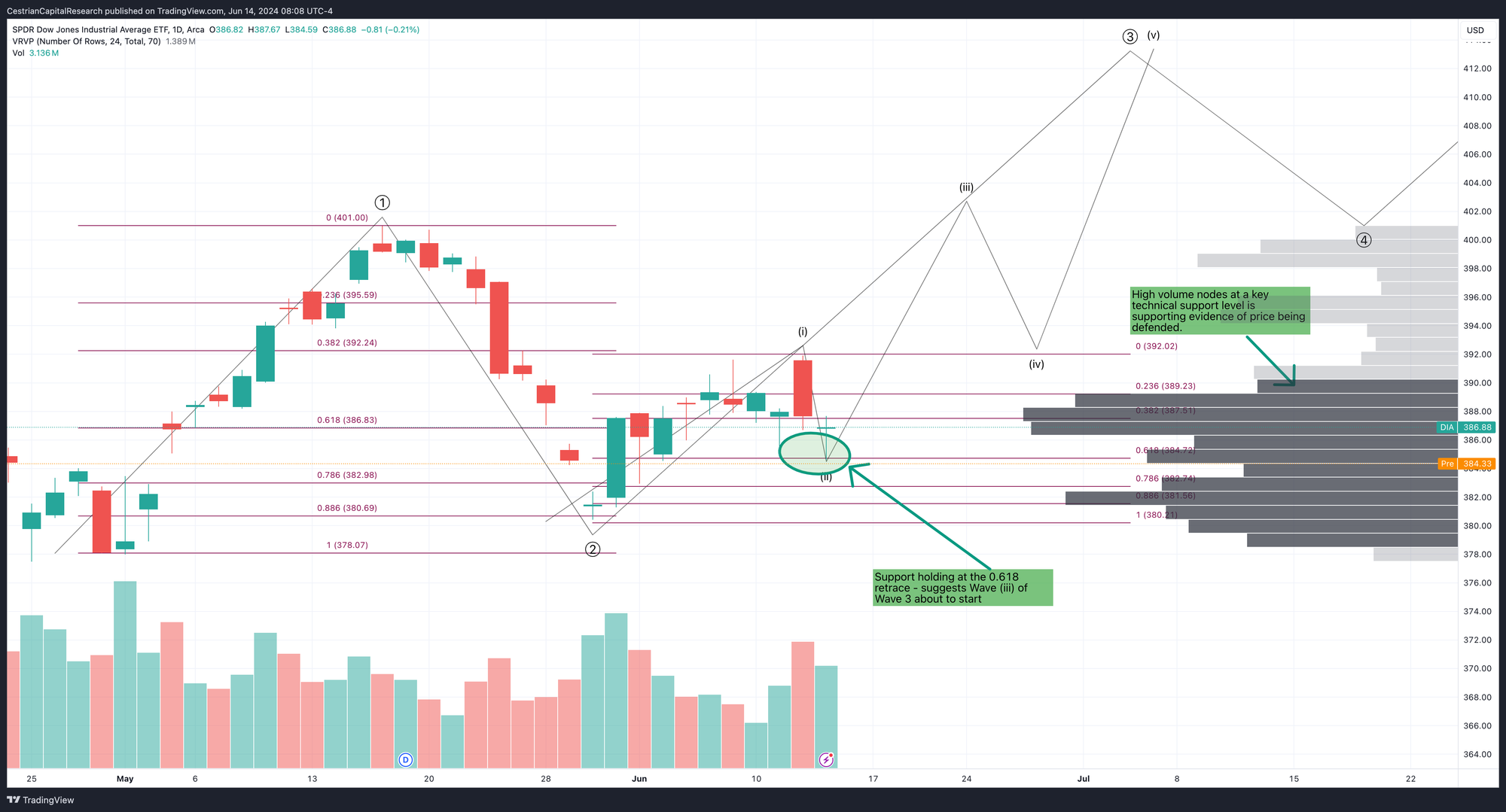

The other question on my mind is whether the Dow is set to move up - I think it is - here's how $DIA looks to me (again, for disclosure, I am long the Dow via $UDOW). You can open a full page version of this chart, here.

Well, we'd best get ready for the day ahead. Below we run through our usual gamut of charts, from the S&P through the Nasdaq, Dow and Russell 2000, then on to bonds, oil, and semiconductor ETFs.

Read on!