Market On Open - Friday 11 August

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

CPI Digestion

Yesterday at 0830 Eastern the latest CPI print hit the wires. As is common on 'event' days, volatility was huge in the equity indices, a function of stop-hunting by large account players. If you had proximate stops a little below or a little above Wednesday's close, there's a good chance those stops were taken out Thursday only for the index to then move past them anyway - on both sides! It was a good day to be hedged.

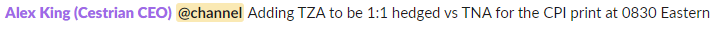

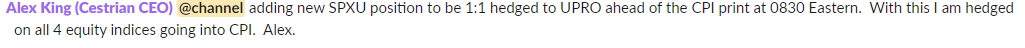

In staff personal accounts we opened new long TZA and long SPXU positions early in the day to hedge our long Russell and long S&P500 positions - we alerted our paying Inner Circle subscribers in Slack before the trades were placed, as always.

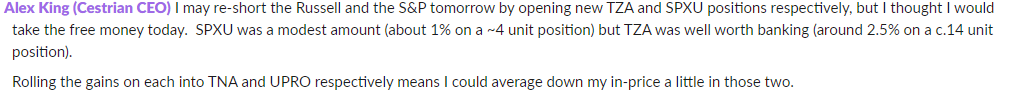

We then cashed gains on the short positions late in post-market Thursday, again disclosing beforehand.

This was the logic:

Today at the time of writing (a little after 0600 Eastern) the 10-year yield is down a touch, but not meaningfully so. At the present time futures are more or less flat.

In staff personal accounts we remain hedged in the Nasdaq and the Dow but unhedged long the Russell and the S&P. If those two indices start to slip this morning we intend to re-hedge, wait and see what happens.

So, as always, for our paying members only let's now walk through the shorter- and longer-term outlooks for the S&P500, the Nasdaq, the Dow and the Russell.

We include more detailed Cestrian staff personal account trading plans in our charts - these are disclosures rather than commandments, we include them to (1) clarify our own thinking and (2) to help explain what we think about the direction of markets. Paying Inner Circle members can reach out in Slack anytime to discuss. You will, of course, make your own decisions as to how to use our charts in your own work.

If you've yet to sign up to a paying plan here, you can do so right from the link below.