Market On Close - Monday 31 July

Smoked Bear Jerky Remains The Market's Snack Of Choice

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Where Is Dave Portnoy For The Swansong?

It seems like only yesterday when here at Cestrian Towers we held a requiem for the Zombie Stonks of 2020-21. And yet they are now rearing their heads once more. $ROKU is resurrected, $ARKW is moving up with some conviction and $PLTR clearly means business. Having completed a vertical takeoff in Q1, equity indices lit the afterburners in Q2 and haven't looked back. Stocks, it seems, do in fact Only Go Up.

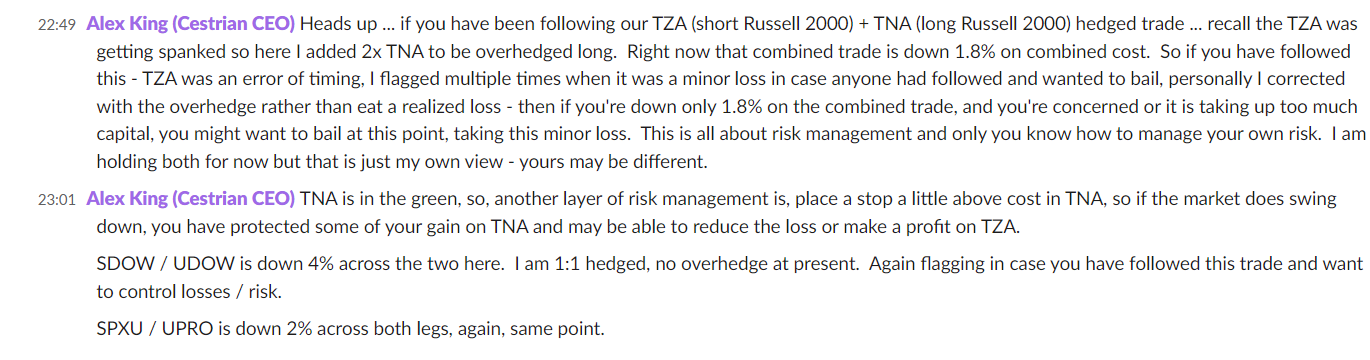

Now this is untrue, of course, as November 2021 taught even Portnoy himself. But the pace with which equities are rising has caused much pain amongst otherwise sensible investors and traders. The stress level is palpable among online communities, from FinTwit on down. Everyone expecting a material pullback has been disappointed, shorts thwarted, only longs rewarded. In this service you've seen that in staff personal accounts here at Cestrian, whilst we are heavily net long in single stock names and have been all year, our attempts in recent weeks to make some gains with short index ETFs - from the point where, on regular chart analysis, the indices 'should' have sold off, can only be described as, no bueno. Since we run dead inside here and care not about being 'right', only about making money and managing losses, we've executed a quick-fire dose of long hedging (Dow), long overhedging (Russell and the S&P), and cut back new short positions for a tiny gain (Nasdaq). This has kept our short losses small whilst allowing our sizable $TQQQ position to keep growing in value.

Here's what we posted in Slack earlier today.

We do have a sizable unrealized loss in $SQQQ but we already partially mitigated that by realizing long scalper gains time and again in the Dow and the Russell over the last 2-3 months, to the point where even if we just ate the loss at this point we would be at ease.

So ... so far so good. Errors of judgment, execution and timing go with the territory. Hedging and overhedging aren't admissions of errors, they are the essential tools one has at hand in order to course correct when, not if, errors are made.

So what next?

Well, we've been saying loud and clear since well before the October 2022 lows that we thought markets would head to new all time highs. Why have we been saying this? Because the long-term index charts have been as clear as day on this - we post them here daily - and so far they haven't disappointed.

So the risk with longs is selling too early; the risk with shorts is they become stranded. Hence the hedging and overhedging above. And hence also our lack of meddling with the single-stock picks we've named in this service. They continue to perform rather well.

A pullback will come, and when it does, we have to decide whether to just close the shorts out at a small gain or loss, and let the longs ride down in anticipation of them riding back up the wave, or, whether to close out both the long and short side of the index ETFs in order to reduce gross exposure. That's something we have a close eye on. If you're a paying member here, you'll know just after we know, but before we place trades - as always watch for the Trade Disclosure alerts in Slack.

Now, for our paying members only we walk through the shorter- and longer-term outlooks for the S&P500, the Nasdaq, the Dow and the Russell. If you've yet to sign up to a paying plan here, you can do so right from the link below.