Market On Close, Friday 28 March

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Big Money Eyes The Door

by Alex King, CEO, Cestrian Capital Research, Inc

Pretty soon we will have to call a bear market. It’s as simple as that. I don’t think we are there yet; you can make technical arguments as to why this is a selloff not a bull / bear flip, and those arguments have some logic.

As to what kind of bear market it might be - it would seem that simple policy uncertainty is causing institutional money to withdraw from major US equities. This isn’t a case of capital fleeing the US - if that were the case, the 10yr yield wouldn’t be falling as it is and US government bonds wouldn’t be rising. This same fact tells us that this is not likely a fear-of-inflation type selloff / proto-bear market. Corporate earnings are fine for now - if you read through the earnings reports we publish here for our large list of covered names you can see that top and bottom line in most companies we cover is just fine. That’s as good a view on the current economy as one can find, I think. I also don’t think this is tariffs per se. Tariffs aren’t a problem for the market at any sensible level in my view.

One can piece together a grand united theory of the current Administration’s economic policy - this is as good a take as I have seen- (I refer solely to this tweet, not to the podcast he mentions):

But this and other such takes, and having to spend your time pondering what “the plan” might be are not the same as hearing a grand unified theory of the economy and its policies from the Administration itself.

Narrative matters to markets and at the moment there is no grand unifying narrative - there is only day to day glimpses into policy. Perhaps we will start to see this emerge as the current restructuring phase comes to a close. Sec. Bessent is capable of this - the market would benefit from his being out front and center on economic matters.

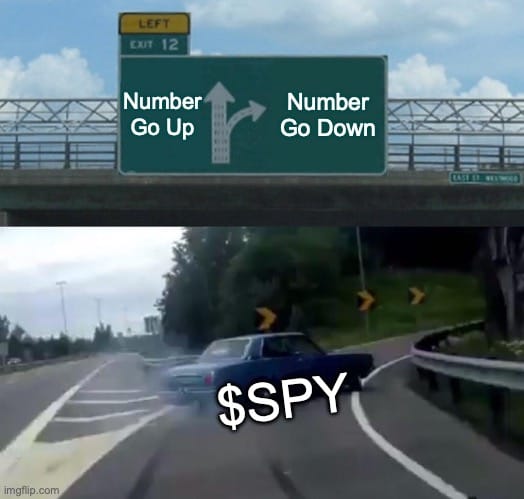

For now we remain in a very choppy, twitchy, easily-spooked market. It has the character of 2022, where all up-moves were sold and then the subsequent selloff found new lows. Personally I have tried a couple of long swing trades with tight stops at sensible technical levels (in $DIA and $AVGO), and had the same result each time, which is, getting stopped out. All the positive surprises for me are coming from short positions (I prefer to use inverse ETFs as short exposure). And the only disappointments for me have been to not hold those shorts for longer before cashing in, or to hold unhedged long positions. This says we are in a different market to 2023-4 when the reverse was true. Short profits were scarce and prone to evaporate unless taken quickly. Now, the short side is the gift that keeps on giving if you know how to use it well. (Join our Inner Circle service if you want to learn how to do so).

A number of key levels are close at hand. $SOXX < 185 means I think a bear in semiconductor, which is itself a leading indicator for the $QQQ and $SPY. The main equity indices closing below their 13 March lows. That’s not far away. So again, for now, a correction. A tough one to below the 200-day moving average in all equity indices and plenty of stocks too - but just a correction. Next week I think we find out whether it was all just a Q1 correction artefact - don’t assume this isn’t the case - or whether something more serious is afoot.

LAST CALL! RIA Insight Pro - Join Now To Beat The Price Rise

Prices rise for our RIA Insight Pro service on 31 March - this applies to new members joining thereafter. We never raise prices on our existing members. The current $1999/yr rises to $2999/yr in ten days. Click below to see what you’re missing if you’re yet to join up.

Short- And Medium-Term Market Analysis

If you want this daily dose of pattern recognition, and you aren’t yet a subscriber of course, you can read about and choose from all the subscription services that include this note, here.

US 10-Year Yield

5-wave pattern down remains intact.

Equity Volatility

Not quite done selling yet, is what this chart suggests.

Disclosure: No position in volatility-linked securities.