Market Before The Open, Monday 14 April

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Dizzy Yet?

by Alex King, CEO, Cestrian Capital Research, Inc

The market is in a very simple setup at the moment in my opinion and does not require extensive analysis. Changes to global trade policy are of course going to impact markets and the extent to which the existing arrangements are changed matters to the degree of impact to markets. In essence we have a ideological change afoot within the US Executive Branch, a shift from deregulation to re-regulation of trade, from limited government to maximal government. This ideological shift is tempered by money, as is always the case with ideas in politics. Why did the Soviet Union end in ruin? Was it because of political reasons? It was not. It was because the political arrangements meant the economy was unsustainable which meant the polity failed. Which is why China doesn’t have the same economic policy as the Soviet Union. Because you always have to have the money to pay for your ideas.

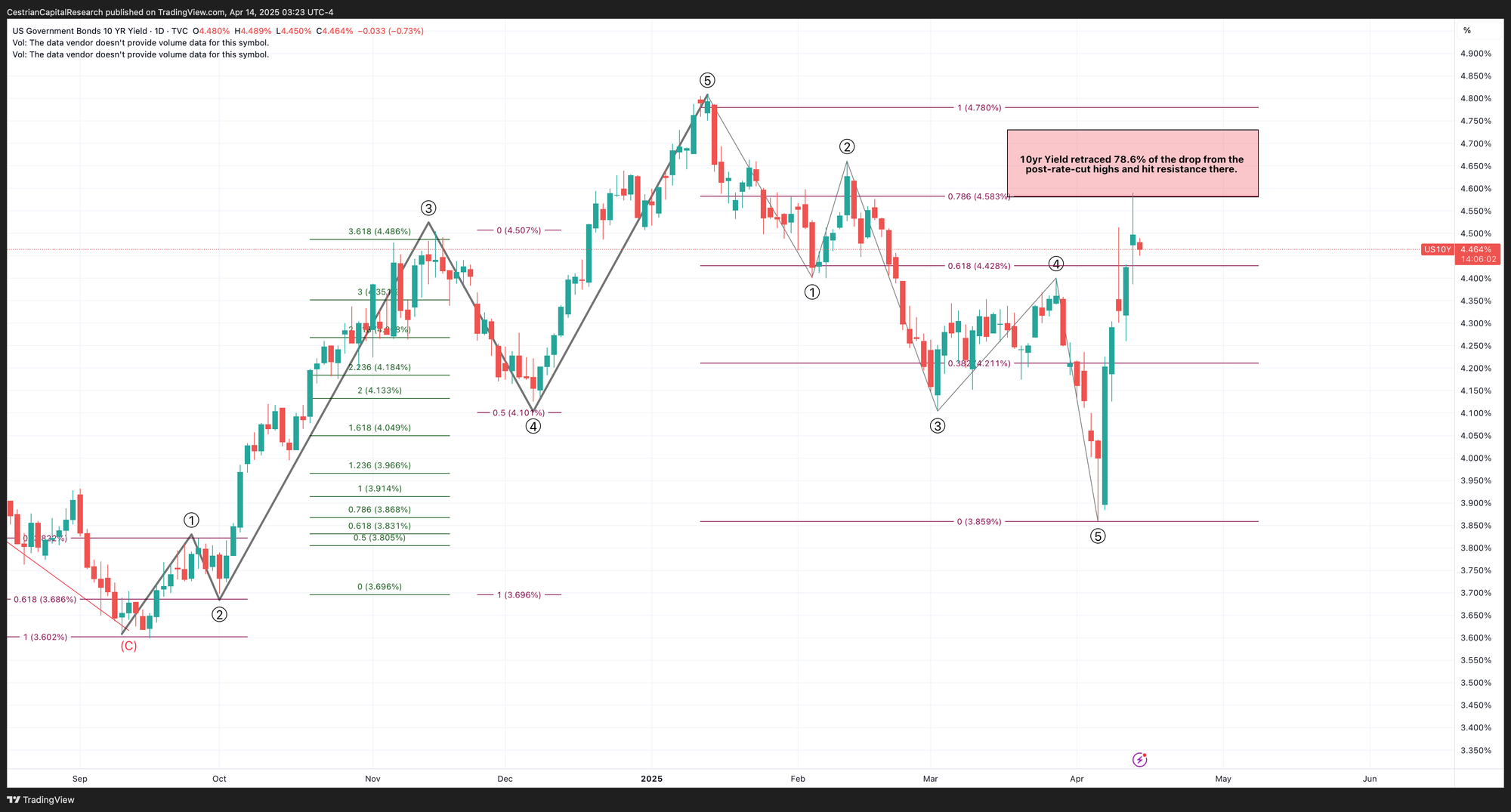

Right now the limits to government intervention in trade are being tested between the US and China and I think it is fair to say that no-one knows where the line will hold. Mixed messages from the US Executive Branch mean that it is difficult to set a course in markets. For now I think we will continue to see heavy volatility, until a direction is set. If ideology wins out over money, we’ll be in a bear market. If money wins out over ideology, the bull will resume. I don’t think it’s any more complicated than that. The single most important indicator right now is the 10yr yield. If money is winning, bonds will get bid and the yield will fall. If ideas are winning, bonds will be sold and the yield will rise. If bonds are getting bid, so too will equities, and the reverse is also true.

Specifically because this is a tussle of ideas and money - and as a human one cannot but have a view on how the ideas impact the money - I think there has been no better time to include a quantitative approach in your investing and trading.

This Is Our Quant.

Our SignalFlow family of quantitative signal services are built on the idea that the machine can help you avoid material drawdowns in the securities they cover. Right now this is in the S&P500 and Nasdaq-100 complex - we will be adding more categories soon.

Here’s three testimonials we received after the current market turmoil. The SignalFlow AI model declared “Risk Off” in the S&P on March 3rd; the index dropped some 15% thereafter since then - a drawdown the model could have helped you avoid if you were a member.

- "I am wildly thrilled with SignalFlow AI for $SPY! I have been following the signals and moved almost completely to cash with the most recent change to risk off. Absolutely incredible for me, mentally and financially. Thanks so much to the team for developing this service.” - April 2025

- “The long/short service paid for itself in one day overnight by the way! Thankyou.” - April 2025

- “Rather than a day that could have ruined the weekend, I was able to watch the market tank knowing that I had the knowledge to weather the storm and come out far ahead.” - April 2025

The latest SignalFlow service provides long/short signals for the S&P500 and Nasdaq-100. This is a very easy to use service running on a quantitative model; complex below the waterline, simple above it. This is pure machine logic driven by price alone, not by the news, not by narrative, not by fear or greed.

Please do take a moment to read about what I believe to be a truly excellent service - here.

Short- And Medium-Term Market Analysis

If you want this daily dose of pattern recognition, and you aren’t yet a subscriber of course, you can read about and choose from all the subscription services that include this note, here.

US 10-Year Yield

Equity Volatility

Ideas = high volatility. Money = low volatility.

Disclosure: No position in volatility-linked securities.

Now, for our paying subscribers we move on to bonds, the S&P500, the Nasdaq, the Dow, and key sectors.